- United States

- /

- Biotech

- /

- NasdaqCM:HOOK

Why Investors Shouldn't Be Surprised By HOOKIPA Pharma Inc.'s (NASDAQ:HOOK) 34% Share Price Plunge

HOOKIPA Pharma Inc. (NASDAQ:HOOK) shares have had a horrible month, losing 34% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

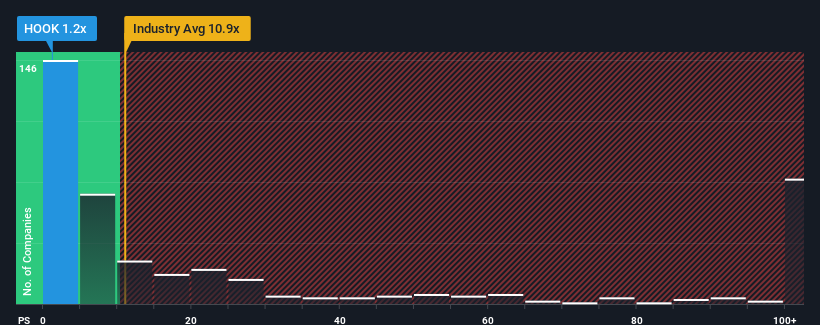

Following the heavy fall in price, HOOKIPA Pharma may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 10.9x and even P/S higher than 63x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for HOOKIPA Pharma

How Has HOOKIPA Pharma Performed Recently?

With revenue growth that's superior to most other companies of late, HOOKIPA Pharma has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HOOKIPA Pharma.Do Revenue Forecasts Match The Low P/S Ratio?

HOOKIPA Pharma's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 235%. Pleasingly, revenue has also lifted 153% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 27% each year during the coming three years according to the four analysts following the company. Meanwhile, the broader industry is forecast to expand by 196% per annum, which paints a poor picture.

With this information, we are not surprised that HOOKIPA Pharma is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does HOOKIPA Pharma's P/S Mean For Investors?

Shares in HOOKIPA Pharma have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that HOOKIPA Pharma maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 6 warning signs with HOOKIPA Pharma (at least 2 which are a bit unpleasant), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on HOOKIPA Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HOOKIPA Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HOOK

HOOKIPA Pharma

A clinical stage biopharmaceutical company, develops immunotherapeutics targeting infectious diseases and cancers based on its proprietary arenavirus platform.

Moderate with adequate balance sheet.

Market Insights

Community Narratives