- United States

- /

- Pharma

- /

- NasdaqGS:INVA

Earnings Beat and Shifting Stakes Might Change the Case for Investing in Innoviva (INVA)

Reviewed by Sasha Jovanovic

- During the past week, SEC filings revealed that KLP Kapitalforvaltning AS reduced its stake in Innoviva, Inc. by 8.7% during the second quarter, with other major investors, such as Millennium Management LLC and American Century Companies Inc., also making substantial adjustments to their holdings.

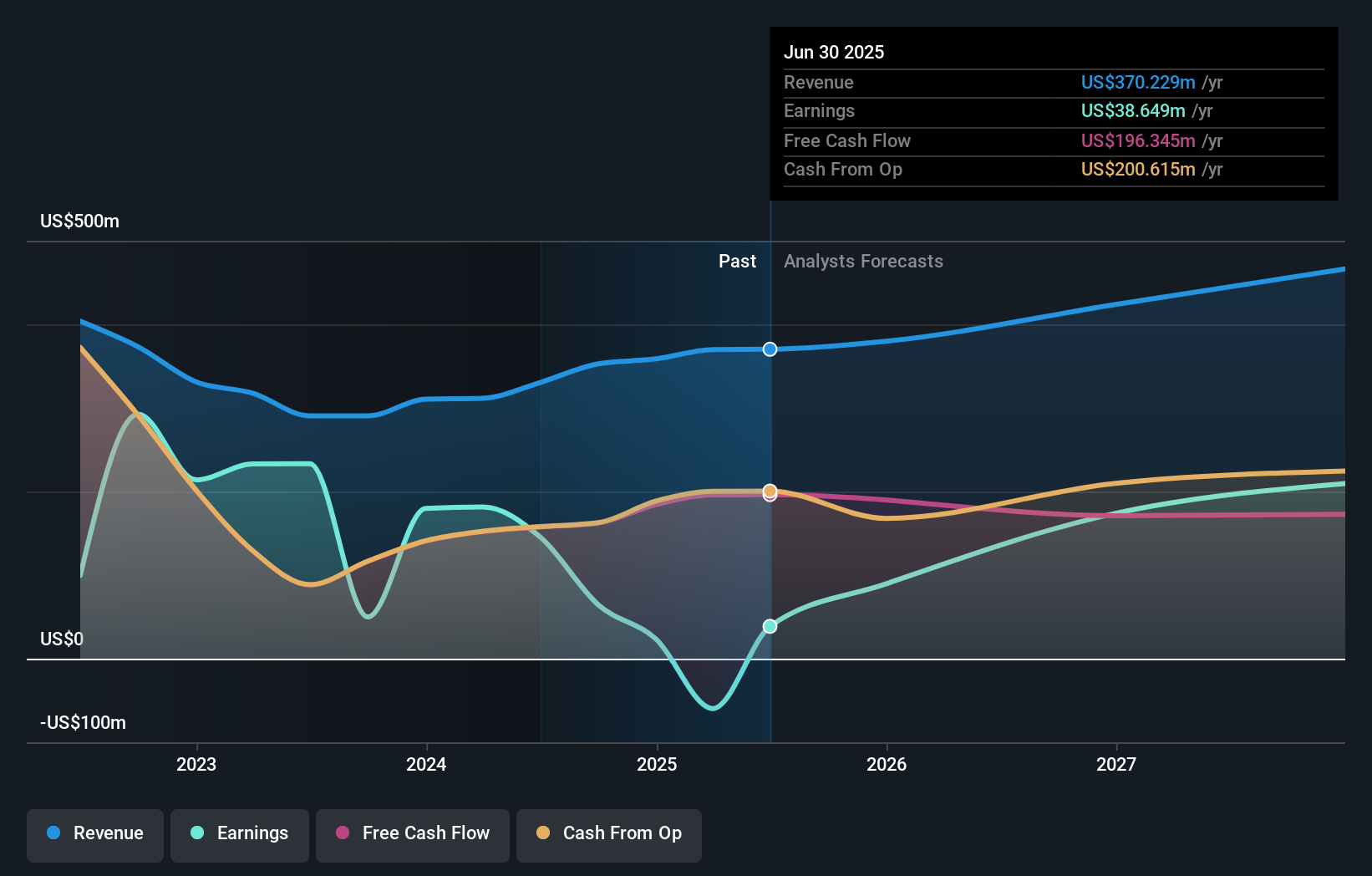

- Innoviva also reported quarterly earnings that surpassed analyst expectations, highlighting renewed interest from institutional investors and potential market reassessment of the company.

- We'll examine how Innoviva's better-than-expected earnings drive new perspectives on its investment narrative amid shifting institutional interest.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Innoviva's Investment Narrative?

Investors considering Innoviva are often drawn to its story of turnaround potential, especially given the most recent quarterly earnings that surprised to the upside. The company has shown accelerated earnings forecasts and an improving revenue outlook, but the management team is relatively new and profit margins have been compressed, especially compared to last year’s numbers. With the SEC filings showing significant institutional adjustments last week, some may question whether these shifts are signals of deeper concerns or just tactical rebalancing. However, the latest earnings beat seems to offset any near-term anxiety around these changes, and recent share price moves have been moderate, suggesting that this news does not meaningfully alter the company’s short-term risk and catalyst profile. The real story continues to be about whether Innoviva’s management can deliver on growth targets and transition from a period of one-off losses and margin volatility to lasting profitability.

But, those margin swings may not be finished just yet, here’s what investors should keep in mind. Despite retreating, Innoviva's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Innoviva - why the stock might be worth just $36.20!

Build Your Own Innoviva Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innoviva research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innoviva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innoviva's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives