- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

ImmunityBio (IBRX): Valuation Check After Piper Sandler Conference Focus and Anktiva-Driven Revenue Growth

Reviewed by Simply Wall St

ImmunityBio (IBRX) just dropped around 9% as traders reposition ahead of its appearance at the Piper Sandler 37th Annual Healthcare Conference, even though Anktiva fueled sharp revenue growth last quarter.

See our latest analysis for ImmunityBio.

Despite today’s pullback, ImmunityBio’s 1 month share price return of 10.58 percent and 7 day gain of 7.98 percent suggest short term momentum is rebuilding, even though the 1 year total shareholder return of negative 49.67 percent shows long term holders are still deep underwater.

If Anktiva’s progress has you watching ImmunityBio more closely, it could also be a good moment to explore other promising healthcare stocks that might fit a similar thesis.

With revenues accelerating but losses still steep and analysts seeing sizable upside to the current 2.30 dollar share price, is ImmunityBio quietly undervalued here, or is the market already pricing in the next leg of growth?

Price-to-Sales of 27.4x: Is it justified?

On a headline basis, ImmunityBio’s last close at 2.30 dollars implies a rich 27.4 times price to sales multiple, sitting well above typical biotech peers.

The price to sales ratio compares the company’s market value to its annual revenue. It is a common yardstick for high growth, loss making biotech names where earnings are still negative.

For ImmunityBio, this steep multiple signals that investors are already baking in very strong future growth. The stock still screens as good value versus our estimated fair price to sales ratio of 32.3 times and trades 63.8 percent below our SWS DCF based fair value of 6.36 dollars.

Stacked against the wider US biotech industry, where the average price to sales ratio sits at 12.1 times and close peers average around 22.8 times, ImmunityBio’s 27.4 times still represents an aggressive valuation, even if our fair ratio work suggests the market could ultimately be willing to pay more for its growth profile.

Explore the SWS fair ratio for ImmunityBio

Result: Price-to-Sales of 27.4x (OVERVALUED)

However, steep annual losses and ImmunityBio’s heavy reliance on Anktiva’s commercial ramp still risk derailing the bullish growth and valuation narrative.

Find out about the key risks to this ImmunityBio narrative.

Another View: DCF Points to Deep Discount

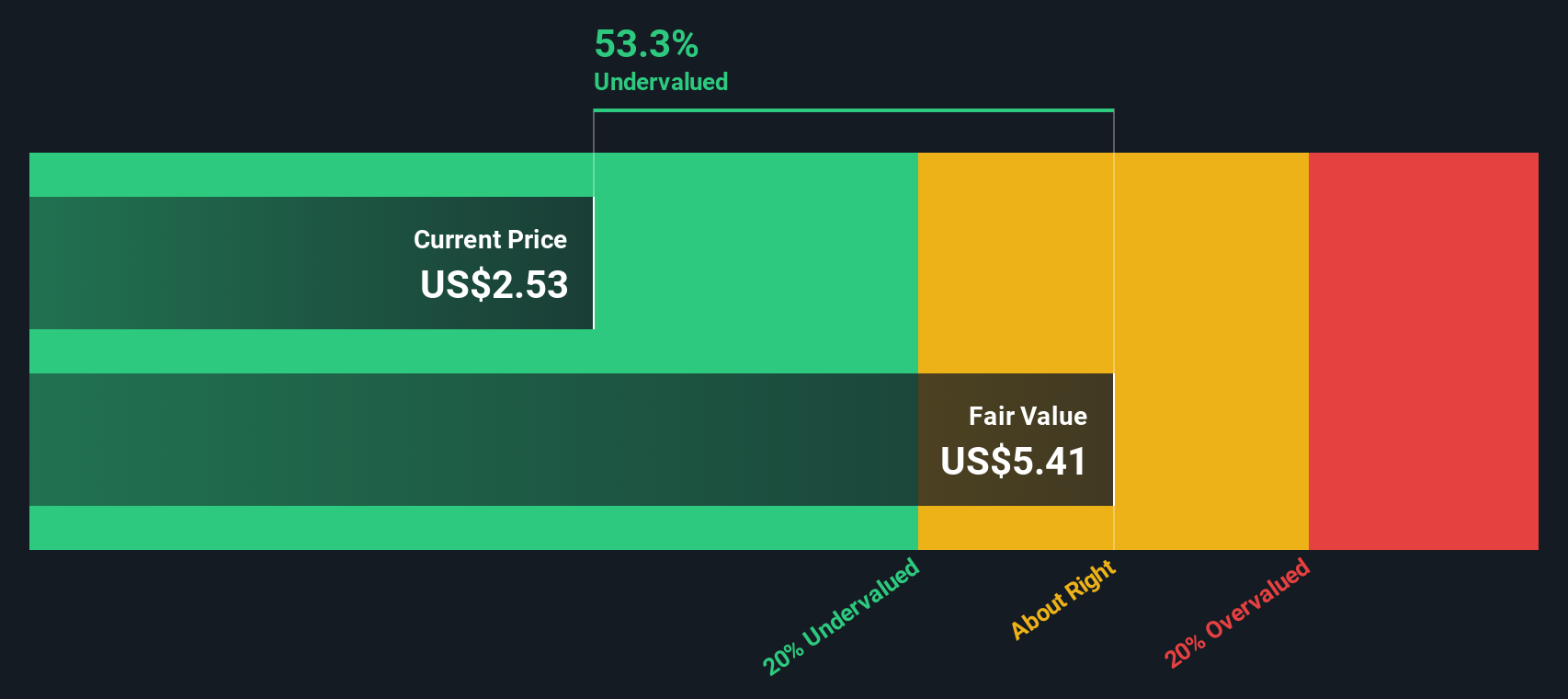

While the 27.4 times price to sales ratio makes ImmunityBio look stretched, our DCF model paints a different picture, with a fair value of 6.36 dollars per share, around 64 percent above today’s 2.30 dollars. Is the market overly fixated on near term risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ImmunityBio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ImmunityBio Narrative

If this perspective does not quite fit your view or you would rather dive into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential winner by using the Simply Wall St Screener, where focused, data driven ideas are waiting right now.

- Capture overlooked value by targeting these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Ride structural growth trends with these 30 healthcare AI stocks that blend medical innovation with cutting edge algorithms, reshaping how care is delivered.

- Position yourself early in frontier themes through these 81 cryptocurrency and blockchain stocks harnessing blockchain, tokenization, and digital payments for long term upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026