- United States

- /

- Biotech

- /

- NasdaqGS:IONS

Ionis Pharmaceuticals (IONS) Is Up 8.6% After Groundbreaking Study Results in Alexander Disease Therapy - What’s Changed

Reviewed by Sasha Jovanovic

- Ionis Pharmaceuticals recently announced positive topline results from its pivotal study of zilganersen in children and adults with Alexander disease, a rare and progressive neurological condition without approved disease-modifying treatments.

- This marks the first time an investigational medicine has shown clinically meaningful disease-modifying effects in Alexander disease, highlighting a potential new treatment path for patients with high unmet need.

- We'll explore how these landmark clinical results in a rare neurological disease could influence Ionis Pharmaceuticals' broader investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ionis Pharmaceuticals Investment Narrative Recap

To be a shareholder in Ionis Pharmaceuticals, you need conviction in its ability to convert innovative clinical advances, like the recent pivotal results for zilganersen in Alexander disease, into sustainable revenue growth and regulatory approvals. While this breakthrough may help build confidence around the pipeline’s disease-modifying promise, shorter-term catalysts and risks still hinge most on upcoming FDA decisions and market launches for broader indications such as Olezarsen in severe hypertriglyceridemia, as these will more materially drive revenue and margin trends in the near future.

The September 2 announcement of positive Phase 3 results for Olezarsen in severe hypertriglyceridemia remains particularly relevant as Ionis seeks to expand beyond rare diseases. This program’s planned supplemental FDA submission by year-end is seen as a near-term driver of financial results, while also carrying risks of price negotiations and reimbursement complexity if the patient population broadens, making it crucial in the context of sustained top-line momentum for the business.

However, despite the clinical wins, investors should be aware that potential revenue compression from price declines on expanded indications still looms as...

Read the full narrative on Ionis Pharmaceuticals (it's free!)

Ionis Pharmaceuticals' narrative projects $1.5 billion revenue and $241.3 million earnings by 2028. This requires 16.7% yearly revenue growth and a $509.5 million increase in earnings from -$268.2 million currently.

Uncover how Ionis Pharmaceuticals' forecasts yield a $69.48 fair value, in line with its current price.

Exploring Other Perspectives

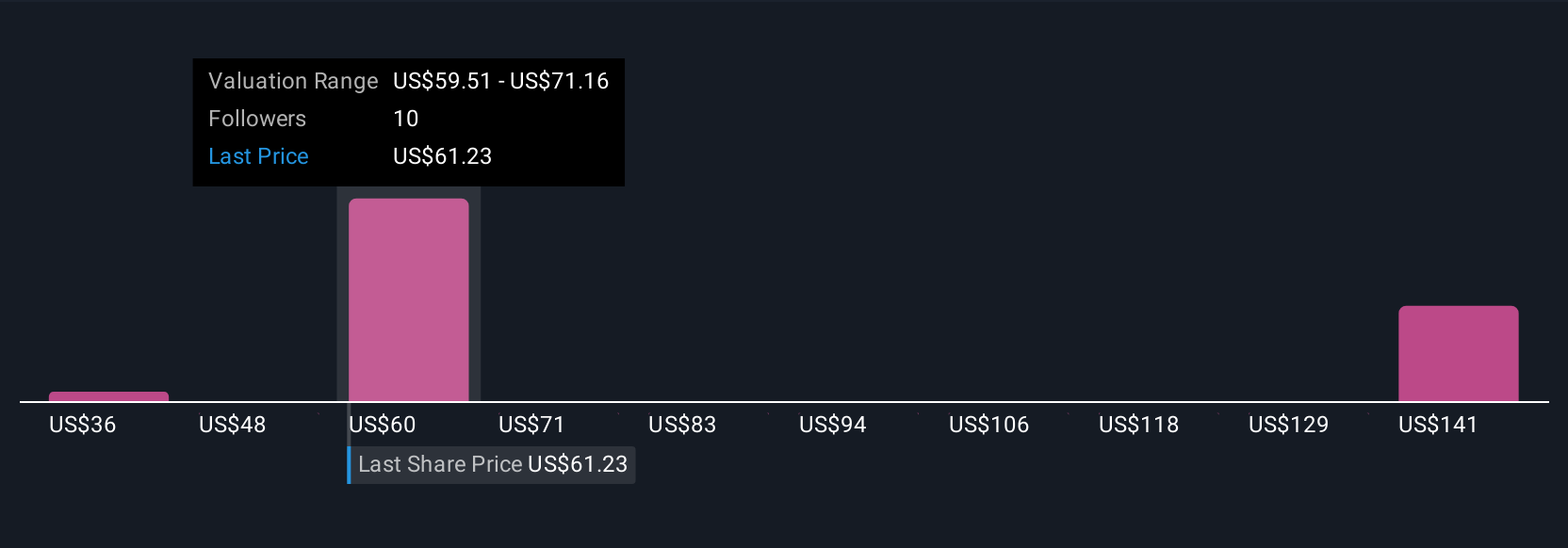

Four fair value estimates from the Simply Wall St Community span from US$36.19 to US$158.10, reflecting broad differences in conviction about Ionis’s future. As future pricing and reimbursement for new launches remain uncertain, consider how these contrasting outlooks might shape your own view on Ionis’s long-term prospects.

Explore 4 other fair value estimates on Ionis Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Ionis Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ionis Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ionis Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ionis Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IONS

Ionis Pharmaceuticals

A commercial-stage biotechnology company, provides RNA-targeted medicines in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives