- United States

- /

- Biotech

- /

- NasdaqGS:INSM

Analyzing Insmed Stock After Positive FDA Filing News and Triple Digit Gains in 2025

Reviewed by Bailey Pemberton

If you’re wondering what to make of Insmed after its recent run, you’re not alone. It seems like every time you check the stock, it’s making new headlines. With a closing share price of $152.8 and impressive gains of 12.7% in just the past week, investors are understandably interested. Stretch that time frame to 30 days, and you’ll still see a tidy gain of 5.2%. The really jaw-dropping numbers come when you take a step back: year to date, Insmed is up a staggering 118.4%, and over the last three years, it’s risen 565.2%. Not many companies can cite those kinds of numbers, and even among biotechnology names, Insmed’s long-term chart stands out in the sector.

There’s a story behind those moves. Recent developments in the biotech industry, coupled with optimism surrounding drug development pipelines, have helped reposition Insmed in the eyes of both retail investors and institutions. When risk perceptions change, so does the market’s appetite. Insmed seems to be benefiting from renewed confidence about its future growth. Yet with all this upward momentum, the central question remains: does the stock still offer value at today’s levels?

If we look at valuation using six standard checks, Insmed scores a 2, meaning it appears undervalued on two of those measures. Is this still a bargain or is much of the good news already priced in? Let’s break down the traditional valuation approaches and, before we finish, explore an even more insightful way to gauge whether Insmed’s current price makes sense.

Insmed scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Insmed Discounted Cash Flow (DCF) Analysis

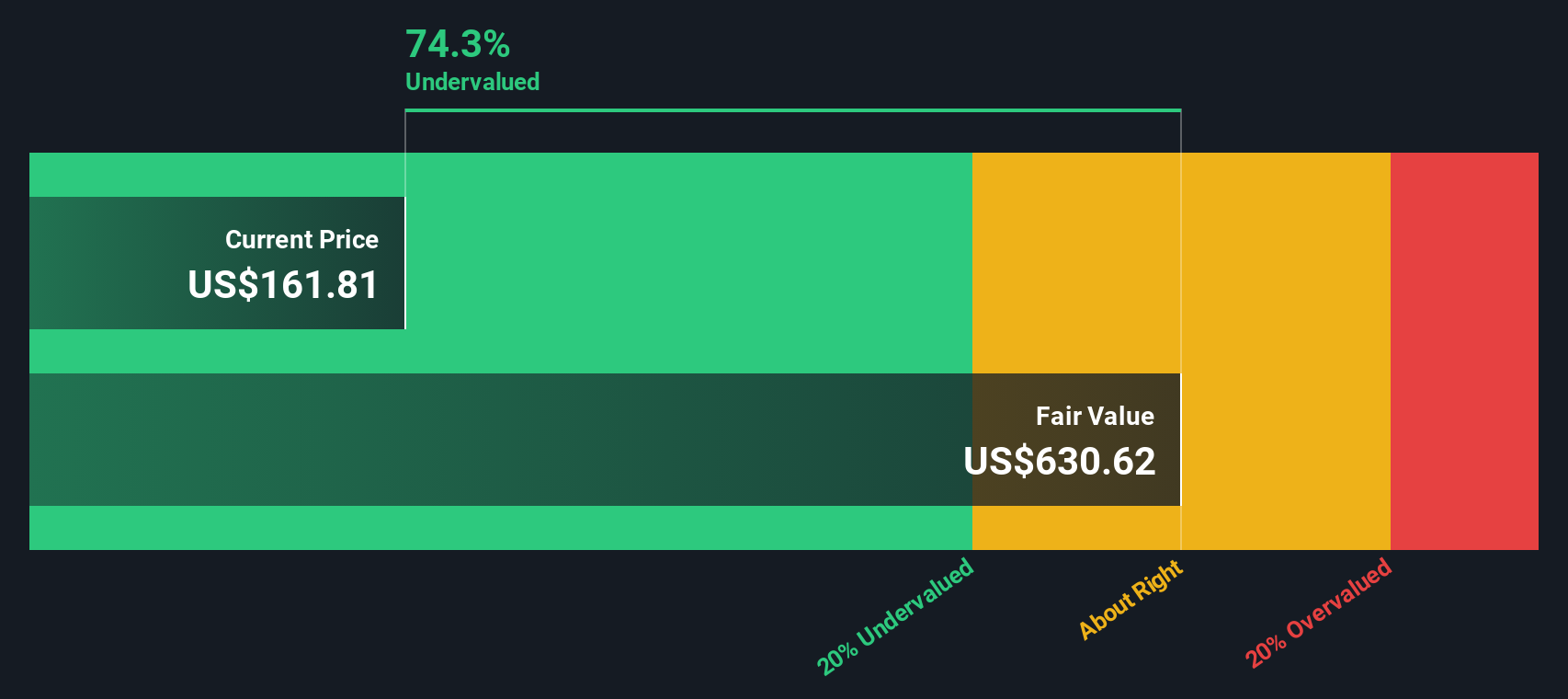

A Discounted Cash Flow (DCF) model estimates what a company’s future cash flows are worth today by projecting out its financial performance and then discounting those figures back to the present. For Insmed, this approach uses cash flow projections over the next decade, blending analyst estimates for the first five years and further projections extrapolated by Simply Wall St for years beyond.

Currently, Insmed’s Free Cash Flow stands at -$866 Million, reflecting significant investment and cash burn as the company develops its drug pipeline. Analyst estimates anticipate that by 2029, Free Cash Flow will rise to $1.5 Billion. By 2035, it could reach up to $7.9 Billion. While these are ambitious targets, they illustrate expectations for massive financial improvement as products move through the clinical and regulatory pipeline.

When all these forecasts are discounted back to today, Insmed’s intrinsic value is estimated at $632.60 per share. With the stock trading around $152.80, this suggests the shares are about 75.8% undervalued according to the DCF model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Insmed is undervalued by 75.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

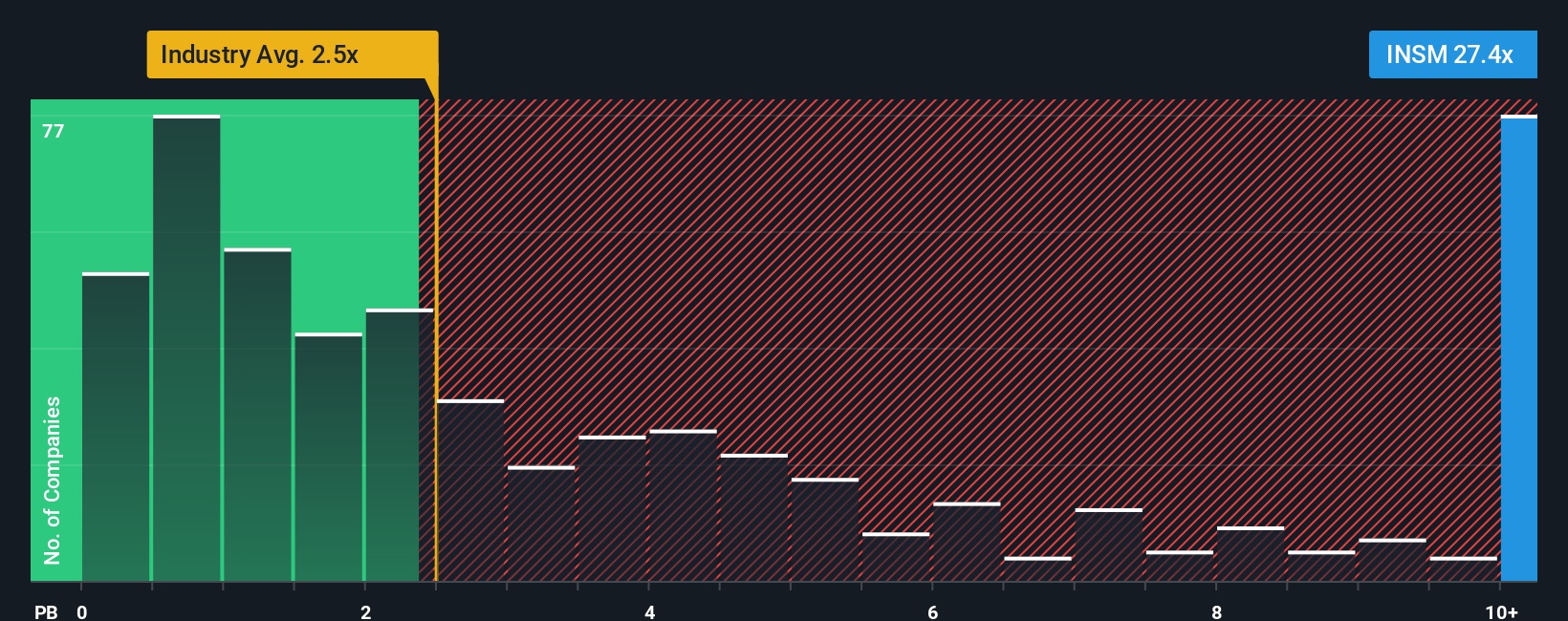

Approach 2: Insmed Price vs Book

The price-to-book (PB) ratio is often used to value companies, especially in sectors like biotech where profits may be lumpy or not yet established. PB compares a company’s market value to its net assets, giving investors a sense of how much they're paying for each dollar of book value. For profitable or asset-rich companies, it provides a useful snapshot of whether shares trade at a premium or discount to their underlying assets.

Growth prospects and risk levels play a big role in what a “normal” PB ratio should look like. Companies with promising pipelines or stronger balance sheets may command higher multiples, while those facing uncertainty or low returns justify lower PBs. Industry averages and peer benchmarks help to provide context. In Insmed’s case, its PB ratio stands at 25.8x, far higher than the biotech industry average of 2.45x and also above the peer average of 7.38x.

Simply Wall St’s proprietary “Fair Ratio” offers a more tailored benchmark by analyzing Insmed’s specific growth, profit margins, industry characteristics, market cap, and risk factors. This goes beyond simple peer or industry comparisons as it adjusts expectations for the company’s unique situation. By weighing all these elements, the Fair Ratio reveals whether the current valuation is justified or out of line.

Comparing Insmed’s actual PB ratio with its calculated Fair Ratio, we see a notable gap, suggesting the stock may be priced above what fundamentals and risk would support.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Insmed Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story, your perspective on a company’s future, turned into a financial forecast and an estimated fair value, making it easy to see how belief in Insmed's pipeline, revenue growth, and margins translates into numbers.

Rather than relying on a single spreadsheet or analyst target, Narratives let you connect the dots between Insmed’s latest milestones, such as product launches, clinical readouts, or new risks, and your own assumptions about future earnings and fair price. This feature, available on Simply Wall St’s Community page and used by millions of investors, makes investing more accessible by allowing you to test different stories against up-to-date facts and see instantly how shifts in news or financials change the outlook.

The real edge is that when news drops or earnings are released, Narratives update dynamically so your thesis always stays relevant. For example, one investor might see Insmed’s international expansion and successful FDA approvals and assign a high fair value like $158 per share. A more cautious user, wary of competition and reimbursement risk, could see the fair value closer to $89. By comparing your Fair Value to the current Price, Narratives help you decide when it is time to buy, sell, or simply watch.

Do you think there's more to the story for Insmed? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INSM

Insmed

Develops and commercializes therapies for patients with serious and rare diseases in the United States, Europe, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives