- United States

- /

- Pharma

- /

- NasdaqGS:INDV

A Look at Indivior (INDV) Valuation Following New Clinical Trial Results for SUBLOCADE

Reviewed by Simply Wall St

Indivior (NasdaqGS:INDV) has drawn attention after releasing results from a new multicenter clinical trial examining initiation methods for SUBLOCADE, its extended-release buprenorphine therapy. The data signals higher retention rates and better patient engagement, especially for those with fentanyl use.

See our latest analysis for Indivior.

Indivior's latest clinical milestone comes on the back of powerful stock momentum, with a 99.2% year-to-date share price return and a remarkable 190.9% total shareholder return over one year. While the news of SUBLOCADE's improved outcomes adds to the positive outlook, recent moves also reflect growing confidence in Indivior's long-term strategy and evolving risk profile. Momentum is clearly building as both innovation and market sentiment align.

If innovations like SUBLOCADE have you thinking about what's next in the sector, now’s a great time to explore See the full list for free.

With shares gaining nearly 100% this year and clinical momentum accelerating, investors are considering whether Indivior’s current valuation presents a bargain for the long term or if the market already reflects the potential of SUBLOCADE’s growth story.

Price-to-Earnings of 58.6x: Is it justified?

At a last close price of $24.90, Indivior trades at a hefty price-to-earnings (P/E) ratio of 58.6x, which is notably higher than its industry peers. This figure stands out given how rapidly the company’s valuation has risen compared to others in the US Pharmaceuticals sector.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company’s earnings. For pharmaceutical companies like Indivior, a high P/E ratio can reflect strong expectations for future growth or optimism about breakthrough products.

In Indivior’s case, the current P/E multiple significantly exceeds both the peer average (21.4x) and the broader US Pharmaceuticals industry average (18.4x). The market appears to be pricing in earnings growth far greater than competitors. However, compared to the estimated fair P/E ratio of 29.6x, the current multiple looks expensive and may attract future scrutiny if delivery on projected growth slows.

Explore the SWS fair ratio for Indivior

Result: Price-to-Earnings of 58.6x (OVERVALUED)

However, slower revenue growth or any setbacks in clinical adoption could quickly challenge the optimism that currently supports Indivior’s elevated valuation.

Find out about the key risks to this Indivior narrative.

Another View: Discounted Cash Flow Shows Deep Value

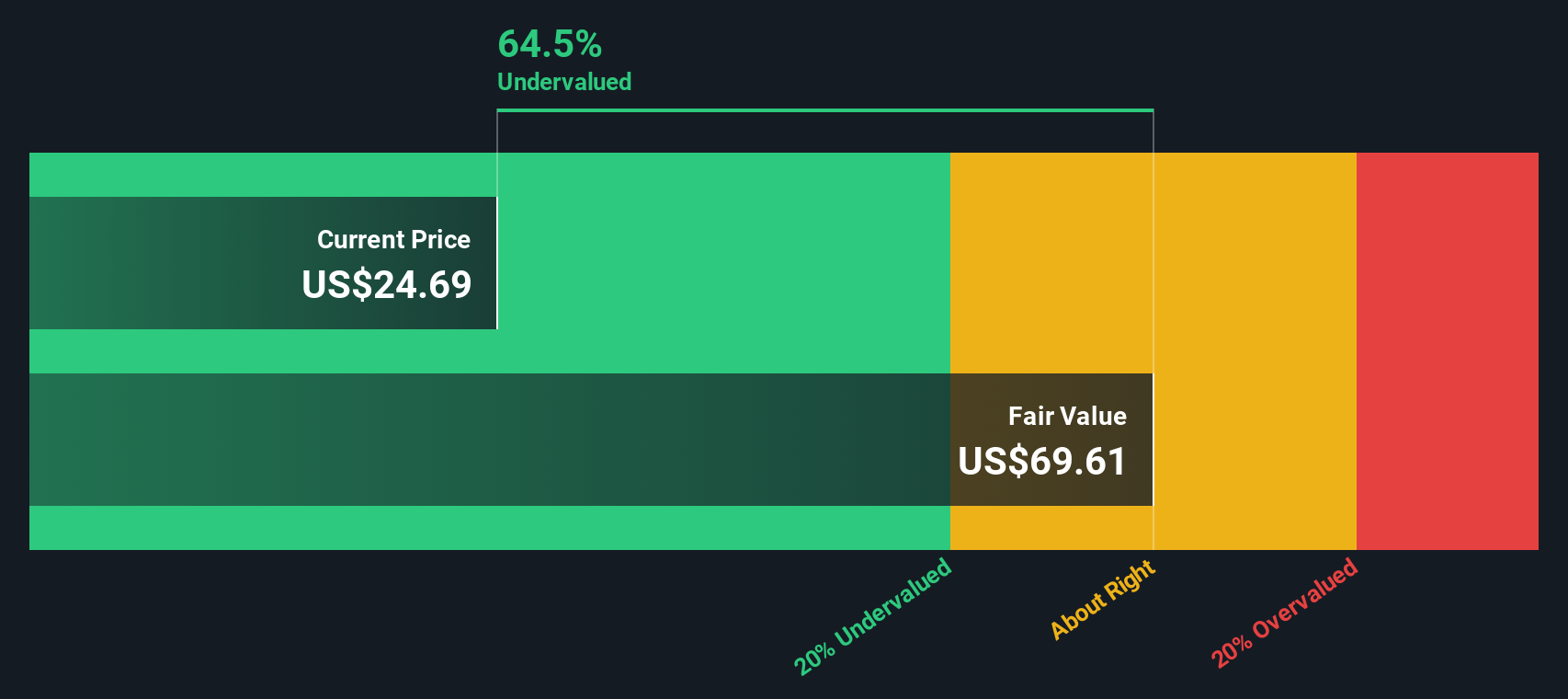

Looking beyond traditional price-to-earnings comparisons, our SWS DCF model presents a significantly different perspective for Indivior. The model estimates the fair value at $69.61 per share, which indicates that the stock is trading at a steep 64.2% discount. Is the market overlooking something crucial, or is this simply too good to be true?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Indivior for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Indivior Narrative

If this perspective doesn't quite match your own, or you’d rather draw your own conclusions from the numbers, you can shape your unique Indivior narrative in just a few minutes with Do it your way

A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let your next great stock slip off the radar. Set yourself up for smarter moves by checking out these targeted opportunities today:

- Capitalize on strong cash flow potential by spotting compelling bargains through these 871 undervalued stocks based on cash flows and seize undervalued companies before the market catches on.

- Power your portfolio for the long term by tracking reliable payouts with these 17 dividend stocks with yields > 3%, offering standout yields above 3%.

- Get ahead of transformative innovation and zero in on breakthrough opportunities with these 26 AI penny stocks leading the way in artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives