- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Why Indivior (INDV) Lifted Its 2025 Outlook After Positive SUBLOCADE Data and Real-World Evidence

Reviewed by Sasha Jovanovic

- Indivior PLC recently reported third-quarter earnings surpassing last year's figures, raised its full-year 2025 revenue guidance to between US$1.18 billion and US$1.22 billion, and presented new real-world evidence at AMCP Nexus 2025 highlighting the clinical and economic benefits of SUBLOCADE for opioid use disorder treatment.

- The presented data indicated that higher adherence to SUBLOCADE was associated with fewer hospitalizations, emergency visits, and reduced total medical costs among both Medicaid and commercially insured patients.

- We'll explore how Indivior's upgraded 2025 revenue forecast, supported by positive SUBLOCADE study results, shapes its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Indivior's Investment Narrative?

For those who see promise in Indivior, the big picture centers on the company’s ability to establish SUBLOCADE as a standard treatment for opioid use disorder, with clinical and health economics data now signaling clear value for both patients and payors. The latest AMCP Nexus data didn’t just affirm lower hospitalizations and costs with higher SUBLOCADE adherence; it added fresh momentum to Indivior’s story right after the company raised its full-year revenue guidance. This strengthens a key short-term catalyst: expanding payer adoption and market share. On the risk side, while Indivior is now showing profitability, its high price-to-earnings ratio and recent management turnover remain top concerns, with growth projections still modest relative to valuation. The recent data could help mitigate some business risks, but the market’s enthusiasm may already reflect much of this positive shift. On the other hand, the high valuation multiples may deserve a closer look as new management beds in.

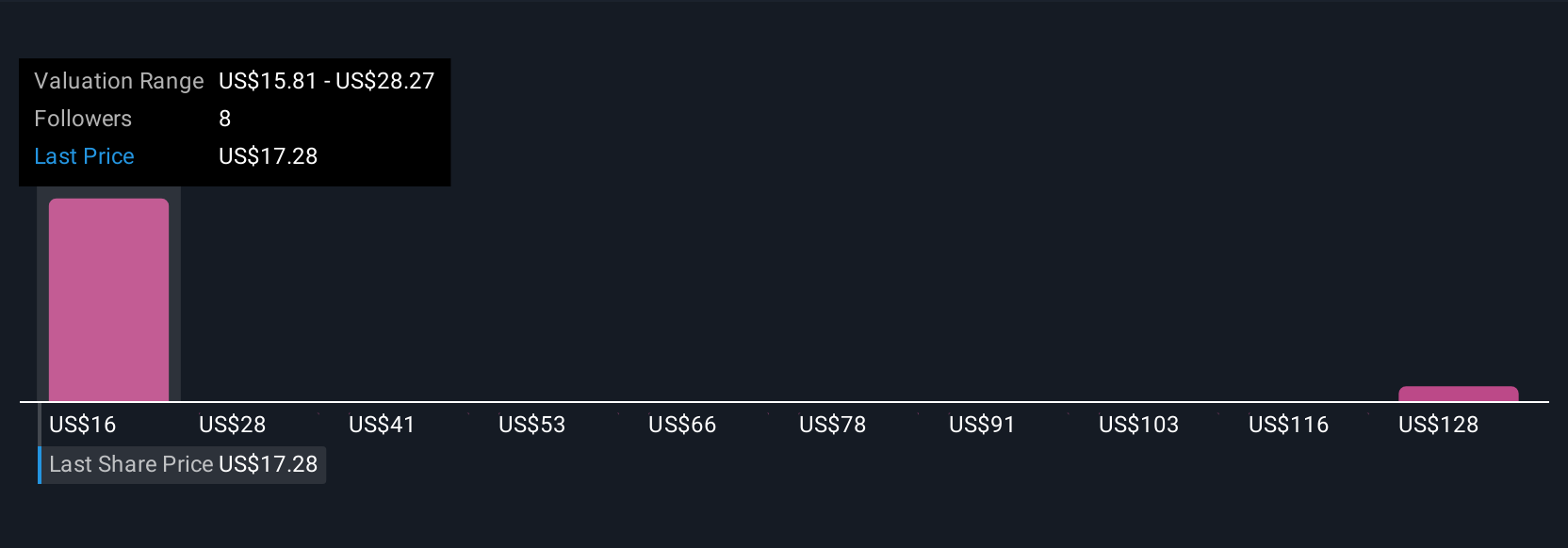

Despite retreating, Indivior's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Indivior - why the stock might be worth over 3x more than the current price!

Build Your Own Indivior Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Indivior research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Indivior research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Indivior's overall financial health at a glance.

No Opportunity In Indivior?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives