- United States

- /

- Biotech

- /

- NasdaqGS:IONS

Ionis Pharmaceuticals (IONS): How Does Valuation Stack Up Following Revenue Surge and Upbeat 2025 Guidance?

Reviewed by Kshitija Bhandaru

Ionis Pharmaceuticals (IONS) recently delivered second quarter results with revenue doubling year over year. The company also raised its full-year revenue guidance, signaling management’s growing confidence in continued product growth and a strong pipeline.

See our latest analysis for Ionis Pharmaceuticals.

Ionis Pharmaceuticals has generated serious momentum this year, with a 19.8% one-month share price return and a surge of over 74% for the last 90 days. This performance is backed by positive revenue surprises and growing investor confidence. While the latest share price sits at $73.09, the stock's total shareholder return over the past year stands at an impressive 87%. New FDA approvals and product launches are fueling optimism for the long term.

If Ionis’ breakthrough year has you curious about what else the biotech space has to offer, discover more standout healthcare and pharma names with our See the full list for free.

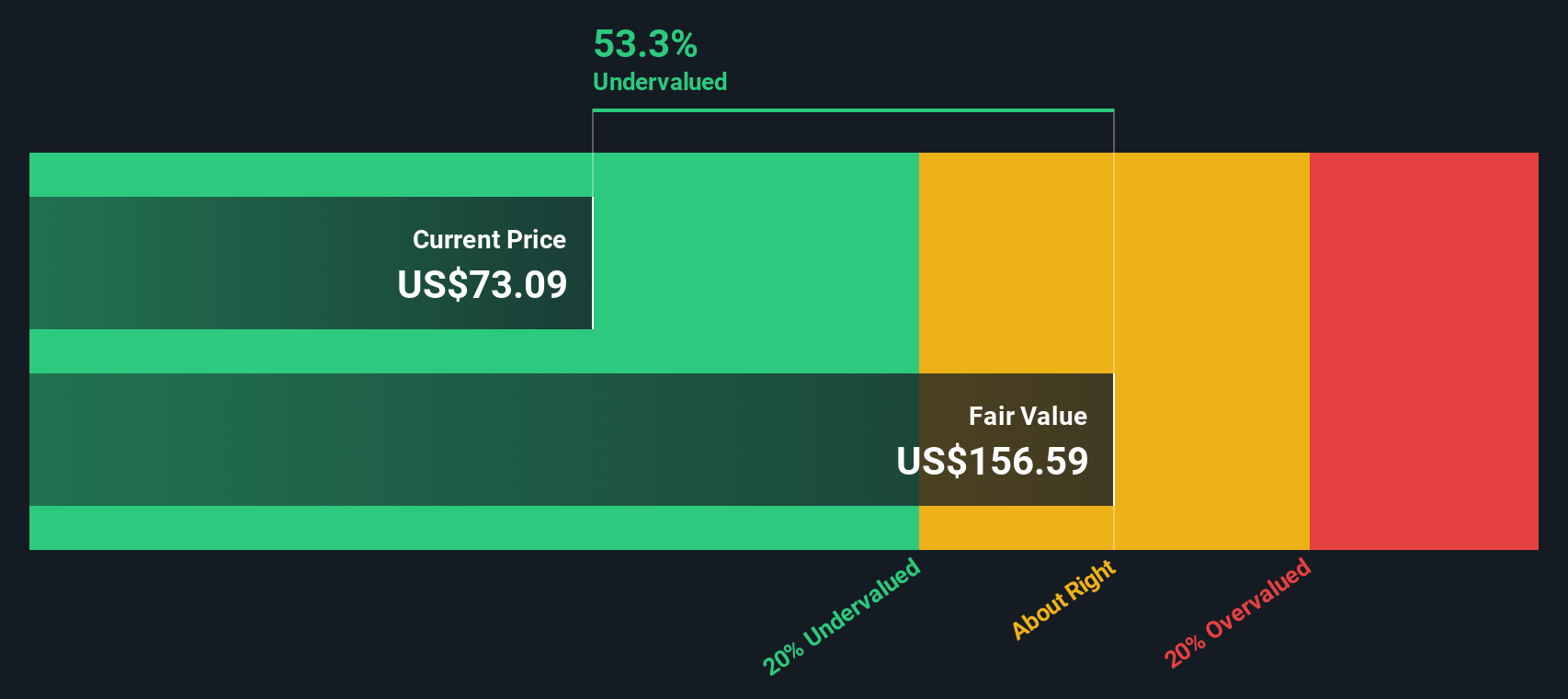

With shares climbing and analysts upbeat, the question now is whether Ionis is still undervalued by the market or if recent gains already reflect all the company’s future potential. Is there a buying opportunity here, or is growth already priced in?

Most Popular Narrative: 10% Overvalued

Ionis Pharmaceuticals’ most-watched narrative sets a fair value of $73.03, just below the recent close of $73.09. This suggests little room for upside in the current price. This valuation highlights how optimism around major product launches and pipeline momentum compares with ambitious growth and profitability targets.

“Ionis is regarded as well-positioned for sustainable revenue growth, especially with an expanding commercial portfolio and pipeline diversification. Approval and strong labels for therapies targeting hereditary angioedema also support this view.”

Want to know what fuels this nearly break-even fair value? The answer lies in bold projections around expanding margins and high profit multiples, supported by expected blockbuster launches. Which growth levers and margin assumptions could drive the price higher, or leave shares trailing? Get the full breakdown in the most popular narrative.

Result: Fair Value of $73.03 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in key drug launches or pricing pressure as Ionis moves into larger markets could quickly curb the upbeat outlook.

Find out about the key risks to this Ionis Pharmaceuticals narrative.

Another View: Discounted Cash Flow Model Points to Deep Value

While the fair value based on analyst numbers suggests Ionis Pharmaceuticals is slightly overvalued, the SWS DCF model offers a contrasting perspective. According to this approach, shares trade more than 50% below their estimated fair value. Does this signal an overlooked value opportunity, or is there something missing in the long-term expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ionis Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ionis Pharmaceuticals Narrative

If you think there’s more to Ionis Pharmaceuticals’ story, or if you want to reach your own conclusions, dive into the numbers and shape your own perspective in minutes. Do it your way

A great starting point for your Ionis Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity slip by. Expand your investing horizons with strategies proven to find tomorrow’s winners and power your portfolio’s future growth.

- Capture impressive yields and grow your income stream by searching the market's top performers through these 18 dividend stocks with yields > 3%.

- Unlock the next big breakthrough by spotting fast-moving innovators with these 24 AI penny stocks reshaping tomorrow’s technology landscape.

- Capitalize on hidden gems that trade below fair value, thanks to our data-driven spotlight on these 871 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IONS

Ionis Pharmaceuticals

A commercial-stage biotechnology company, provides RNA-targeted medicines in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives