- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

ImmunityBio (IBRX): Revisiting Valuation After ANKTIVA’s Regulatory Wins and New Growth Initiatives

Reviewed by Kshitija Bhandaru

ImmunityBio (IBRX) has seen momentum build around its ANKTIVA therapy, with recent regulatory wins such as UK approval and updated U.S. reimbursement sparking stronger adoption and more sales. The company also raised $80 million to accelerate growth initiatives.

See our latest analysis for ImmunityBio.

ImmunityBio’s recent regulatory successes and rapid sales growth have helped stir investor interest, but the stock’s momentum has not quite followed suit. The 1-year total shareholder return shows a decline of 26%, even as new funding and clinical progress mark a turning point for the company’s growth story.

If ImmunityBio’s latest advancements caught your attention, take the next step and see the full list of biotech and pharma movers in our free collection: See the full list for free.

With ImmunityBio’s share price lagging behind its rapid revenue and clinical progress, investors are left to wonder: Is the current valuation overlooking future growth potential, or has the market already factored in what comes next?

Price-to-Sales of 41.8x: Is it justified?

ImmunityBio's shares are trading at a price-to-sales (P/S) ratio of 41.8x, a striking premium considering the last close at $2.50. This lofty multiple suggests investors are paying far more per dollar of revenue than the average company in the biotech sector.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of a company's revenue. For a company like ImmunityBio, which is focused on high-risk, high-reward drug development, this ratio can signal confidence in outsized future growth or heightened speculation about what the pipeline could deliver.

At present, ImmunityBio’s P/S is over four times the US Biotechs industry average of 9.9x, and well above the peer average of 7.7x. Even when compared to an estimated fair price-to-sales ratio of 34x, the stock still looks expensive. This could mean high expectations for breakthrough revenues, or it could flag a valuation stretched beyond typical fundamentals.

Explore the SWS fair ratio for ImmunityBio

Result: Price-to-Sales of 41.8x (OVERVALUED)

However, persistent net losses and a sharp decline in total return over the past three years remain key risks that could weigh on ImmunityBio’s outlook and future momentum.

Find out about the key risks to this ImmunityBio narrative.

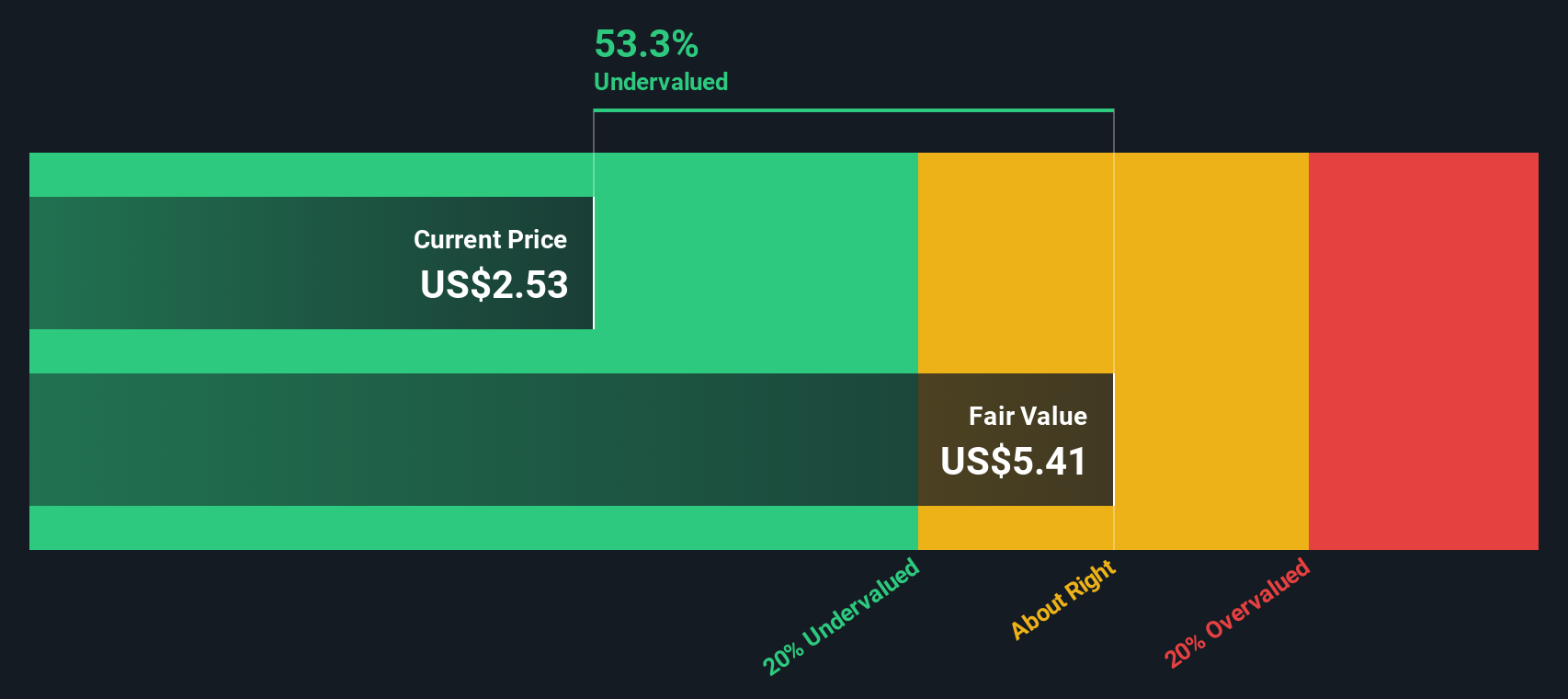

Another View: Our DCF Model Finds Undervaluation

Looking at ImmunityBio through the lens of our SWS DCF model offers a very different perspective. This method estimates the company’s fair value at $5.43, which is more than double the current share price. By this approach, the stock looks undervalued, despite its elevated price-to-sales ratio. Does this signal a hidden opportunity, or is the discount a reflection of the risks involved?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ImmunityBio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ImmunityBio Narrative

If you want to take a different angle or run your own analysis, you can easily build your personal narrative from scratch in just minutes. Do it your way.

A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. Give yourself an edge by checking out these handpicked stock ideas that could be easily overlooked.

- Supercharge your search for explosive growth by screening through these 23 AI penny stocks, which are transforming industries with innovative artificial intelligence breakthroughs.

- Uncover undervalued gems with real earnings power by using these 914 undervalued stocks based on cash flows, a tool that surfaces stocks with strong cash flow potential that the market may be missing.

- Unlock stable income possibilities with these 19 dividend stocks with yields > 3%, which offers attractive yields and consistent performance for long-term investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives