- United States

- /

- Pharma

- /

- NasdaqGS:INVA

Does Innoviva’s Recent Double-Digit Drop Signal a New Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with Innoviva stock right now? You're not alone. The stock has made investors curious after some big price swings in recent months, and everyone wants to know whether this is an opportunity or a warning sign. Over the past year, Innoviva’s share price has dipped -11.1%, but zoom out to a three-year lens and you see it up by a strong 41%. Stretch even further to five years, and it's delivered an impressive 67.8% gain. So, while the journey hasn’t been a smooth ride, especially with a -7.3% drop just this past week and a -14.6% fall over the last month, there is clear evidence of long-term growth for investors willing to stomach the bumps.

Much of this recent price action seems tied to shifting sentiment around healthcare stocks in general, with the market weighing both innovation potential and renewed competition. In short, investors are actively reassessing risk and reward in this sector, and Innoviva is right in the crosshairs.

When it comes to valuation, Innoviva currently checks 2 out of 6 boxes for being undervalued by common financial metrics, giving it a value score of 2. This hints that there may be some attractive pockets, but not slam-dunk cheapness across the board.

So where does that leave us? Let’s walk through the valuation methods most investors use to measure Innoviva’s worth. Stick around, because at the end I’ll share one often-overlooked angle that could really sharpen your view on what Innoviva is actually worth.

Innoviva scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Innoviva Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common way investors estimate a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This approach helps reveal what the business might be worth based on its ability to generate cash over time.

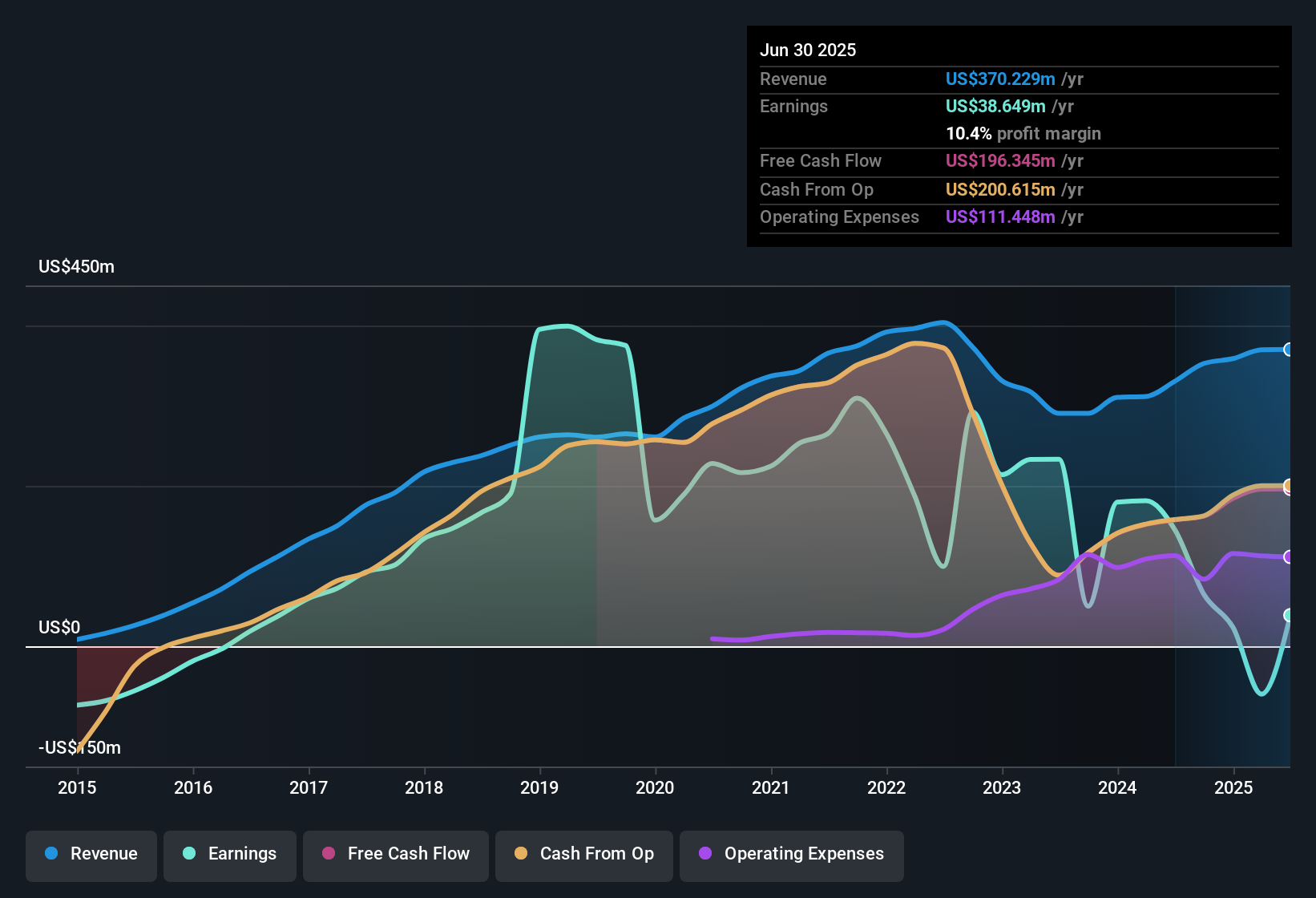

For Innoviva, the most recent reported Free Cash Flow (FCF) is $195.4 million. Over the next decade, analysts expect Innoviva's FCF to remain fairly steady, with five-year analyst projections reaching $177.6 million by 2029. Beyond that, cash flows are extrapolated using conservative growth estimates, with the ten-year FCF projection climbing to approximately $198.6 million in 2035. All of these cash flow figures are presented in US dollars and reflect the consistent cash generation investors are watching closely.

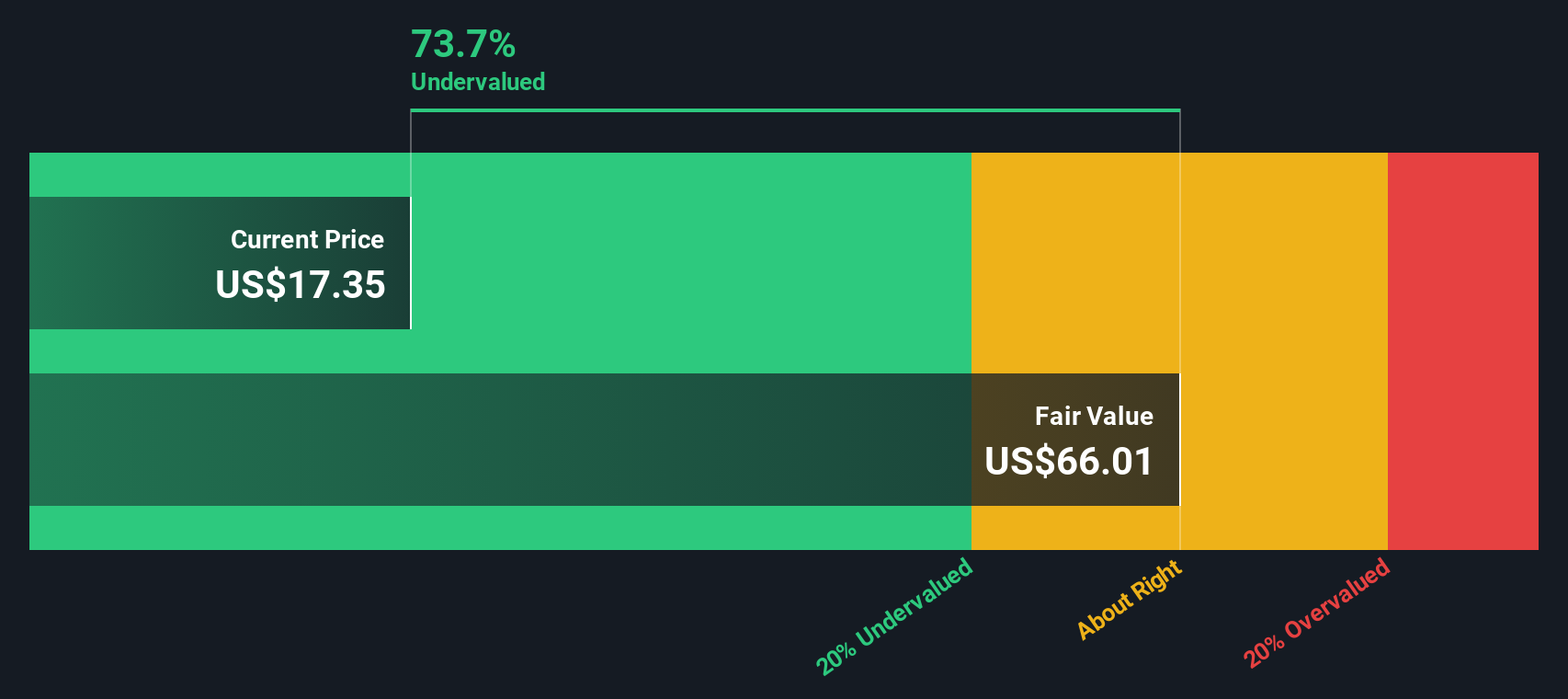

Applying the DCF model, Innoviva's estimated intrinsic value is $66.01 per share. The current share price is trading at a 73.5% discount to this estimate, so the model suggests that Innoviva stock is significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Innoviva is undervalued by 73.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Innoviva Price vs Earnings

The Price-to-Earnings (PE) ratio is the primary valuation metric for profitable companies like Innoviva, as it connects a company’s share price directly to its earnings, making it easier for investors to compare across businesses and industries. A “normal” or “fair” PE ratio is not universal, though. It is influenced by expectations of how fast a company will grow and how much risk investors see in its future prospects. Faster-growing, lower-risk companies often justify higher PE ratios.

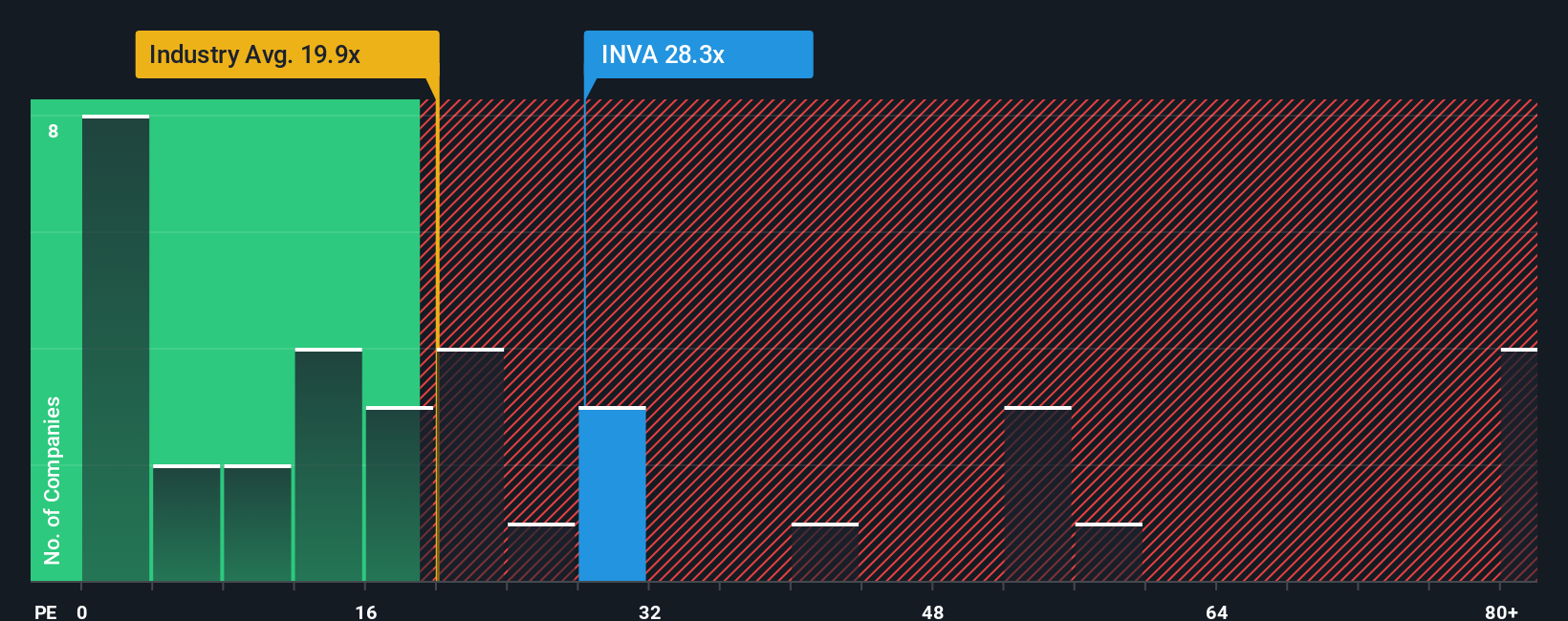

Currently, Innoviva trades at a PE ratio of 28.5x. That is noticeably higher than both the average PE for its pharmaceutical peer group (19.8x) and the broader industry average of 20.0x. This premium suggests investors are either expecting higher growth from Innoviva or are paying extra for some other perceived advantage.

This is where Simply Wall St's “Fair Ratio” provides additional insight. This in-house metric, 16.7x for Innoviva, factors in growth potential, risk, profit margins, industry landscape, and company size, offering a more nuanced view than a simple industry or peer comparison. Because the Fair Ratio examines what truly drives a sensible multiple, it can highlight when a company seems fairly priced, regardless of surface-level premiums or discounts.

With Innoviva’s PE ratio significantly above its Fair Ratio, the numbers point to the stock being overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Innoviva Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple but powerful concept. They let you connect the story you believe about a company (like Innoviva) directly to a set of numbers, including what you think its fair value and future financials could be. This means you are not just relying on static ratios or models; you are anchoring your investment decisions to your own assumptions and forecasts, all linked together in an easy-to-use tool available on Simply Wall St's Community page.

By using Narratives, millions of investors are able to see exactly how new information, such as earnings or breaking news, can update their story and alter their calculated fair value in real time. Narratives give you a clear view of whether Innoviva’s current share price is above or below your fair value estimate, helping you decide exactly when to buy, hold, or sell. For example, one investor might see Innoviva’s fair value at $75 per share based on rapid revenue growth, while another, more cautious user sets it at $50 due to lower growth expectations.

Do you think there's more to the story for Innoviva? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives