- United States

- /

- Life Sciences

- /

- NasdaqGS:ICLR

Can Analyst Upgrades Drive a Rethink of ICON’s (ICLR) Long-Term Profit Ambitions?

Reviewed by Sasha Jovanovic

- ICON Public Limited Company recently attracted significant analyst optimism, with several raising their outlook based on expectations for profit growth over the next few years.

- This wave of positive sentiment appears to have caught market attention, as many analysts view the company’s current valuation as still attractive relative to its potential earnings trajectory.

- We'll explore how renewed analyst optimism for ICON, particularly regarding its profit growth prospects, shapes the company’s investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ICON Investment Narrative Recap

To be a shareholder in ICON right now, you need to believe in the company’s ability to deliver profit growth as market conditions shift and industry headwinds ease, despite ongoing concerns about project delays and sector funding volatility. The latest analyst optimism and price target upgrades may help underpin near-term sentiment, but the most immediate catalyst remains the company’s upcoming earnings release, which will provide a clearer view of whether recent profit growth expectations can be met. Meanwhile, the biggest challenge still stems from persistent cancellations and delays in clinical trials, a risk that the recent bullish news does little to materially diminish.

One announcement deeply relevant to recent analyst enthusiasm is the modest increase in ICON’s 2025 revenue guidance, reflecting leadership confidence and potentially shoring up the narrative for profit growth over the coming quarters. This guidance revision, set against a backdrop of macroeconomic uncertainty and ongoing pressures from trial delays, may serve as a bellwether for ICON’s prospects and the sustainability of renewed optimism during the next results cycle.

Yet, against this optimism, it's important to remember that unexpected clinical trial cancellations could still put downward pressure on results and investors should be aware of...

Read the full narrative on ICON (it's free!)

ICON's narrative projects $8.8 billion revenue and $1.0 billion earnings by 2028. This requires 2.9% yearly revenue growth and a $205.8 million increase in earnings from $794.2 million.

Uncover how ICON's forecasts yield a $215.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

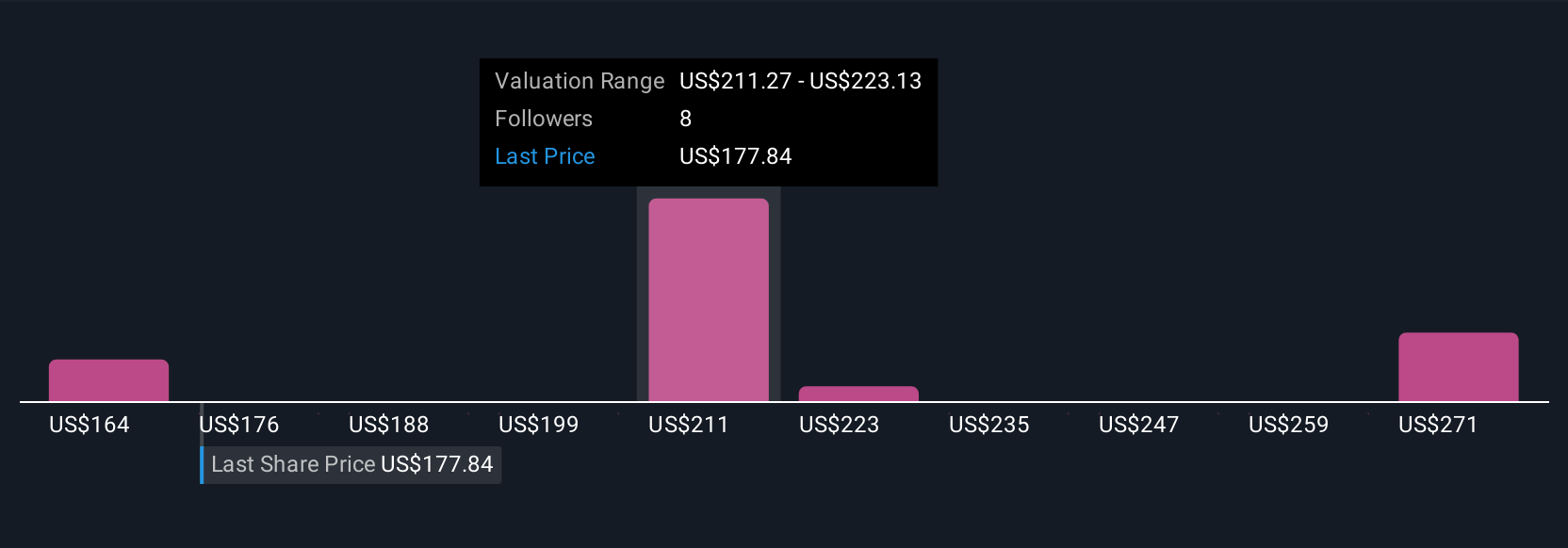

Five fair value estimates from the Simply Wall St Community range from US$163.85 to US$261.62, reflecting a wide span of investor forecasts. Many continue to watch how trial delays and sector funding challenges could influence ICON’s performance, perspectives you’ll want to consider as you weigh these differing views.

Explore 5 other fair value estimates on ICON - why the stock might be worth 15% less than the current price!

Build Your Own ICON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICON research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ICON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICON's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICLR

ICON

A clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives