- United States

- /

- Biotech

- /

- NasdaqGS:ICPT

Revenues Working Against Intercept Pharmaceuticals, Inc.'s (NASDAQ:ICPT) Share Price Following 25% Dive

To the annoyance of some shareholders, Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 14% share price drop.

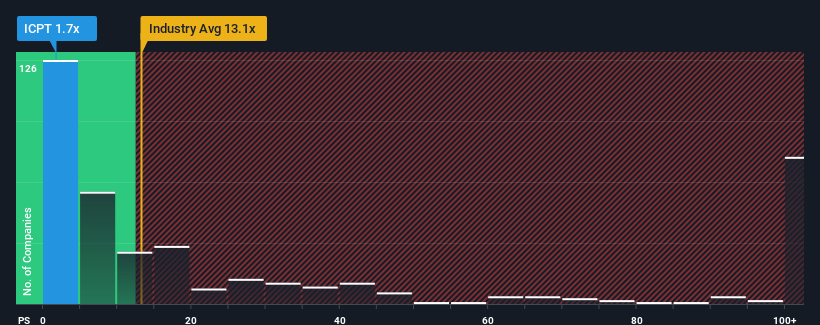

After such a large drop in price, Intercept Pharmaceuticals may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.1x and even P/S higher than 61x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Intercept Pharmaceuticals

What Does Intercept Pharmaceuticals' P/S Mean For Shareholders?

Intercept Pharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Intercept Pharmaceuticals will help you uncover what's on the horizon.How Is Intercept Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, Intercept Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. Revenue has also lifted 8.1% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 102% per annum growth forecast for the broader industry.

In light of this, it's understandable that Intercept Pharmaceuticals' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Having almost fallen off a cliff, Intercept Pharmaceuticals' share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Intercept Pharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Intercept Pharmaceuticals, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ICPT

Intercept Pharmaceuticals

Intercept Pharmaceuticals, Inc., a biopharmaceutical company, focuses on the development and commercialization of therapeutics to treat progressive non-viral liver diseases in the United States, Europe, and Canada.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives