- United States

- /

- Pharma

- /

- NasdaqGS:INDV

The Bull Case For Indivior (INDV) Could Change Following Positive SUBLOCADE Rapid Induction Trial Data—Learn Why

Reviewed by Sasha Jovanovic

- Earlier this month, Indivior PLC announced new clinical trial data published in JAMA Network Open showing that rapid induction with SUBLOCADE®, its extended-release buprenorphine injection for opioid use disorder, was well tolerated and resulted in higher patient retention at the second injection compared to standard induction strategies.

- An especially noteworthy finding from the study is the pronounced benefit of rapid induction among patients using fentanyl, a population with considerable clinical need.

- We'll review how the rapid induction approach and improved retention rates with SUBLOCADE® influence Indivior's investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Indivior's Investment Narrative?

To have conviction in Indivior as a shareholder right now, you need to believe in the company’s ability to turn scientific advances, like the recent positive SUBLOCADE® rapid induction data, into meaningful commercial traction. This study’s findings could enhance one of Indivior’s key near-term catalysts: better patient retention for SUBLOCADE®, especially among people with high clinical needs such as those using fentanyl. If the market views these outcomes as clinically significant and likely to influence prescribing patterns, the potential impact could shift focus toward increased adoption of SUBLOCADE® and future revenue growth. Prior to this news, Indivior’s major risks centered on high debt, a newly restructured board, and questions about sustained profitability after a year of one-off gains. The new clinical evidence may partly offset worries about slow forecast revenue growth, but it doesn’t resolve balance sheet and turnover issues.

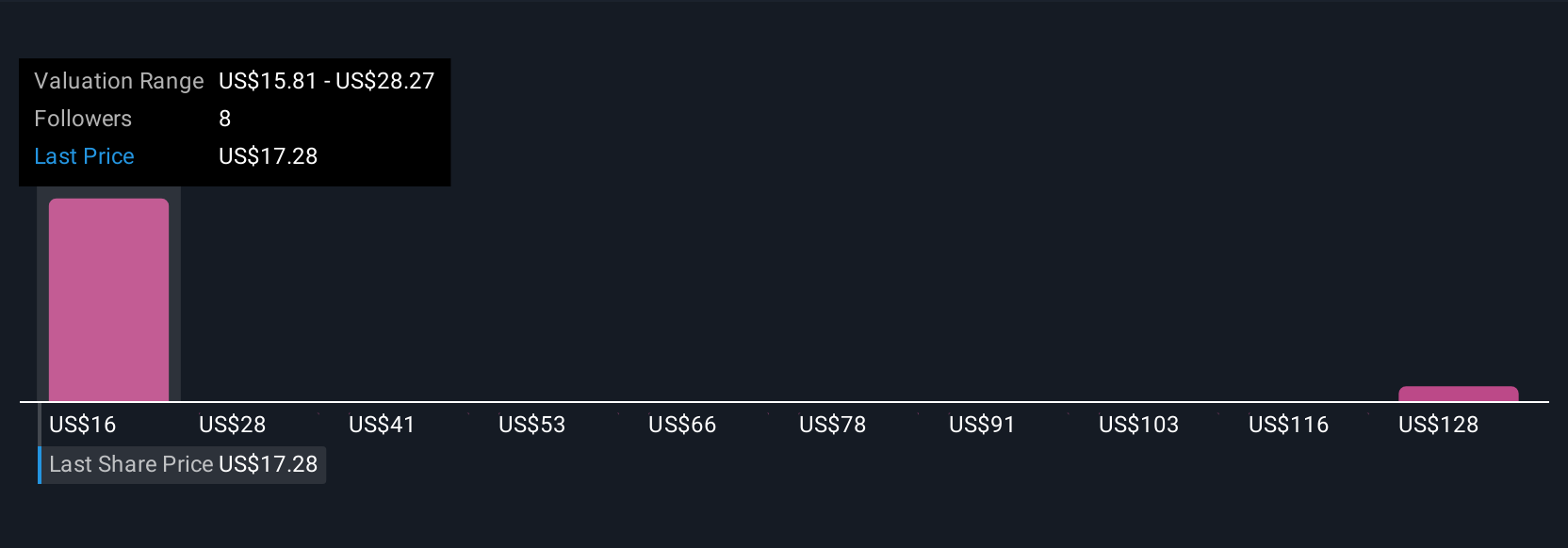

On the other hand, risks like rapid board changes and high debt remain critical to monitor. Indivior's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Indivior - why the stock might be worth just $29.17!

Build Your Own Indivior Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Indivior research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Indivior's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives