- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Has Illumina’s Rally After Grail Divestiture Put Its Valuation Back on Track?

Reviewed by Bailey Pemberton

If you are wondering what to do with Illumina stock right now, you are definitely not alone. The company has been on a roller coaster, posting a strong 9.3% surge in just the last week, even as shares remain down almost 31% for the past year and an eye-popping 68% over five years. That kind of volatility can make anyone do a double take.

Why the recent bounce back? Much of the optimism recently has been tied to ongoing speculation around Illumina’s high-profile divestiture of Grail, following years of regulatory scrutiny that weighed down investor sentiment. With clearer signals emerging about the company’s future direction and leadership refocusing on its core genomics business, some investors see renewed growth potential, while others still see risk on the horizon.

On the valuation front, Illumina currently earns a score of 4 out of 6, suggesting it appears undervalued in most, but not all, of the key metrics analysts watch. That’s not a perfect score, but it clearly leans to the bullish side, especially given the company’s strong brand in genomics and the rapidly evolving DNA sequencing landscape.

So, is Illumina’s recent rally the start of a sustained comeback, or just another stop along a bumpy road? To answer that, let’s break down the valuation metrics that matter most and explore why the usual checklist might not tell the whole story for this stock.

Why Illumina is lagging behind its peers

Approach 1: Illumina Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to their value in today's dollars. This approach tries to answer the question, “What is Illumina really worth if we consider how much cash it will generate in the years to come?”

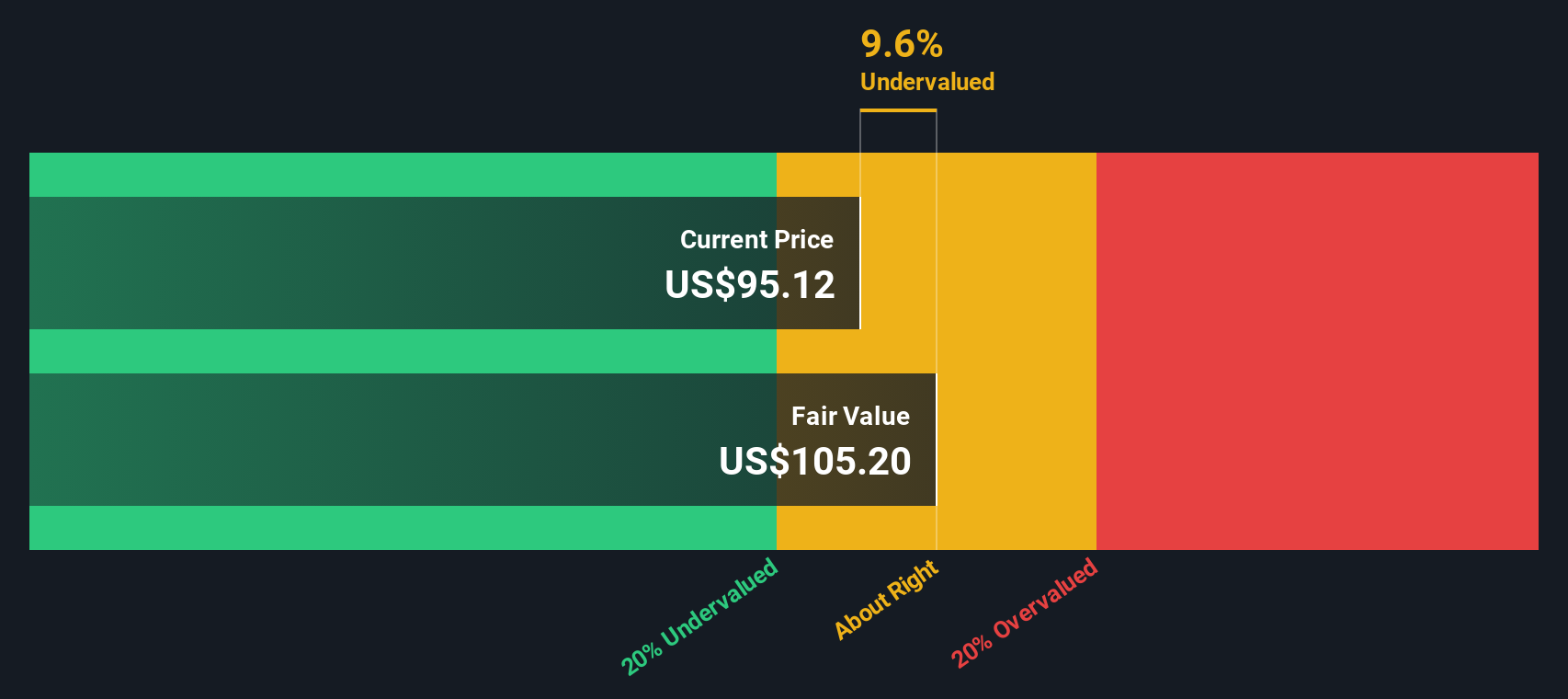

For Illumina, analysts estimate the company’s 2028 Free Cash Flow (FCF) will be around $786 million, compared to $917.6 million over the last twelve months. While projections from 2026 to 2028 are based on analysts’ inputs, estimates further into the future are calculated by Simply Wall St using extrapolation. Over a ten-year horizon, the FCF is expected to steadily increase, reflecting optimism about Illumina’s role in the genomics industry.

Using these projections, the estimated intrinsic value per share comes to $103.30. This implies Illumina is trading at a roughly 3.7% discount to its calculated fair value. Based on standard valuation practice, this difference is not major and indicates the market price is quite close to fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Illumina's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Illumina Price vs Earnings

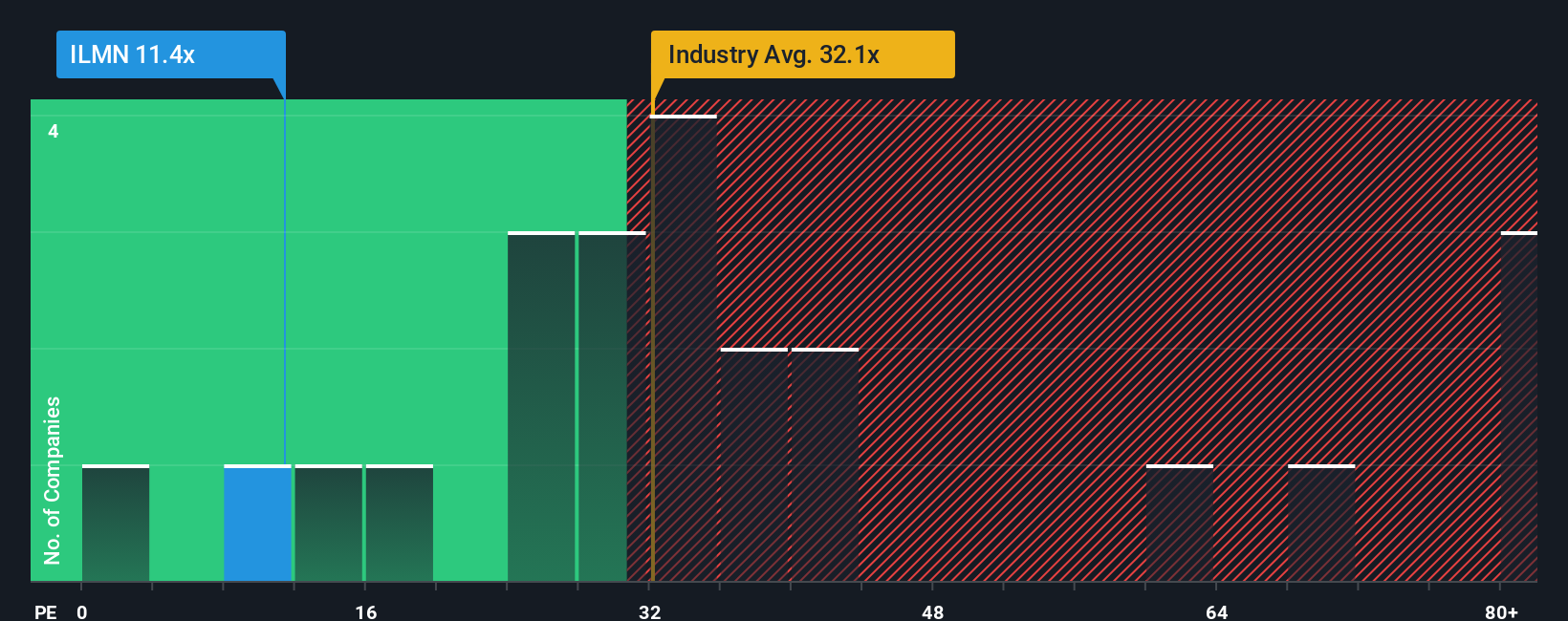

The Price-to-Earnings (PE) ratio is a widely trusted benchmark for valuing profitable companies such as Illumina, since it directly measures what investors are willing to pay today for a dollar of the company’s earnings. When a company is generating steady profits, the PE ratio offers a quick lens into whether the stock trades at a sensible level relative to its actual earnings power.

That said, not all PE ratios are created equal. Higher growth companies or those with lower risk profiles often deserve a premium PE, reflecting investors’ willingness to pay more for future earnings potential, while slower growth or riskier companies typically command lower multiples. This is why context, like industry norms and business fundamentals, is so important when evaluating a specific PE ratio.

Illumina’s current PE stands at 12.2x, which is notably lower than the Life Sciences industry average of 32.5x, and well below the peer average of 29.5x. At first glance, this might look like a major bargain. However, blindly comparing to industry or peer averages can miss crucial differences in growth, profitability, and risk that actually impact what a fair PE multiple should be.

This is where Simply Wall St’s “Fair Ratio” comes in, a tailored metric that calculates what multiple is reasonable after factoring in Illumina’s earnings growth prospects, margins, risk factors, industry dynamics, and company size. The Fair PE for Illumina is estimated at 18.2x, suggesting the company ought to command a somewhat higher multiple than what it currently receives. Because Illumina’s PE is about 6x below this Fair Ratio, there is a strong indication the stock is undervalued on this metric. This makes the Fair Ratio far more actionable than broad industry comparisons, since it reflects Illumina’s specific strengths and risks, not just generic sector trends.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Illumina Narrative

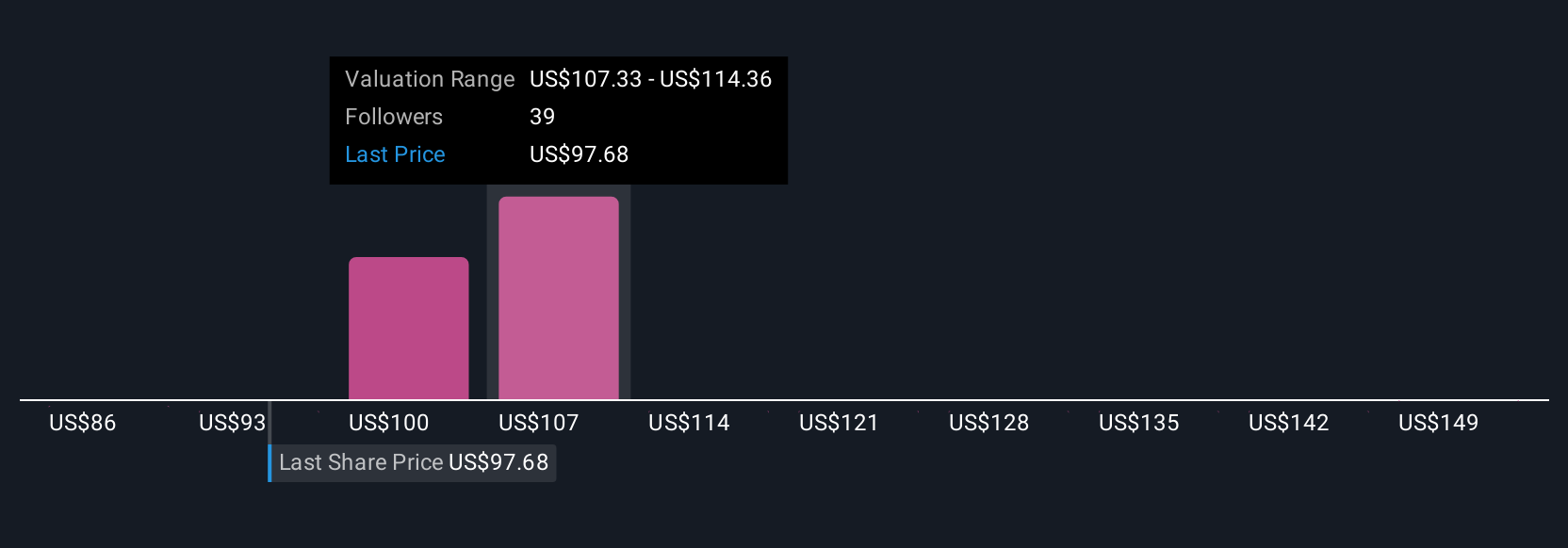

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple way to connect the story you believe about a company, like Illumina’s next-gen sequencing growth or its ongoing regulatory risks, to your own financial forecasts, such as future revenue, margins, and what you view as a fair value.

Put simply, a Narrative turns your perspective on the business into a living valuation by letting you map out “what you think will happen” directly on Simply Wall St’s Community page, which millions of investors use. Narratives help you track how your investment thesis stacks up by comparing your fair value to the current market price, making your buy, hold, or sell decisions much easier.

Best of all, Narratives update automatically as earnings releases, news, and key events are announced, so your valuation view is always relevant. For example, Illumina bulls might use a Narrative reflecting strong adoption of next-generation sequencing, setting a forecast fair value near $185, while more bearish investors focused on regulatory and budget risks may set theirs around $75. Both approaches let you see at a glance if the current price presents an opportunity or risk based on your view.

Do you think there's more to the story for Illumina? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives