- United States

- /

- Biotech

- /

- NasdaqGS:IRWD

Ironwood Pharmaceuticals (IRWD): Evaluating Valuation After Q3 Earnings Beat and Linzess Pediatric Approval

Reviewed by Simply Wall St

Ironwood Pharmaceuticals (IRWD) captured investor attention after reporting a strong beat in its third-quarter 2025 earnings and raising its full-year guidance. The results were fueled by higher-than-expected U.S. sales of Linzess as well as regulatory progress.

See our latest analysis for Ironwood Pharmaceuticals.

Ironwood’s blowout quarterly earnings and boosted financial guidance sparked a dramatic shift in sentiment, sending the share price up over 120% in the last month alone. While momentum has returned in a big way lately, it comes after a tough stretch. Total shareholder return over the past year remains negative, reflecting how sharp the turnaround has been.

If rapid rebounds like this have you rethinking what’s possible in healthcare, it could be the right moment to discover other companies shaping the sector with our See the full list for free.

But with Ironwood’s stock price more than doubling in recent weeks and a history of volatility, investors are left to wonder: is the latest growth story still undervalued, or is all the upside already baked in?

Most Popular Narrative: 82% Overvalued

Compared to the last close price of $3.37, the most widely followed analyst narrative values Ironwood Pharmaceuticals at just $1.85 per share. This suggests the recent price surge far outpaces fundamentals and sets a stark backdrop for the debate over whether new growth catalysts can realistically boost value that much higher.

The completion of the NDA submission for apraglutide is anticipated in the third quarter of 2025, with plans for a potential commercial launch. This implies a future increase in earnings once the product is approved and marketed. The company has strategically restructured to focus on the commercialization of apraglutide, aligning resources to strengthen their financials through cost savings leading to improved net margins.

Curious why analysts draw the line where they do? The secret sauce in this narrative is bold margin projections and a single therapy launch that underpins the entire future value. Wondering just how aggressive these growth bets are? The next section lays bare the critical numbers and the financial leap of faith this valuation asks investors to make.

Result: Fair Value of $1.85 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant pricing pressures and uncertainty around apraglutide’s approval timeline could quickly challenge the bullish long-term outlook for Ironwood Pharmaceuticals.

Find out about the key risks to this Ironwood Pharmaceuticals narrative.

Another View: Deep Value or Deeper Questions?

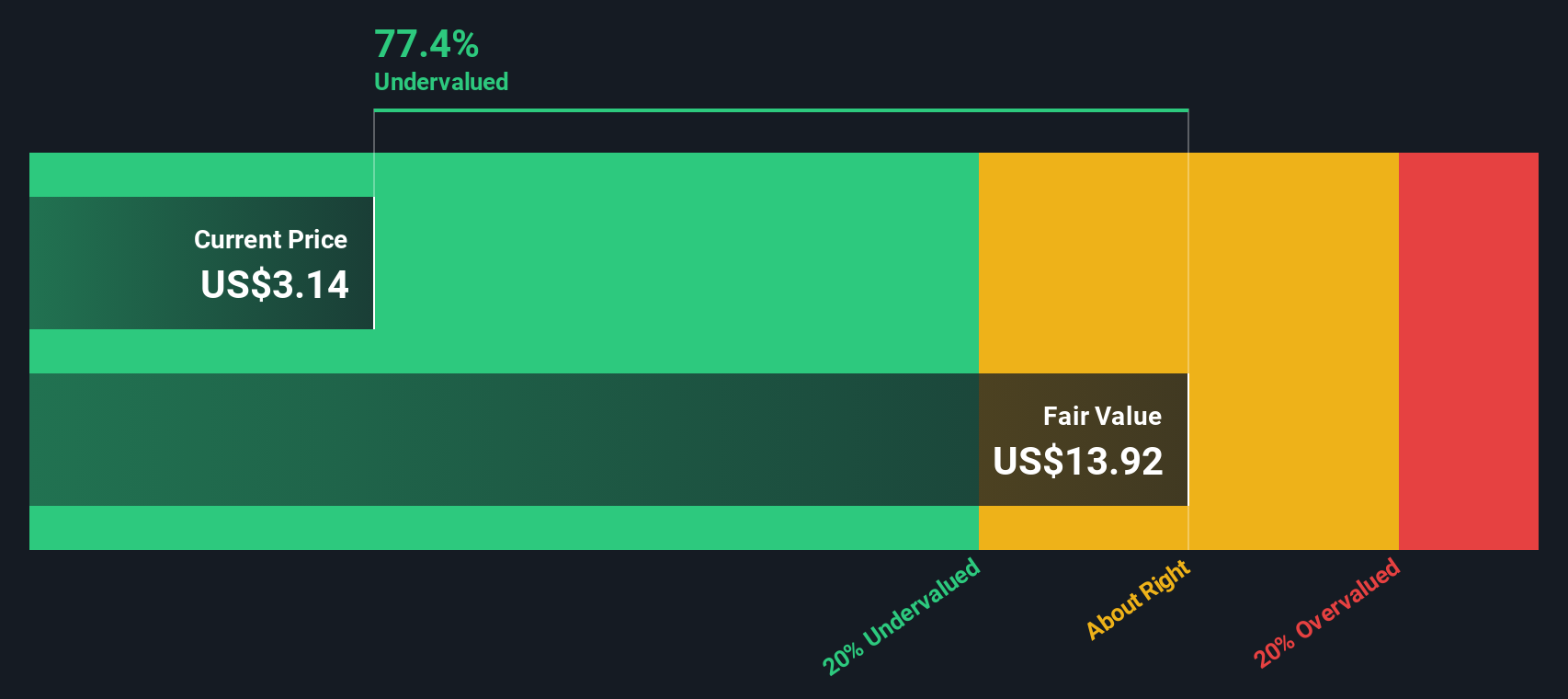

Switching from the analyst narrative to our SWS DCF model gives a surprisingly different picture: while analyst consensus sees Ironwood Pharmaceuticals as overvalued at the current price, our DCF model finds the shares trading at a sharp discount, more than 75% below estimated fair value. This sharp divide highlights just how differently the company’s future could play out. Are analysts too pessimistic on Ironwood’s turnaround, or is the model overlooking real-world risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ironwood Pharmaceuticals Narrative

If these viewpoints don’t quite match your own outlook, you can dive into the data and craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Ironwood Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let this moment pass by while others seize new opportunities. Take control and hunt for stocks built for tomorrow using powerful tools from Simply Wall St.

- Tap into tomorrow’s tech by targeting growth opportunities among these 26 AI penny stocks at the forefront of artificial intelligence innovation and disruption.

- Boost your portfolio’s passive income by zeroing in on reliable picks through these 15 dividend stocks with yields > 3% offering yields that outpace savings accounts and many bonds.

- Ride secular trends before the crowd by focusing on these 82 cryptocurrency and blockchain stocks reshaping finance and digital infrastructure worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRWD

Ironwood Pharmaceuticals

A biotechnology company, focuses on the development and commercialization of therapies for gastrointestinal (GI) and rare diseases in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives