- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Indivior (INDV): Valuation in Focus After Return to Profit and Raised Full-Year Guidance

Reviewed by Kshitija Bhandaru

If you’ve been following Indivior (NasdaqGS:INDV), this is the kind of update that makes you sit up and reconsider your stance. The company just swung back to profitability in the second quarter of 2025, turning last year’s net loss into an $18 million gain, and has confidently raised its full-year net revenue guidance. That kind of reversal is bound to draw investor eyes, especially with the management signaling stronger momentum for the remainder of the year, even if ongoing legal battles and high debt load are still on the radar.

Investors have seen Indivior’s stock charge ahead, with a 150% rally in the past year and an 86% climb year-to-date. Most of that excitement has built up in just the past three months, where optimism around execution and guidance upgrades has clearly spilled into share price momentum. Yet, it’s not all smooth sailing, as discussions about management changes and legal uncertainties continue to cast a long shadow, even as the market appears to have recalibrated near-term risk and reward.

So with shares now trading at a multi-year high, the big question looms: are you looking at a genuine buying opportunity, or is the market already pricing in everything Indivior has to offer?

Price-to-Earnings of 54.8x: Is it justified?

Based on the preferred price-to-earnings multiple, Indivior is currently trading at a 54.8x ratio, which appears expensive when weighed against both the peer group average and the broader US pharmaceuticals industry.

The price-to-earnings (P/E) ratio is a common metric used to assess how the market is valuing a company’s profits relative to similar firms. It is especially important for pharmaceutical and biotech firms, where profit growth expectations often drive valuations more than traditional revenue metrics.

In Indivior's case, this elevated multiple suggests that investors are pricing in very high future earnings growth or possible one-off gains that may not persist. This raises the question of whether such optimism is justified by the company’s profit history and sector prospects.

Result: Fair Value of $23.27 (OVERVALUED)

See our latest analysis for Indivior.However, persistent legal overhangs and Indivior's significant debt levels could quickly shift sentiment if these issues are not managed more effectively in the coming quarters.

Find out about the key risks to this Indivior narrative.Another View: What Does the SWS DCF Model Say?

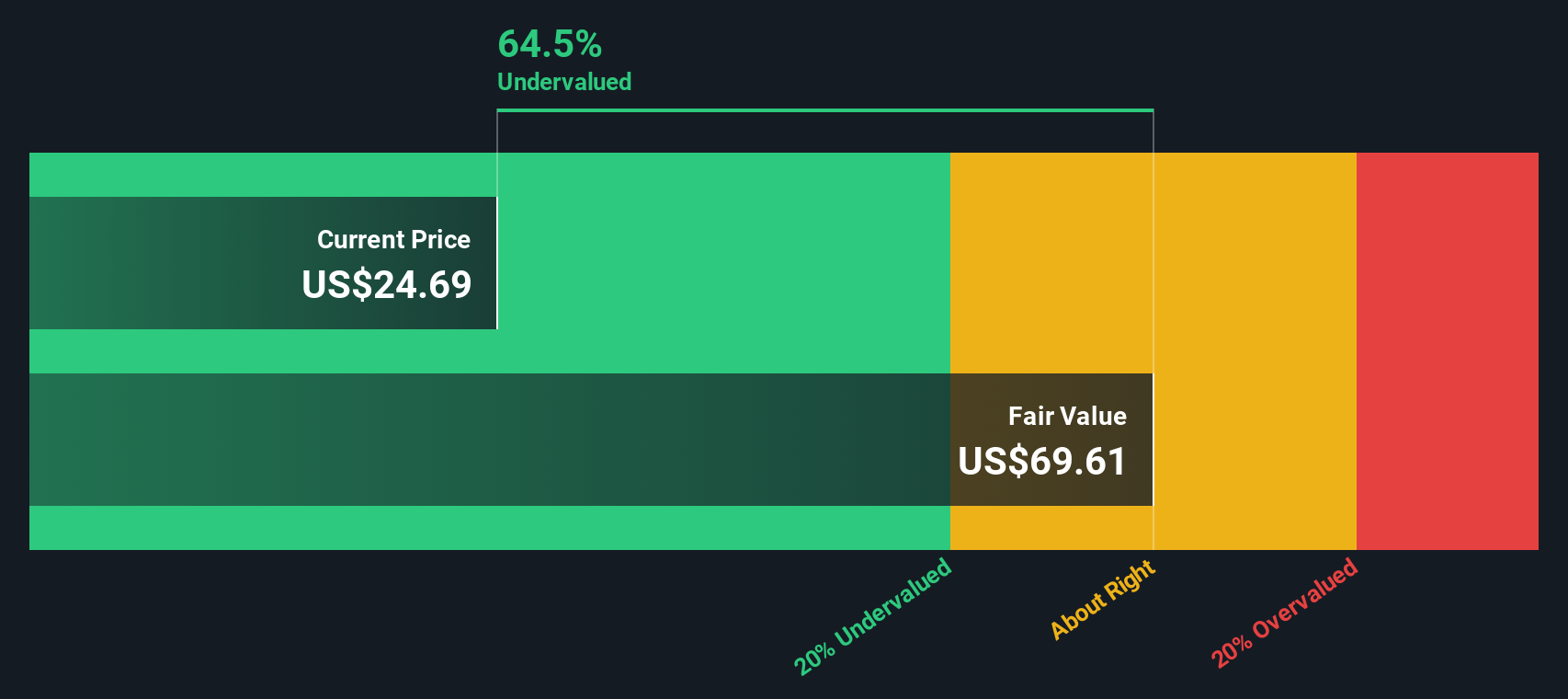

While the market seems to be assigning a high value based on recent earnings, our DCF model tells a very different story. It suggests the stock could actually be undervalued. Which signal should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Indivior Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own view on Indivior’s story in just a few minutes. Do it your way

A great starting point for your Indivior research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just pause at Indivior. Expand your horizons and tap into some of the brightest investing trends right now using the Simply Wall Street Screener. These strategies spotlight bold opportunities you won’t want to ignore.

- Uncover hidden value with companies trading below their potential when you check out our undervalued stocks based on cash flows for those quietly outperforming expectations.

- Step ahead of the curve by tracking healthcare disruptors transforming patient care with artificial intelligence powered breakthroughs through our healthcare AI stocks.

- Secure steady income with stocks offering yields above 3 percent using our dividend stocks with yields > 3% to target reliable dividend payers in turbulent markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives