- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Will Illumina's (ILMN) BioInsight AI Bet Redefine Its Edge in Drug Discovery?

Reviewed by Sasha Jovanovic

- On October 1, 2025, Illumina launched BioInsight, a new business unit designed to harness AI, software, and multiomic data analysis for drug discovery and life science research, with Rami Mehio appointed as its senior vice president and general manager.

- This initiative highlights Illumina's shift toward comprehensive data analysis and advanced AI-powered tools to support pharmaceutical partners in identifying novel drug targets and accelerating scientific innovation.

- We'll examine how BioInsight's focus on AI-driven large-scale data analysis could influence Illumina's long-term investment outlook and sector leadership.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Illumina Investment Narrative Recap

To be an Illumina shareholder today, you need to believe that the company will successfully transition beyond sequencing hardware into AI-driven multiomic data analysis, enabling deeper partnerships with pharma and expanding clinical applications. The launch of BioInsight is a step in this direction, but the long-term impact on clinical consumables growth and the pressing risk of research end-market softness due to funding uncertainty does not appear materially changed in the short term.

Among recent announcements, Illumina’s new collaborations with pharmaceutical companies to develop companion diagnostics for KRAS biomarkers stand out. This initiative exemplifies continued momentum in oncology testing, a major driver for clinical consumables revenue, and demonstrates how partnerships could bolster clinical market expansion, which remains an important catalyst for offsetting cyclical research weakness.

But against the promise of new business lines and clinical partnerships, investors should also keep in mind the ongoing challenges in U.S. research funding and ...

Read the full narrative on Illumina (it's free!)

Illumina's outlook suggests $4.8 billion in revenue and $873.5 million in earnings by 2028. This assumes a 3.6% annual revenue growth rate but a decrease in earnings of $426.5 million from current earnings of $1.3 billion.

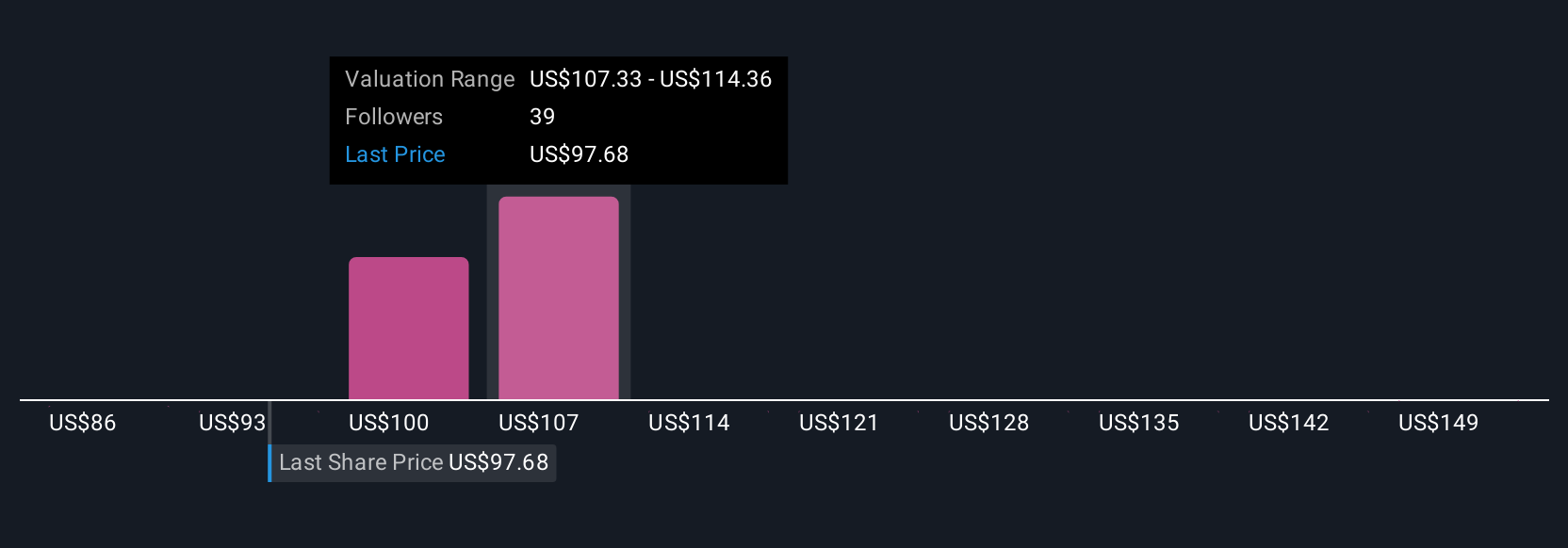

Uncover how Illumina's forecasts yield a $111.95 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members offered fair value targets for Illumina between US$86 and US$156 per share. Many weigh ongoing NIH funding headwinds as a key factor impacting Illumina’s performance, prompting fresh discussion around future revenue resilience and market positioning.

Explore 5 other fair value estimates on Illumina - why the stock might be worth as much as 58% more than the current price!

Build Your Own Illumina Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illumina research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Illumina research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illumina's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives