- United States

- /

- Biotech

- /

- NasdaqCM:IMTX

Shareholders in Immatics (NASDAQ:IMTX) have lost 35%, as stock drops 6.3% this past week

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, you risk returning less than the market. We regret to report that long term Immatics N.V. (NASDAQ:IMTX) shareholders have had that experience, with the share price dropping 35% in three years, versus a market return of about 20%. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days.

Since Immatics has shed US$74m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Immatics

Given that Immatics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Immatics saw its revenue grow by 5.1% per year, compound. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 11% over the last three years. If revenue growth accelerates, we might see the share price bounce. But the real upside for shareholders will be if the company can start generating profits.

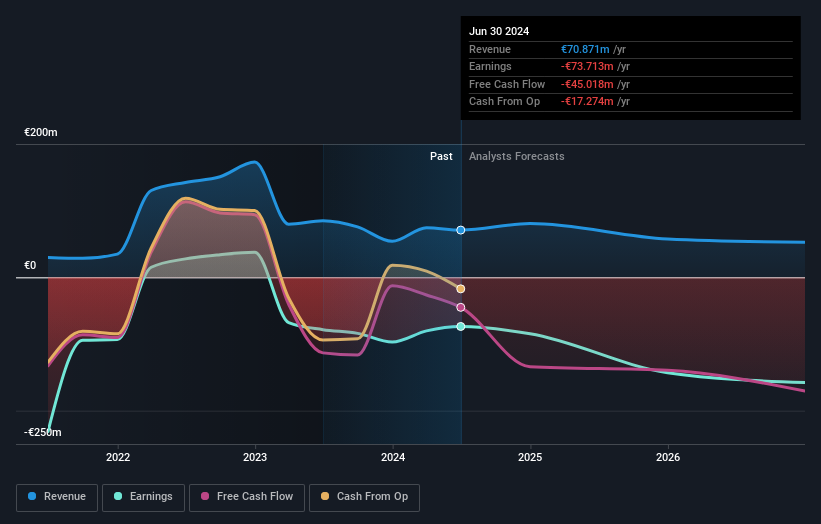

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Immatics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Immatics shareholders gained a total return of 23% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.9% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Immatics is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IMTX

Immatics

A clinical-stage biopharmaceutical company, focuses on the research and development of potential T cell redirecting immunotherapies for the treatment of cancer in the United States.

Flawless balance sheet low.