For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Innoviva (NASDAQ:INVA). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Innoviva

Innoviva's Improving Profits

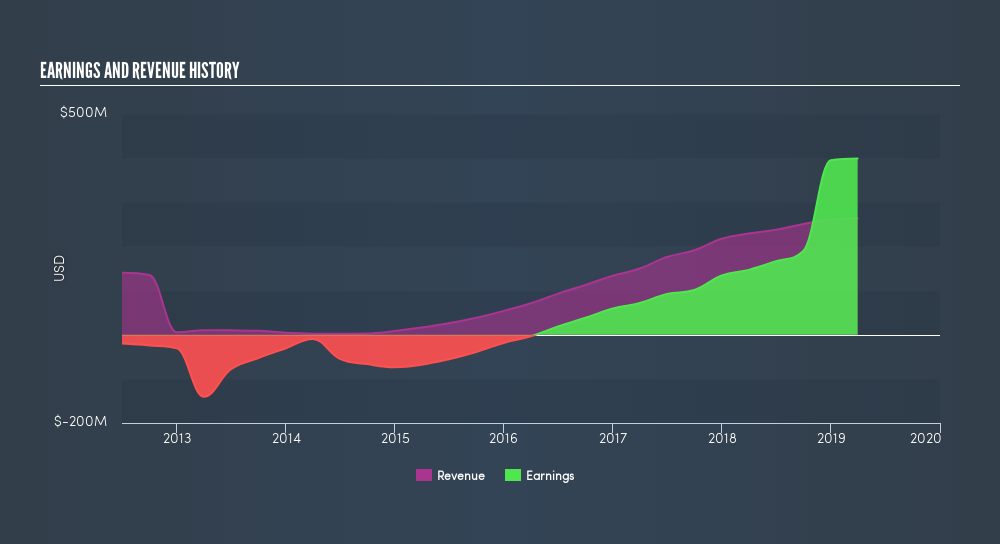

Over the last three years, Innoviva has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Innoviva's EPS shot from US$1.40 to US$3.95, over the last year. Year on year growth of 183% is certainly a sight to behold.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Innoviva's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that Innoviva is growing revenues, and EBIT margins improved by 8.5 percentage points to 95%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Innoviva's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Innoviva Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Innoviva were both selling and buying shares; but happily, as a group they spent US$82k more on stock, than they netted from selling it. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. We also note that it was the Independent Director, George Bickerstaff, who made the biggest single acquisition, paying US$239k for shares at about US$15.90 each.

The good news, alongside the insider buying, for Innoviva bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$36m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Geoff Hulme is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Innoviva with market caps between US$1.0b and US$3.2b is about US$4.1m.

The CEO of Innoviva only received US$420k in total compensation for the year ending December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Innoviva To Your Watchlist?

Innoviva's earnings have taken off like any random crypto-currency did, back in 2017. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Innoviva may be at an inflection point. If so, then it the potential for further gains probably merit a spot on your watchlist. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Innoviva's ROE with industry peers (and the market at large).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Innoviva, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives