- United States

- /

- Pharma

- /

- NasdaqGM:HRMY

Harmony Biosciences (HRMY) Is Up 7.6% After GR Pitolisant Bioequivalence Win and Patent Runway Push

Reviewed by Sasha Jovanovic

- Harmony Biosciences recently reported positive pivotal bioequivalence results for its gastro-resistant (GR) pitolisant formulation, confirming equivalence to existing WAKIX tablets and supporting plans to file a New Drug Application in early 2026 with a potential review decision in the first quarter of 2027.

- By pairing these GR data with high-dose pitolisant development and patent applications that could extend exclusivity to 2044, Harmony is reinforcing the long-term durability of its pitolisant franchise in sleep and wake disorders.

- Next, we will examine how the GR bioequivalence success and extended patent runway could reshape Harmony’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Harmony Biosciences Holdings Investment Narrative Recap

To own Harmony, you need to believe WAKIX can remain a strong cash engine while the company methodically broadens its sleep and neuro portfolio. The GR bioequivalence win supports the most visible near term catalyst, a 2026 NDA filing, and modestly reduces long term exclusivity risk, but it does not change the key short term risk that Harmony is still highly dependent on a single product.

The recent start of the Phase 1 trial for BP1.15205, an orexin 2 receptor agonist, is especially relevant here, since it directly addresses competitive and concentration risks around WAKIX by opening a potential second respiratory sleep and wake franchise if the data are successful.

Yet, investors should also weigh how emerging orexin therapies could pressure WAKIX’s share and pricing over time, which is something every shareholder should be aware of...

Read the full narrative on Harmony Biosciences Holdings (it's free!)

Harmony Biosciences Holdings' narrative projects $1.2 billion revenue and $333.5 million earnings by 2028.

Uncover how Harmony Biosciences Holdings' forecasts yield a $44.55 fair value, a 16% upside to its current price.

Exploring Other Perspectives

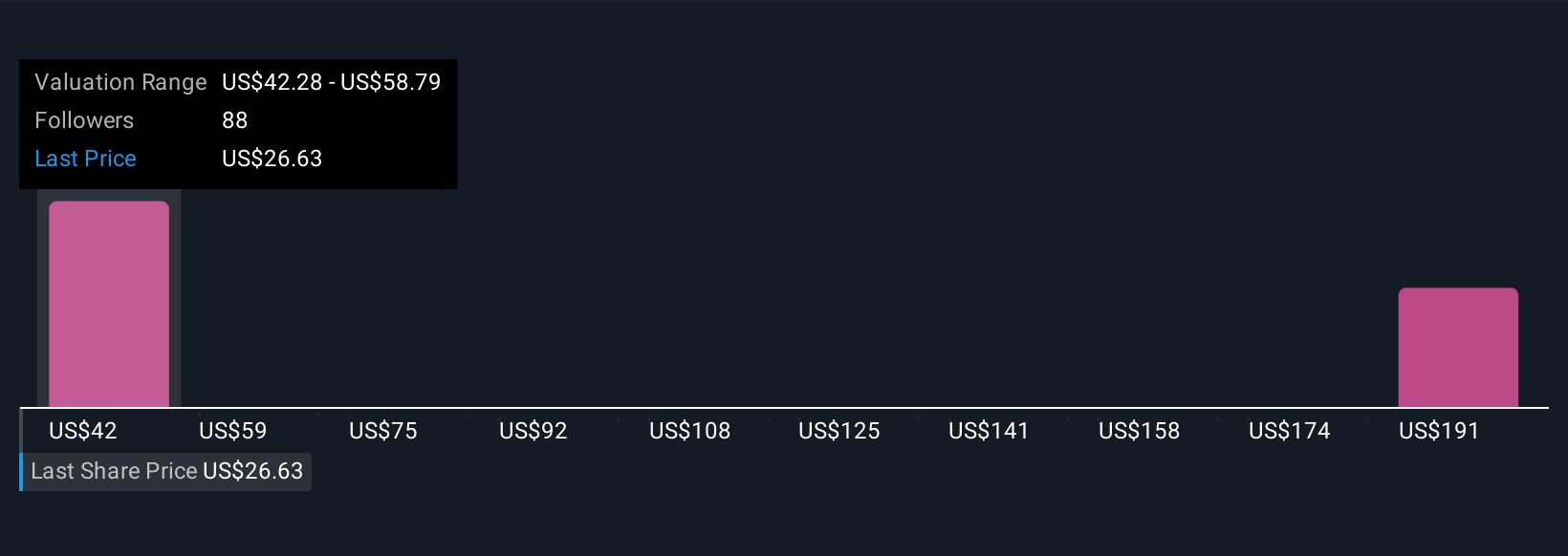

Seven Simply Wall St Community valuations for Harmony range from about US$42 to US$197 per share, showing how far opinions can stretch. You can weigh those views against the central question of whether new pitolisant formulations and orexin programs will meaningfully reduce Harmony’s dependence on WAKIX as its core profit source.

Explore 7 other fair value estimates on Harmony Biosciences Holdings - why the stock might be worth over 5x more than the current price!

Build Your Own Harmony Biosciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmony Biosciences Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmony Biosciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmony Biosciences Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Biosciences Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HRMY

Harmony Biosciences Holdings

A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026