- United States

- /

- Biotech

- /

- NasdaqCM:IMTX

Can Immatics' (IMTX) TCR Bispecifics Reveal Shape the Future of Its Innovation Strategy?

Reviewed by Sasha Jovanovic

- Immatics recently announced it will present the complete TCR Bispecifics dataset and detail the next development steps at a special call scheduled for November 12, 2025.

- This update offers a comprehensive look at clinical advances and may shed light on the company's ongoing innovation in TCR bispecific therapies.

- We'll explore how the unveiling of clinical results and development plans could shape Immatics' investment narrative moving forward.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Immatics' Investment Narrative?

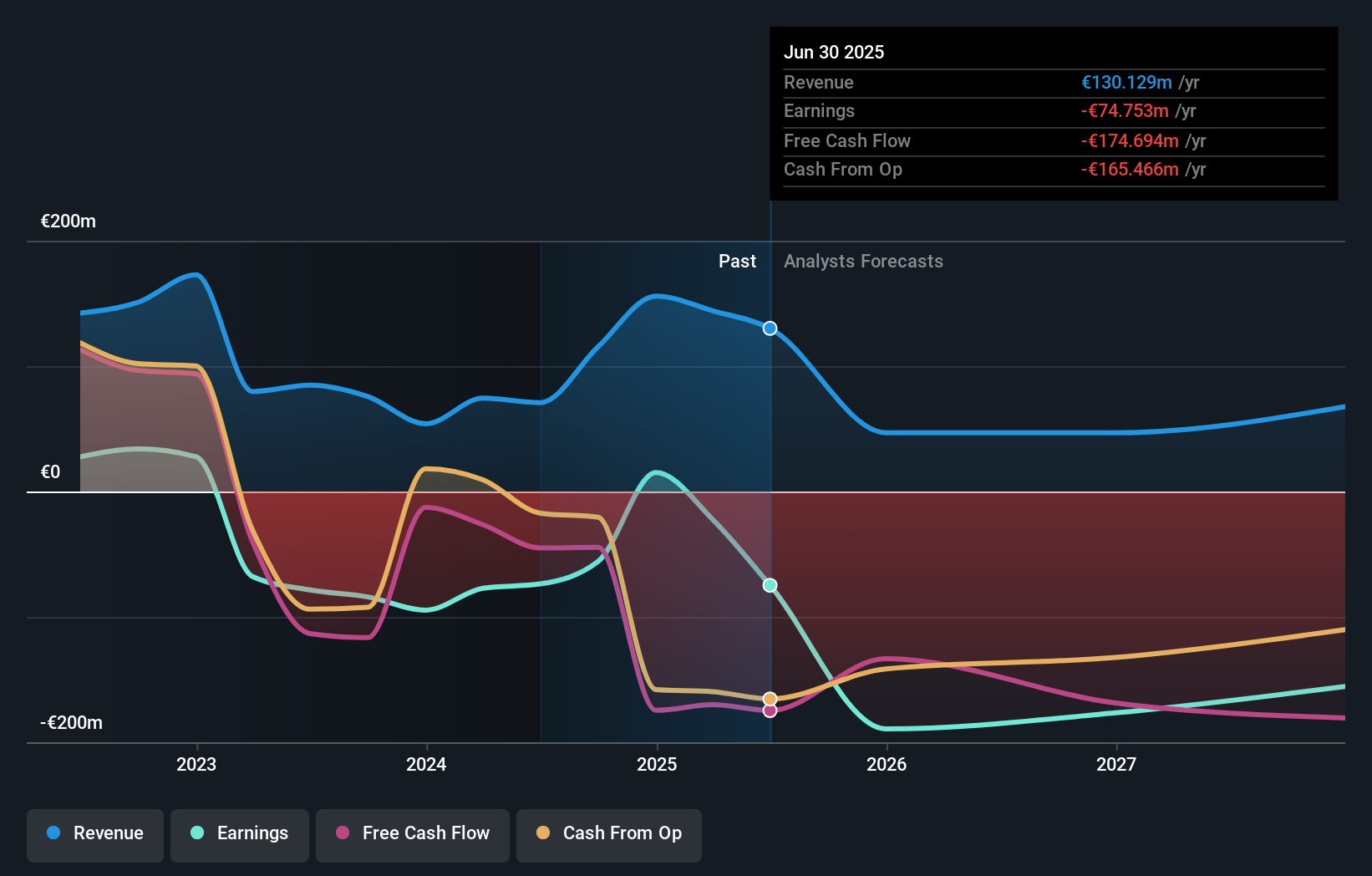

For anyone considering Immatics today, the big picture hasn’t changed: belief hinges on the potential for TCR-based therapies to shift the treatment paradigm in cancers with high unmet needs. Recent management changes have brought in experience across biotech, which should support ongoing execution. The scheduled release of the complete TCR Bispecifics dataset is now the most important near-term catalyst, given how investor sentiment has quickly responded to clinical updates in this volatile space. If the results show strong efficacy and safety signals, the risk profile could shift, with clinical validation possibly attracting new partners or investors. Conversely, any setbacks may reinforce existing risks from persistent losses and significant cash burn, especially with revenue growth still outpaced by R&D expenses. The impact of these clinical results now overshadows other short-term factors for shareholders.

But, ongoing cash burn remains a risk that investors should not overlook.

Exploring Other Perspectives

Explore 4 other fair value estimates on Immatics - why the stock might be worth less than half the current price!

Build Your Own Immatics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Immatics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Immatics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Immatics' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMTX

Immatics

A clinical-stage biopharmaceutical company, focuses on the research and development of potential T cell redirecting immunotherapies for the treatment of cancer in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives