Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether InflaRx (NASDAQ:IFRX) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for InflaRx

When Might InflaRx Run Out Of Money?

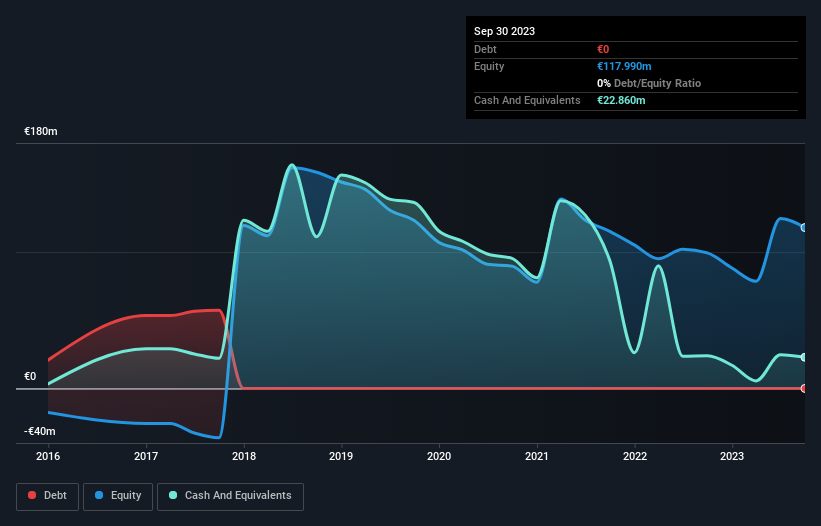

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In September 2023, InflaRx had €23m in cash, and was debt-free. Looking at the last year, the company burnt through €32m. Therefore, from September 2023 it had roughly 8 months of cash runway. Importantly, analysts think that InflaRx will reach cashflow breakeven in 2 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. You can see how its cash balance has changed over time in the image below.

How Is InflaRx's Cash Burn Changing Over Time?

Whilst it's great to see that InflaRx has already begun generating revenue from operations, last year it only produced €61k, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. As it happens, the company's cash burn reduced by 20% over the last year, which suggests that management may be mindful of the risks of their depleting cash reserves. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can InflaRx Raise Cash?

While InflaRx is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of €91m, InflaRx's €32m in cash burn equates to about 35% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

So, Should We Worry About InflaRx's Cash Burn?

On this analysis of InflaRx's cash burn, we think its cash burn reduction was reassuring, while its cash runway has us a bit worried. One real positive is that analysts are forecasting that the company will reach breakeven. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. On another note, InflaRx has 5 warning signs (and 4 which are concerning) we think you should know about.

Of course InflaRx may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IFRX

InflaRx

A clinical-stage biopharmaceutical company, discovers and develops inhibitors using C5a technology in Germany and the United States.

Flawless balance sheet medium-low.

Market Insights

Community Narratives