- United States

- /

- Biotech

- /

- NasdaqGS:HUMA

Combat Trauma Study Results Might Change The Case For Investing In Humacyte (HUMA)

Reviewed by Sasha Jovanovic

- Humacyte, Inc. recently announced in Oxford Academic's Military Medicine the publication of long-term positive results from its humanitarian program using the Symvess acellular tissue-engineered vessel to treat wartime extremity trauma injuries in Ukraine, reporting a high 87.1% patency rate, zero infections, and 100% limb salvage over 18 months in 17 patients.

- This real-world study adds clinically meaningful evidence for Symvess’s durability and performance in challenging combat settings where vascular trauma management options are limited.

- We'll explore how clinical validation of Symvess in combat trauma cases informs Humacyte's broader investment narrative and potential pipeline value.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Humacyte's Investment Narrative?

For Humacyte shareholders, the big picture centers on the successful development and clinical acceptance of engineered tissue products like Symvess, as well as broadening the pipeline’s application beyond vascular trauma. The recently published Ukraine data reinforces Symvess’s potential value in real-world trauma settings, which could address concerns about clinical durability and effectiveness, a key short-term catalyst many investors have been watching. Notably, this evidence may boost credibility among clinicians and regulators just as Humacyte aims for greater market adoption and broader label expansions. However, the simultaneous follow-on equity offering and history of heavy losses underscore dilution and unprofitability as current risks. While the latest results cast Symvess in a favorable light, the immediate impact on cash flow and widespread clinical uptake may be limited for now. Continued volatility and premium valuation compared to peers remain important considerations.

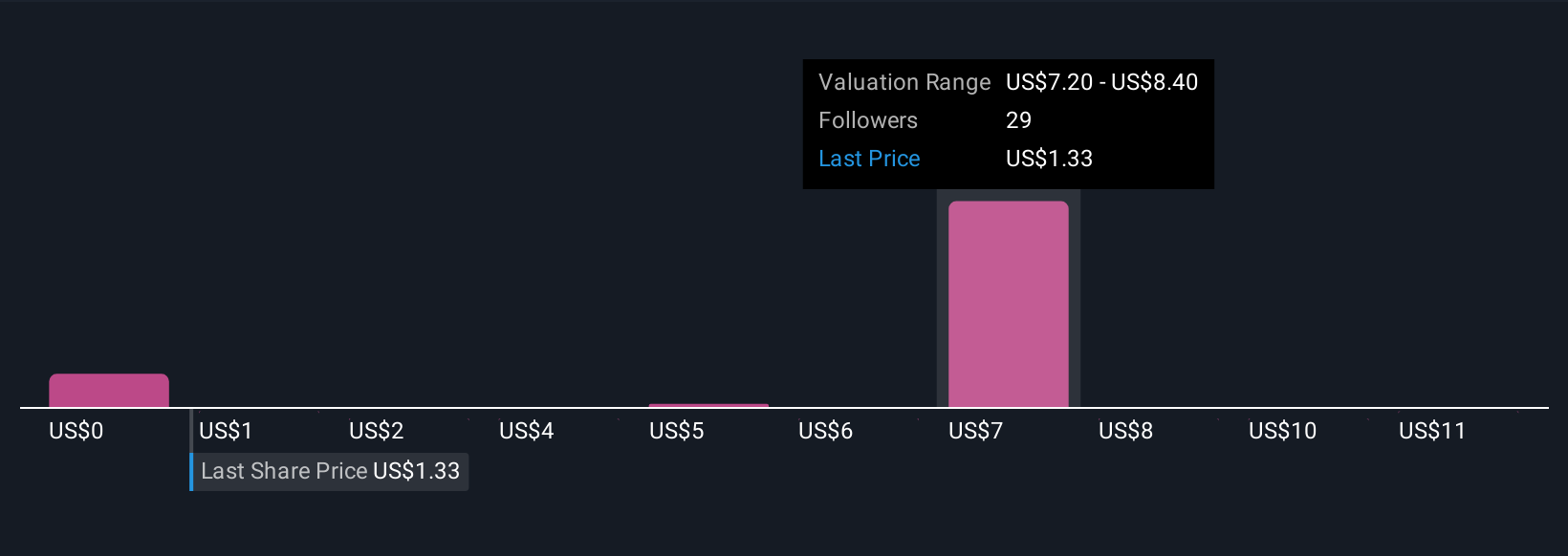

But despite the positive trial data, dilution risk is still front and center for investors. Upon reviewing our latest valuation report, Humacyte's share price might be too optimistic.Exploring Other Perspectives

Explore 13 other fair value estimates on Humacyte - why the stock might be a potential multi-bagger!

Build Your Own Humacyte Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Humacyte research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Humacyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Humacyte's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humacyte might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUMA

Humacyte

Engages in the development and manufacture of off-the-shelf, implantable, and bioengineered human tissues for the treatment of diseases and conditions across a range of anatomic locations in multiple therapeutic areas.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives