- United States

- /

- Communications

- /

- NasdaqGM:AAOI

High Growth Tech Stocks in US with Strong Potential for Investors

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 1.8% over the last week and 9.5% over the past year, with earnings projected to grow by 14% annually. In this context of robust market performance, identifying high growth tech stocks with strong potential involves looking for companies that demonstrate innovative capabilities and adaptability in a rapidly evolving sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.35% | 34.10% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.69% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.29% | 67.39% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alkami Technology | 20.59% | 90.79% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Ascendis Pharma | 32.75% | 59.64% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Applied Optoelectronics (NasdaqGM:AAOI)

Simply Wall St Growth Rating: ★★★★★★

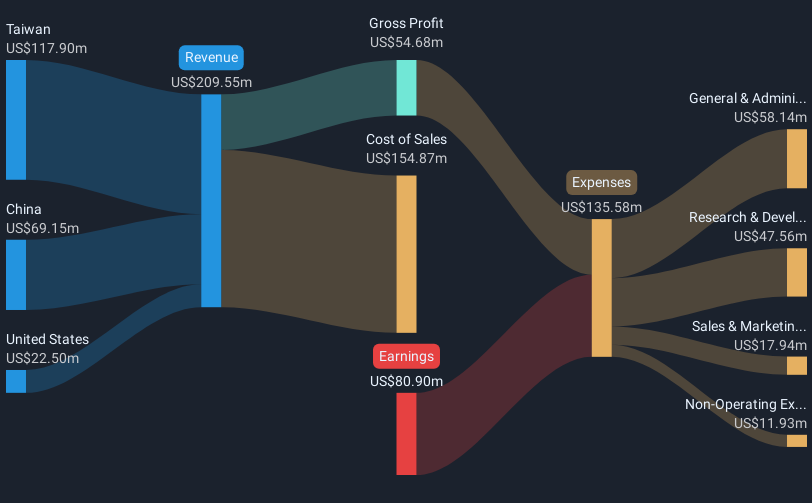

Overview: Applied Optoelectronics, Inc. designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China with a market cap of $710.02 million.

Operations: The company generates revenue primarily from the sale of optical networking equipment, totaling $249.37 million.

Applied Optoelectronics, amid a challenging landscape, has shown resilience with strategic initiatives aimed at bolstering its market position. Recently, the company filed a Shelf Registration to potentially raise $27.74 million, reflecting proactive capital management. This move coincides with an amendment to reduce quorum requirements for shareholder meetings, enhancing governance flexibility. Despite reporting a significant net loss of $119.69 million in Q4 2024, AAOI's revenue forecasts are robust, expecting an annual increase of 58.9%. This positions the firm well within the high-growth tech sector as it transitions towards profitability with anticipated earnings growth of 140.92% per year over the next three years. These figures underscore AAOI’s potential pivot from current challenges towards sustainable growth driven by innovative technology solutions in optical networking.

- Navigate through the intricacies of Applied Optoelectronics with our comprehensive health report here.

Assess Applied Optoelectronics' past performance with our detailed historical performance reports.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

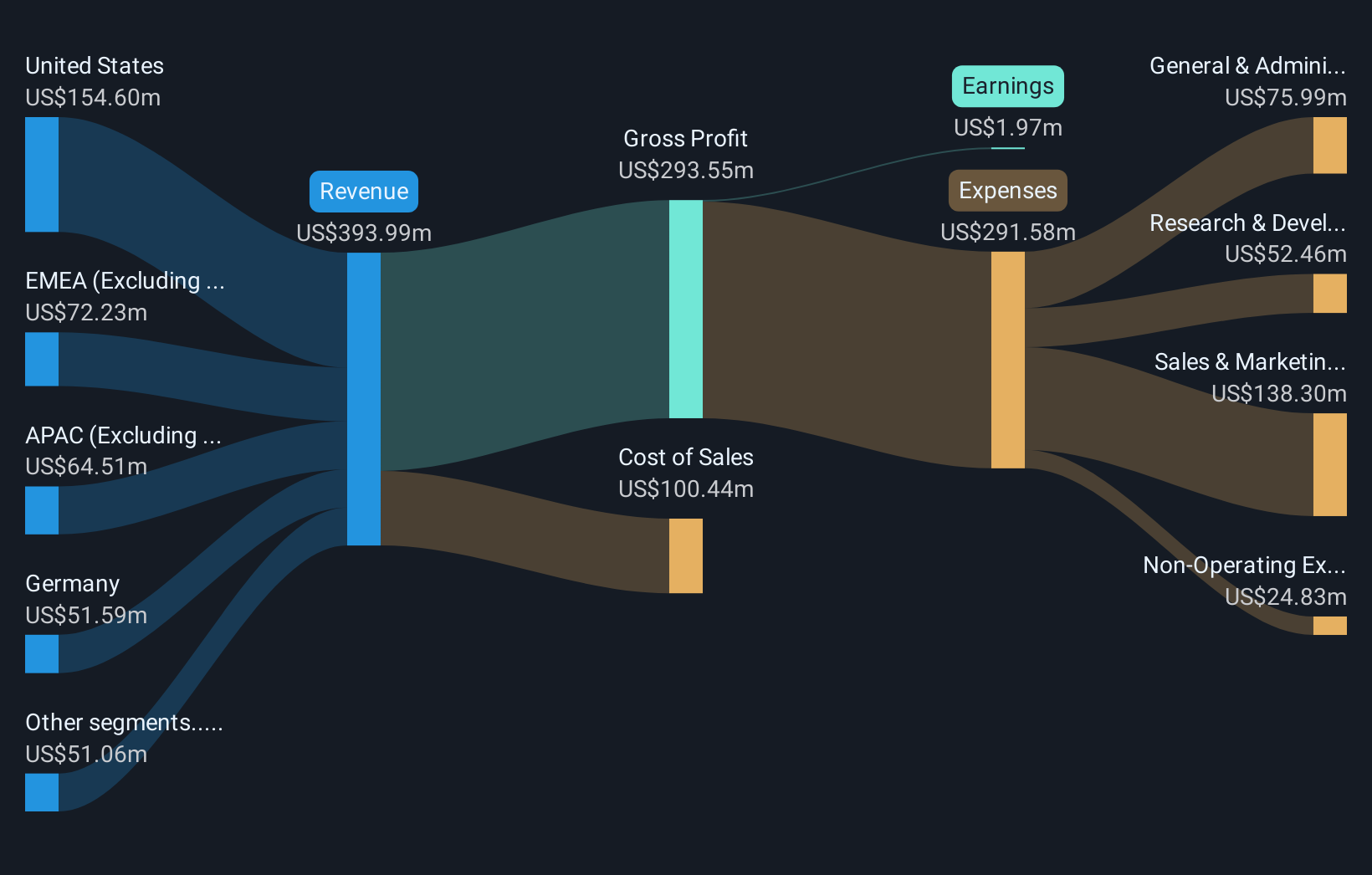

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $3.32 billion.

Operations: With a focus on cloud-native data management, AvePoint generates revenue primarily from its software and programming segment, which accounts for $330.48 million.

AvePoint's recent strategic moves, including the launch of new capabilities on its AvePoint Elements Platform and significant shelf registration filings, underscore its aggressive push to expand in the managed service provider (MSP) market. By enhancing user lifecycle management and device security across tenants, AvePoint taps into a growing need for comprehensive digital ecosystem management—a sector poised for expansion with the managed security services market expected to reach $56.6 billion by 2027. Coupled with a robust annual revenue growth forecast of 17.3% and an anticipated earnings surge of nearly 96%, these developments position AvePoint favorably within the tech landscape as it transitions towards profitability and broadens its market presence through strategic acquisitions aimed at bolstering its SaaS offerings.

- Get an in-depth perspective on AvePoint's performance by reading our health report here.

Review our historical performance report to gain insights into AvePoint's's past performance.

Incyte (NasdaqGS:INCY)

Simply Wall St Growth Rating: ★★★★☆☆

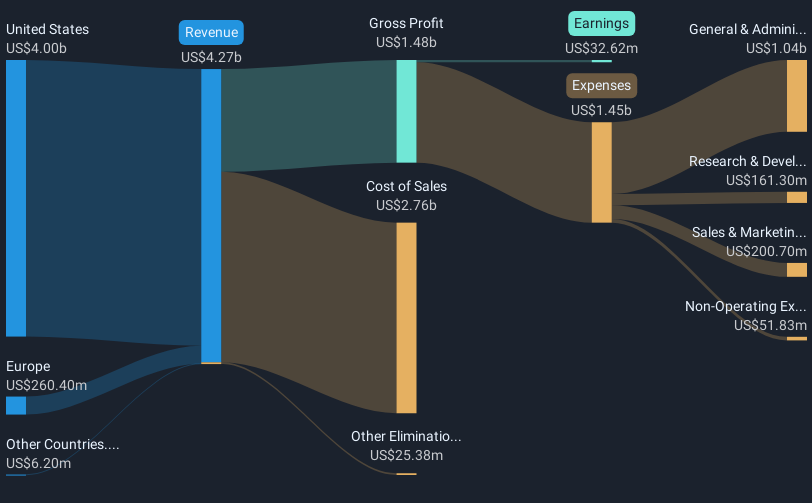

Overview: Incyte Corporation is a biopharmaceutical company focused on discovering, developing, and commercializing therapeutics across the United States, Europe, Canada, and Japan with a market cap of $12.13 billion.

Operations: Incyte generates revenue primarily from its biotechnology segment, amounting to $4.41 billion. The company operates in key markets including the United States, Europe, Canada, and Japan.

Incyte's recent performance and strategic initiatives highlight its adaptive approach in the competitive biotech sector. With a reported Q1 revenue increase to $1.05 billion from $880.89 million year-over-year and a slight dip in net income to $158.2 million, the company is navigating market challenges while investing in growth areas like Jakafi, projected to generate between $2.95 billion and $3 billion this year. The firm's commitment to innovation is evident from its raised guidance and ongoing clinical successes with baricitinib for alopecia areata, showcasing significant potential in dermatological applications. This focus on specialized treatments positions Incyte well for sustained relevance amidst evolving healthcare demands.

Turning Ideas Into Actions

- Reveal the 236 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives