- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

Does Anktiva-Driven Revenue Momentum Reshape the Bull Case For ImmunityBio (IBRX)?

Reviewed by Sasha Jovanovic

- ImmunityBio recently drew attention after reporting strong revenue growth, driven largely by sales of its bladder cancer therapy Anktiva, and highlighting its clinical pipeline at the Piper Sandler 37th Annual Healthcare Conference held earlier this month.

- The combination of accelerating Anktiva uptake and anticipated clinical and business updates has placed ImmunityBio’s commercial execution and pipeline progress firmly in focus for investors.

- With this context, we’ll explore how ImmunityBio’s Anktiva-fueled revenue growth shapes its investment narrative over the past week.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is ImmunityBio's Investment Narrative?

To own ImmunityBio today, you really have to believe that Anktiva can evolve from an early commercial success into a sustainable, multi-indication franchise, while the broader pipeline justifies ongoing heavy investment. The latest conference buzz and strong revenue growth keep Anktiva’s uptake and upcoming regulatory decisions front and center as near term catalysts, but the 9 percent share price drop suggests the market is still waiting for more concrete clinical or regulatory wins rather than just upbeat commentary. At the same time, the story has not fundamentally changed: ImmunityBio is loss making with negative equity, a short cash runway and a history of shareholder dilution, so execution risk around funding and trial progress remains high. This news sharpens the focus, but it does not remove those underlying pressures.

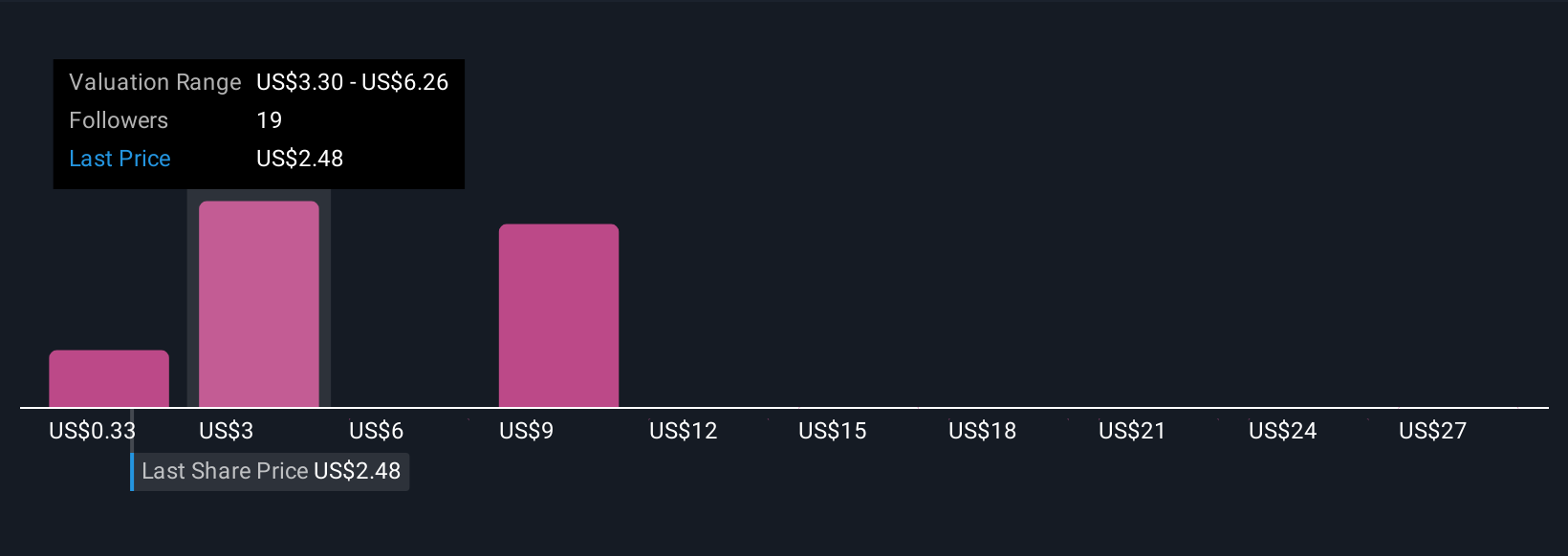

However, investors should also recognize how ImmunityBio’s funding needs could influence future outcomes. Despite retreating, ImmunityBio's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 10 other fair value estimates on ImmunityBio - why the stock might be worth over 6x more than the current price!

Build Your Own ImmunityBio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free ImmunityBio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ImmunityBio's overall financial health at a glance.

No Opportunity In ImmunityBio?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026