- United States

- /

- Life Sciences

- /

- NasdaqCM:HYFT

MindWalk Holdings (NASDAQ:HYFT) spikes 15% this week, taking one-year gains to 405%

MindWalk Holdings Corp. (NASDAQ:HYFT) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But over the last year the share price has taken off like one of Elon Musk's rockets. In fact, it is up 405% in that time. Arguably, the recent fall is to be expected after such a strong rise. While winners often keep winning, it can pay to be cautious after a strong rise.

The past week has proven to be lucrative for MindWalk Holdings investors, so let's see if fundamentals drove the company's one-year performance.

Given that MindWalk Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

MindWalk Holdings grew its revenue by 18% last year. That's a fairly respectable growth rate. But the market is even more excited about it, with the price apparently bound for the moon, up 405% in one of earth's orbits. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on MindWalk Holdings.

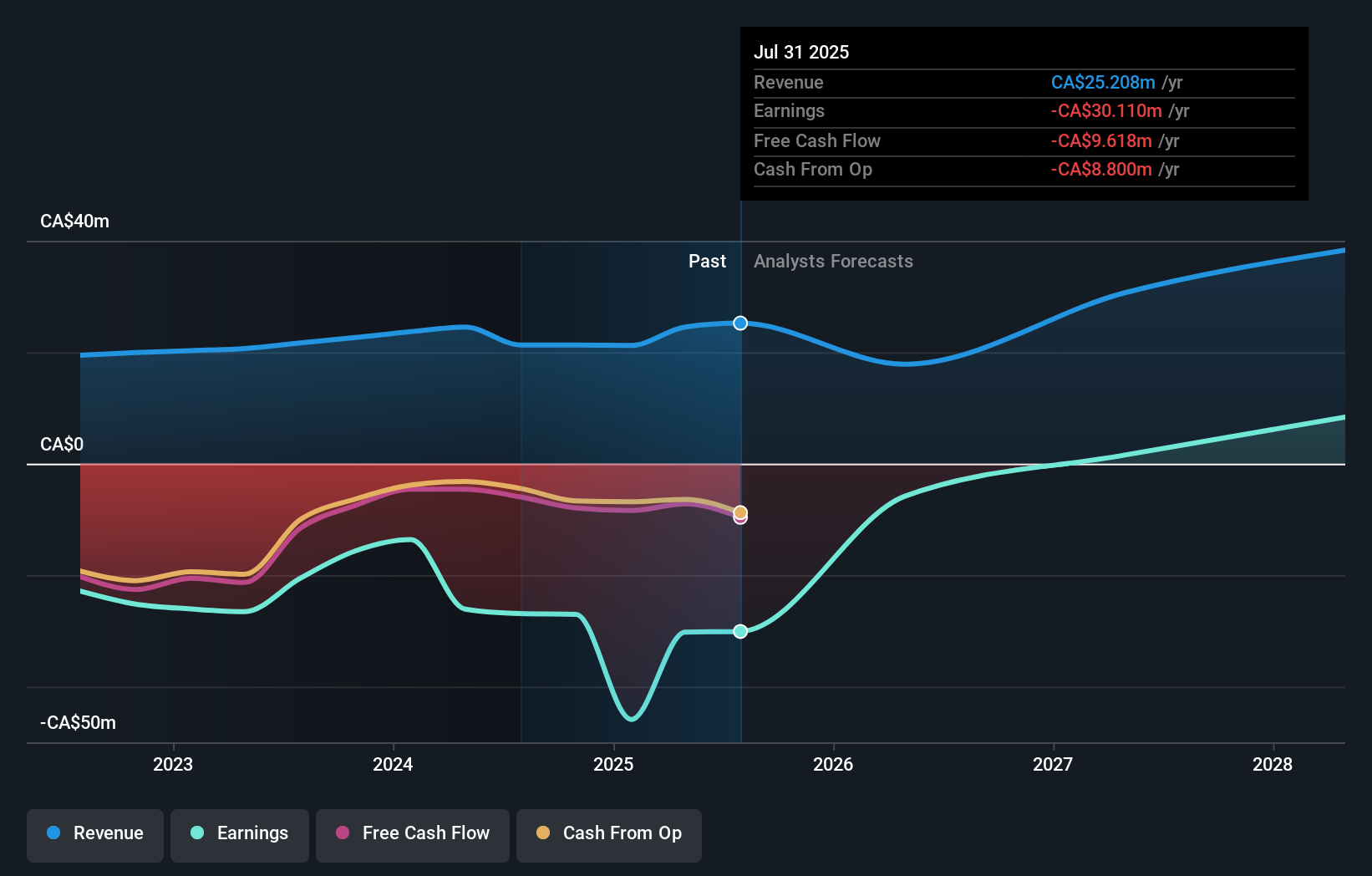

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that MindWalk Holdings shareholders have received a total shareholder return of 405% over one year. That certainly beats the loss of about 12% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for MindWalk Holdings (1 is significant!) that you should be aware of before investing here.

MindWalk Holdings is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HYFT

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.