- United States

- /

- Biotech

- /

- OTCPK:INFI.Q

Can You Imagine How Jubilant Infinity Pharmaceuticals' (NASDAQ:INFI) Shareholders Feel About Its 147% Share Price Gain?

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. For example, the Infinity Pharmaceuticals, Inc. (NASDAQ:INFI) share price has soared 147% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 139% gain in the last three months. It is also impressive that the stock is up 45% over three years, adding to the sense that it is a real winner.

See our latest analysis for Infinity Pharmaceuticals

We don't think Infinity Pharmaceuticals' revenue of US$1,591,000 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Infinity Pharmaceuticals has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Infinity Pharmaceuticals has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

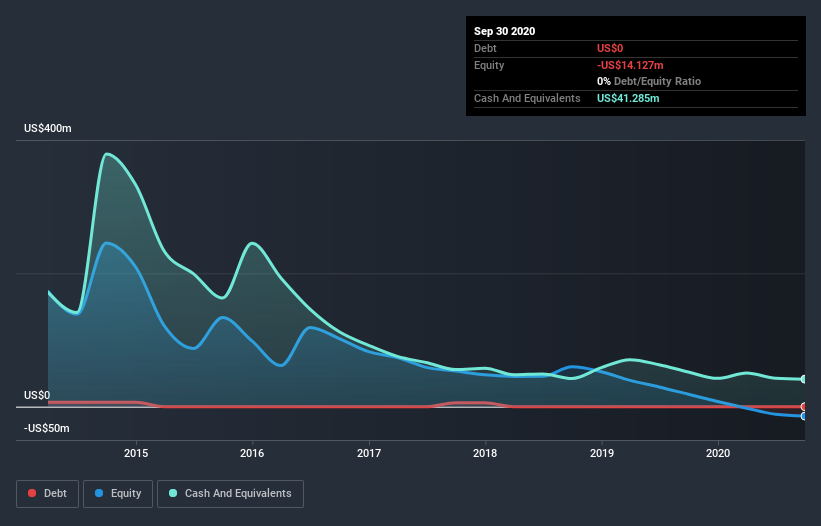

Infinity Pharmaceuticals had liabilities exceeding cash by US$20m when it last reported in September 2020, according to our data. That puts it in the highest risk category, according to our analysis. So the fact that the stock is up 85% in the last year shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. You can click on the image below to see (in greater detail) how Infinity Pharmaceuticals' cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

We're pleased to report that Infinity Pharmaceuticals shareholders have received a total shareholder return of 147% over one year. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Infinity Pharmaceuticals (including 1 which shouldn't be ignored) .

But note: Infinity Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Infinity Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:INFI.Q

Infinity Pharmaceuticals

Infinity Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, focuses on developing novel medicines for people with cancer.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives