- United States

- /

- Biotech

- /

- NasdaqCM:GYRE

Discovering 3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

As the U.S. market faces potential volatility with major stock indexes experiencing slight fluctuations ahead of a government shutdown deadline, investors are keenly observing economic indicators that could impact small-cap stocks. In such an environment, identifying lesser-known companies with strong fundamentals and growth potential can be crucial for those looking to uncover hidden opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Gyre Therapeutics (GYRE)

Simply Wall St Value Rating: ★★★★★★

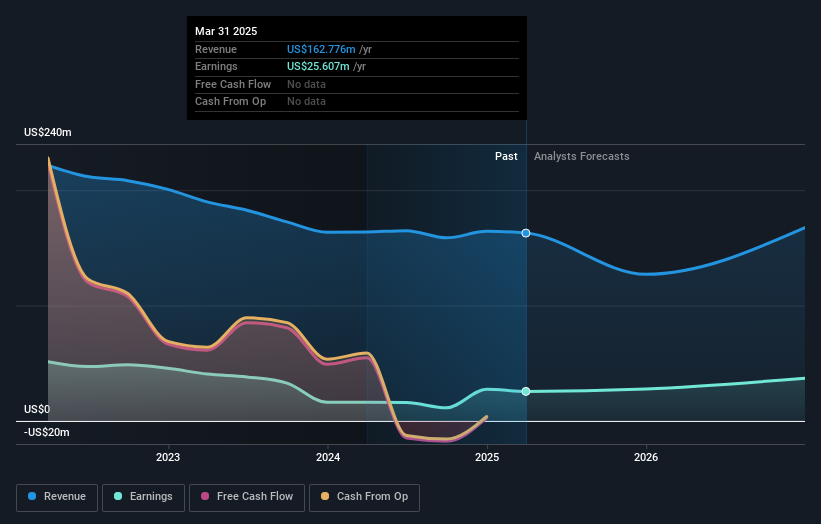

Overview: Gyre Therapeutics, Inc. is a pharmaceutical company focused on developing and commercializing small-molecule drugs for anti-inflammatory and anti-fibrotic treatments targeting organ fibrosis, with a market cap of $650.32 million.

Operations: Gyre Therapeutics generates revenue primarily through its Gyre Pharmaceuticals segment, which reported $102.19 million in revenue.

Gyre Therapeutics, a nimble player in the biotech scene, has recently become profitable, yet faces a forecasted earnings dip of 84.3% annually over the next three years. Despite this, revenue is expected to grow by nearly 17% per year. The company remains debt-free and boasts high-quality past earnings. Recent events include its addition to the S&P Global BMI Index and leadership changes with Ping Zhang stepping in as interim CEO. For 2025, Gyre anticipates revenues between US$118 million and US$128 million, fueled by new product launches like Etorel and Contiva alongside ETUARY® sales.

- Unlock comprehensive insights into our analysis of Gyre Therapeutics stock in this health report.

Explore historical data to track Gyre Therapeutics' performance over time in our Past section.

HarborOne Bancorp (HONE)

Simply Wall St Value Rating: ★★★★★★

Overview: HarborOne Bancorp, Inc. offers financial services to individuals, families, small and mid-size businesses, and municipalities with a market capitalization of $558.17 million.

Operations: HarborOne Bancorp generates revenue primarily through HarborOne Bank, contributing $145.55 million, and HarborOne Mortgage with $19.35 million. The company exhibits a net profit margin trend worth noting for its implications on overall profitability.

HarborOne Bancorp, with total assets of US$5.6 billion and equity of US$580.1 million, showcases a robust financial foundation. Total deposits stand at US$4.5 billion against loans of US$4.7 billion, underlining strong lending activity supported by primarily low-risk funding sources—89% from customer deposits. The bank's allowance for bad loans is sufficient at 147%, with non-performing loans well-managed at 0.7%. Earnings have surged by 65.9% over the past year, notably outpacing the industry growth rate of 12.8%. Recently, HarborOne declared a quarterly dividend of $0.09 per share, reflecting its commitment to shareholder returns amidst steady earnings performance and high-quality earnings history.

Spok Holdings (SPOK)

Simply Wall St Value Rating: ★★★★★★

Overview: Spok Holdings, Inc. offers healthcare communication solutions globally through its subsidiary, Spok, Inc., and has a market capitalization of $358.90 million.

Operations: Spok Holdings generates revenue primarily from its Clinical Communication and Collaboration business, amounting to $140.74 million.

Spok Holdings, a nimble player in the healthcare communication sector, is navigating a transition to a SaaS model, which is boosting its recurring revenue and margins. With no debt for five years and trading at 56.3% below its fair value estimate, Spok seems undervalued. The company reported Q2 2025 earnings with sales of US$17.25 million and net income of US$4.55 million, showing growth from the previous year. Despite these positives, challenges like declining wireless service revenue persist alongside modest projected annual growth of 1.1%. The stock's target price suggests potential upside from current levels around US$17.53 per share.

Where To Now?

- Investigate our full lineup of 286 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GYRE

Gyre Therapeutics

A pharmaceutical company, engages in the development and commercialization of small-molecule, anti-inflammatory, and anti-fibrotic drugs targeting organ fibrosis.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives