- United States

- /

- Biotech

- /

- NasdaqGS:IDYA

IDEAYA Biosciences (IDYA) Is Up 6.3% After Swing to Quarterly Profitability and Revenue Growth - What's Changed

Reviewed by Sasha Jovanovic

- IDEAYA Biosciences, Inc. reported earnings for the third quarter and nine months ended September 30, 2025, showing quarterly revenue of US$207.83 million and net income of US$119.24 million, a turnaround from a net loss in the previous year.

- This marks a significant improvement in profitability, with basic earnings per share rising to US$1.35 for the quarter, compared to a loss per share of US$0.60 a year earlier.

- We'll explore how returning to quarterly profitability shapes IDEAYA Biosciences' investment narrative and future business outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is IDEAYA Biosciences' Investment Narrative?

To be a shareholder in IDEAYA Biosciences, you have to believe in the company's ability to turn scientific progress, especially in rare oncology indications, into sustained financial performance. The latest earnings report, highlighting a sharp swing to profitability this quarter, directly challenges prior assumptions that IDEAYA would remain unprofitable for years. This news could spark a re-evaluation of both short-term catalysts, such as upcoming clinical milestones for darovasertib, and key risks like high spending on drug development and the expense premium relative to sales. The impressive quarterly profit was significantly boosted by a licensing deal, and it remains to be seen whether future quarters can maintain this momentum or if earnings volatility will return. For now, while long-term drivers remain rooted in the clinic, this financial surprise has shifted the near-term conversation and could influence sentiment as analysts and investors adjust their expectations.

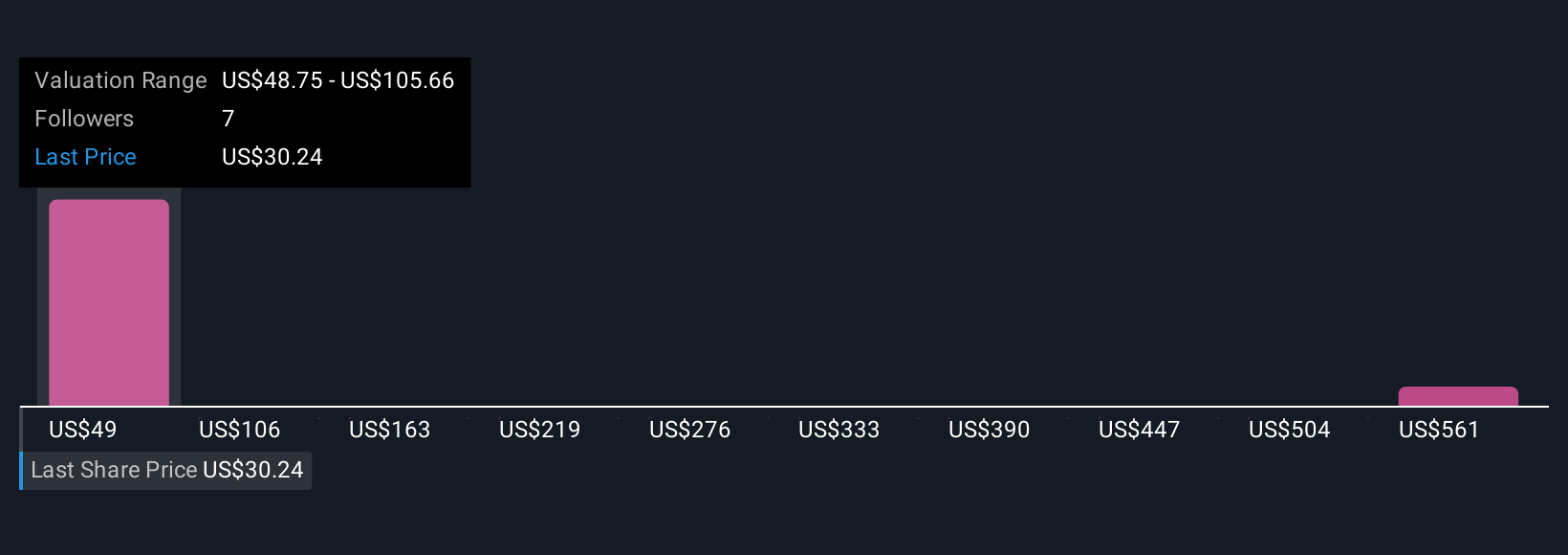

But with profitability driven by a major one-off deal, earnings visibility is still a risk to watch. Insights from our recent valuation report point to the potential overvaluation of IDEAYA Biosciences shares in the market.Exploring Other Perspectives

Explore 2 other fair value estimates on IDEAYA Biosciences - why the stock might be worth just $48.88!

Build Your Own IDEAYA Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDEAYA Biosciences research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free IDEAYA Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDEAYA Biosciences' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDYA

IDEAYA Biosciences

A precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives