- United States

- /

- Biotech

- /

- NasdaqGS:IMCR

Revenues Not Telling The Story For Immunocore Holdings plc (NASDAQ:IMCR) After Shares Rise 37%

Immunocore Holdings plc (NASDAQ:IMCR) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

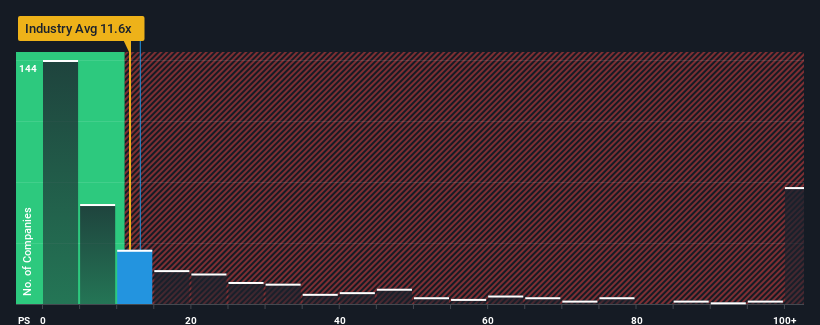

In spite of the firm bounce in price, there still wouldn't be many who think Immunocore Holdings' price-to-sales (or "P/S") ratio of 13x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 11.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Immunocore Holdings

How Immunocore Holdings Has Been Performing

Recent times have been advantageous for Immunocore Holdings as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Immunocore Holdings.How Is Immunocore Holdings' Revenue Growth Trending?

Immunocore Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 88% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 221% per year, which is noticeably more attractive.

With this information, we find it interesting that Immunocore Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Immunocore Holdings' P/S

Immunocore Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Immunocore Holdings' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Immunocore Holdings is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IMCR

Immunocore Holdings

A commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives