- United States

- /

- Biotech

- /

- NasdaqCM:ACGN

We're Keeping An Eye On Idera Pharmaceuticals' (NASDAQ:IDRA) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, Idera Pharmaceuticals (NASDAQ:IDRA) shareholders have done very well over the last year, with the share price soaring by 114%. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So notwithstanding the buoyant share price, we think it's well worth asking whether Idera Pharmaceuticals'cash burn is too risky In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Idera Pharmaceuticals

How Long Is Idera Pharmaceuticals' Cash Runway?

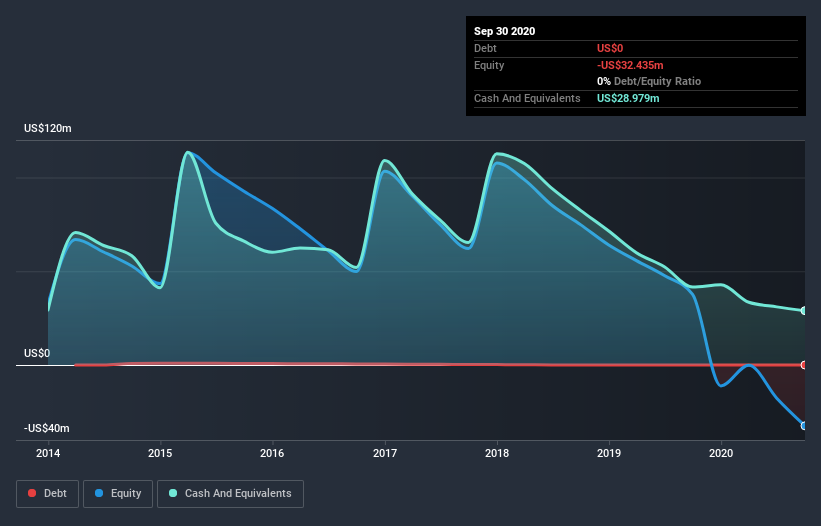

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at September 2020, Idera Pharmaceuticals had cash of US$29m and no debt. In the last year, its cash burn was US$37m. That means it had a cash runway of around 10 months as of September 2020. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Idera Pharmaceuticals' Cash Burn Changing Over Time?

Because Idera Pharmaceuticals isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. As it happens, the company's cash burn reduced by 20% over the last year, which suggests that management may be mindful of the risks of their depleting cash reserves. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Idera Pharmaceuticals Raise Cash?

While Idera Pharmaceuticals is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Idera Pharmaceuticals has a market capitalisation of US$137m and burnt through US$37m last year, which is 27% of the company's market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

So, Should We Worry About Idera Pharmaceuticals' Cash Burn?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Idera Pharmaceuticals' cash burn reduction was relatively promising. Summing up, we think the Idera Pharmaceuticals' cash burn is a risk, based on the factors we mentioned in this article. On another note, Idera Pharmaceuticals has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Idera Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:ACGN

Aceragen

Aceragen, Inc., a clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of drugs for rare pulmonary and rheumatic diseases in the United States.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives