- United States

- /

- Biotech

- /

- NasdaqGS:INCY

Incyte (INCY): Assessing Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Incyte (INCY) shares have modestly outperformed the broader market over the past three months, gaining nearly 27%. For investors, this recent momentum stands out given a mixed track record over the past few years.

See our latest analysis for Incyte.

Over the past year, Incyte has delivered a strong 32.6% total shareholder return, driven by renewed momentum in recent months and positive sentiment around its long-term growth prospects. While the past five years haven’t been as upbeat, the recent stretch suggests investors are warming to its outlook once again.

If pharma’s resurgence has your attention, consider exploring opportunities across the sector using our curated list of promising healthcare innovators: See the full list for free.

After strong gains and improving sentiment, the key question for investors is whether Incyte’s future growth is fully reflected in today’s price, or if the recent rally still leaves room for further upside.

Most Popular Narrative: 4.2% Overvalued

With Incyte’s last close at $87.17 and the narrative fair value at $83.62, the stage is set for a debate on whether current optimism has pushed shares slightly ahead of justified levels. This perspective weighs updated analyst expectations against the realities of commercial execution and pipeline risk.

The company's more disciplined capital allocation strategy, prioritizing internal late-stage pipeline assets, operating expense control, and targeted business development, suggests increasing operating leverage and net margin expansion, as evidenced by guidance for operating expenses to grow more slowly than revenues.

Why do analysts believe margins will leap, and what pipeline behind-the-scenes action is fueling their confidence? The controversial interplay between cost discipline and blockbuster product launches may be driving this bold valuation view. Click to see the key assumptions and the numbers they are betting on.

Result: Fair Value of $83.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any unexpected setbacks in pipeline approvals or heavier than anticipated pricing pressure could quickly cast doubt on the current bullish outlook.

Find out about the key risks to this Incyte narrative.

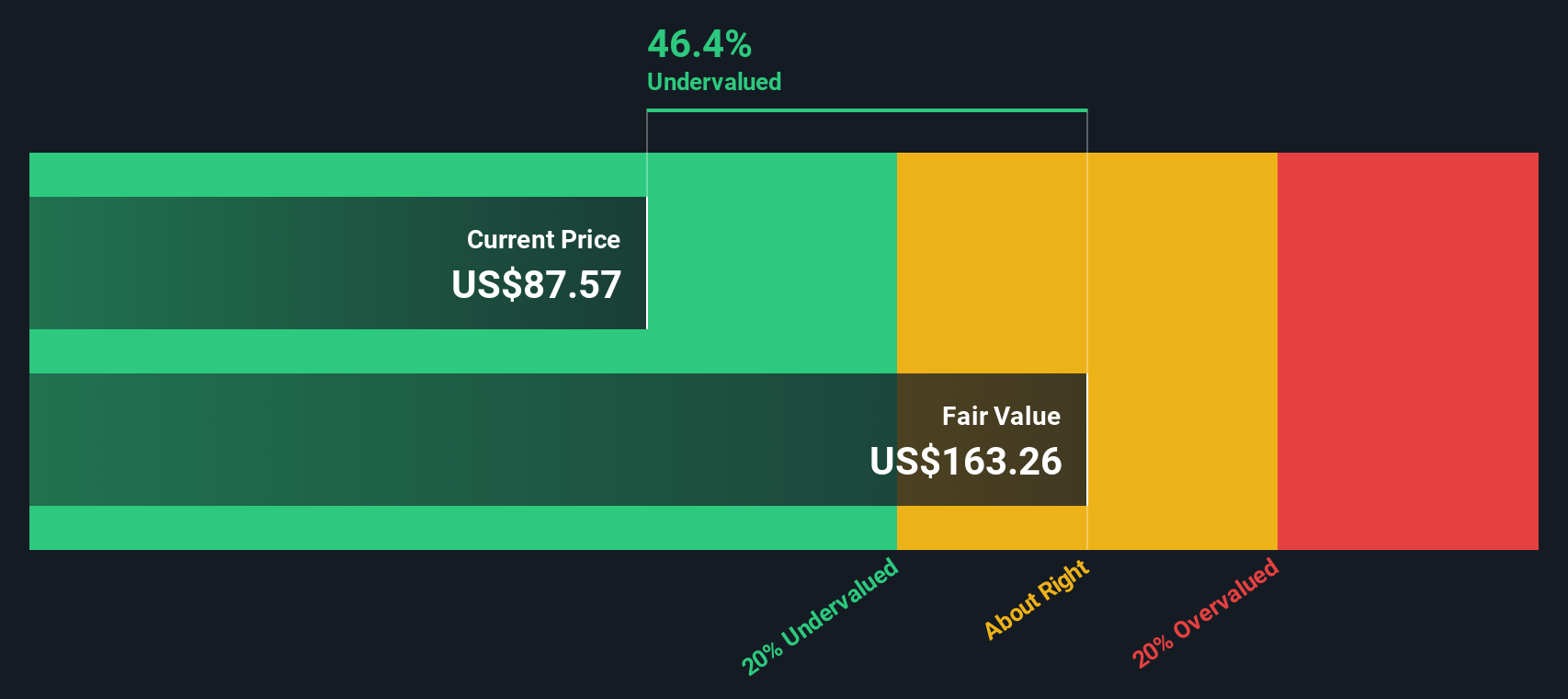

Another View: Discounted Cash Flow Model Suggests Deep Value

While the current fair value narrative points to modest overvaluation, our SWS DCF model paints a much more optimistic picture. According to this method, Incyte’s shares are trading at a substantial 47% discount to its estimated fair value of $165.15. That’s a major gap. Could the market be leaving significant value on the table, or is it pricing in risks the DCF overlooks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Incyte Narrative

If you want to analyze Incyte from your own perspective or put alternative assumptions to the test, it’s easy to build your own view in just a few minutes. Do it your way.

A great starting point for your Incyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great investment opportunities slip by. Use the Simply Wall St Screener to spot stocks you might otherwise overlook and stay ahead of the crowd with unique, data-powered picks.

- Maximize your potential gains and access new market favorites by checking out these 894 undervalued stocks based on cash flows that show strong fundamentals and attractive price points.

- Get ahead of innovation trends and position your portfolio for tomorrow’s breakthroughs by targeting these 25 AI penny stocks built on game-changing artificial intelligence.

- Secure steady income and financial resilience through these 19 dividend stocks with yields > 3%, handpicked for their yields above 3% and reliable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives