- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

What Illumina (ILMN)'s 5-Base Sequencing Launch Means for Shareholders

Reviewed by Sasha Jovanovic

- At the recent American Society of Human Genetics conference in Boston, Illumina unveiled its novel 5-base sequencing solution and announced that GeneDx is piloting its constellation mapped read technology, both of which aim to improve detection of complex genetic variants and DNA methylation from a single sample.

- These advances highlight new capabilities to address hard-to-diagnose rare diseases, as early client feedback suggests both technologies can outperform existing genetic testing approaches in accuracy and data resolution.

- We'll examine how Illumina's launch of its 5-base sequencing solution could influence the company's investment outlook and clinical growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Illumina Investment Narrative Recap

To be a shareholder in Illumina, you need to believe in the long-term growth of genomics in clinical settings, supported by innovation in areas like rare disease and oncology testing. The recent launch of Illumina's 5-base sequencing solution at the American Society of Human Genetics conference could bolster its position in clinical applications, but the most important short-term catalyst remains the continued expansion of clinical demand, while competition from faster sequencing platforms like Roche's is still the biggest risk. At this stage, the new product launch shows incremental innovation, but it is not yet clear if it meaningfully shifts either the main catalyst or the principal risk to Illumina’s business.

Among recent announcements, Illumina’s partnership with GeneDx to pilot constellation mapped read technology stands out, especially as early usage points to improved detection of rare genetic variants compared to established alternatives. As the clinical segment now accounts for a significant share of Illumina’s consumables revenue, technologies that expand the accuracy and breadth of genomic testing could further strengthen the key clinical growth catalyst.

By contrast, investors should also be aware of the intensifying competition from rivals capable of faster sequencing speeds, especially as...

Read the full narrative on Illumina (it's free!)

Illumina's outlook suggests revenue of $4.8 billion and earnings of $873.5 million by 2028. This is based on a forecast revenue growth rate of 3.6% per year and a decrease in earnings of $426.5 million from the current $1.3 billion.

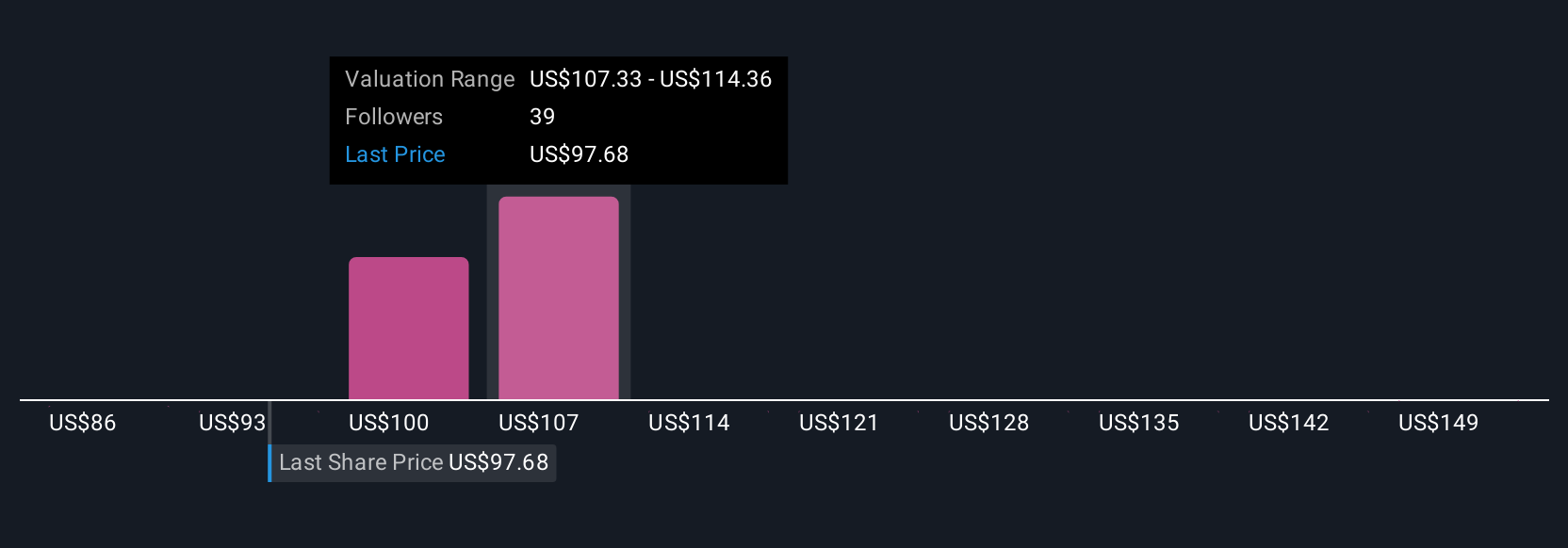

Uncover how Illumina's forecasts yield a $111.95 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Fair value estimates from five Simply Wall St Community members range widely between US$86.26 and US$156.51 per share. With faster sequencing technologies emerging, your view of Illumina’s competitive outlook may shape your assessment, so explore the various perspectives to inform your own approach.

Explore 5 other fair value estimates on Illumina - why the stock might be worth as much as 64% more than the current price!

Build Your Own Illumina Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illumina research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Illumina research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illumina's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives