- United States

- /

- Biotech

- /

- NasdaqGS:GILD

What Gilead Sciences (GILD)'s Global HIV Partnership and US Manufacturing Expansion Means for Shareholders

Reviewed by Simply Wall St

- In early September 2025, Gilead Sciences announced a partnership with the U.S. State Department and PEPFAR to expand access to its twice-yearly injectable HIV-1 prevention therapy, and began construction on a new Pharmaceutical Development and Manufacturing Technical Development Center at its Foster City headquarters.

- This move brings together global health partners to deliver lenacapavir to up to two million people and strengthens Gilead's domestic innovation, research capabilities, and biologics manufacturing as part of a US$32 billion investment through 2030.

- We'll examine how Gilead's expanded commitment to global HIV prevention and U.S. biopharma innovation may influence its investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gilead Sciences Investment Narrative Recap

To be a Gilead Sciences shareholder, you really have to believe in the company's ability to drive consistent innovation across HIV and oncology, overcoming headwinds in pricing and market access. The recent partnership to roll out lenacapavir for HIV prevention expands Gilead’s leadership in global health, but in the immediate term, it does not significantly change the most important catalyst, commercial uptake of new HIV and oncology therapies, or reduce the ongoing risk of pricing pressure in key markets.

Among recent developments, the European Commission’s late August approval of lenacapavir for PrEP stands out. This regulatory green light closely ties into Gilead’s efforts to scale international access and supports the catalyst of portfolio growth by facilitating a larger immediate addressable market, yet the company’s heavy reliance on HIV products leaves its future earnings sensitive to shifts in treatment trends and competition.

But on the other hand, investors should be aware that much of Gilead’s future could hinge on how quickly emerging HIV prevention therapies offset mounting pricing and policy risks...

Read the full narrative on Gilead Sciences (it's free!)

Gilead Sciences is projected to reach $32.3 billion in revenue and $10.0 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 3.8% and a $3.7 billion earnings increase from the current $6.3 billion.

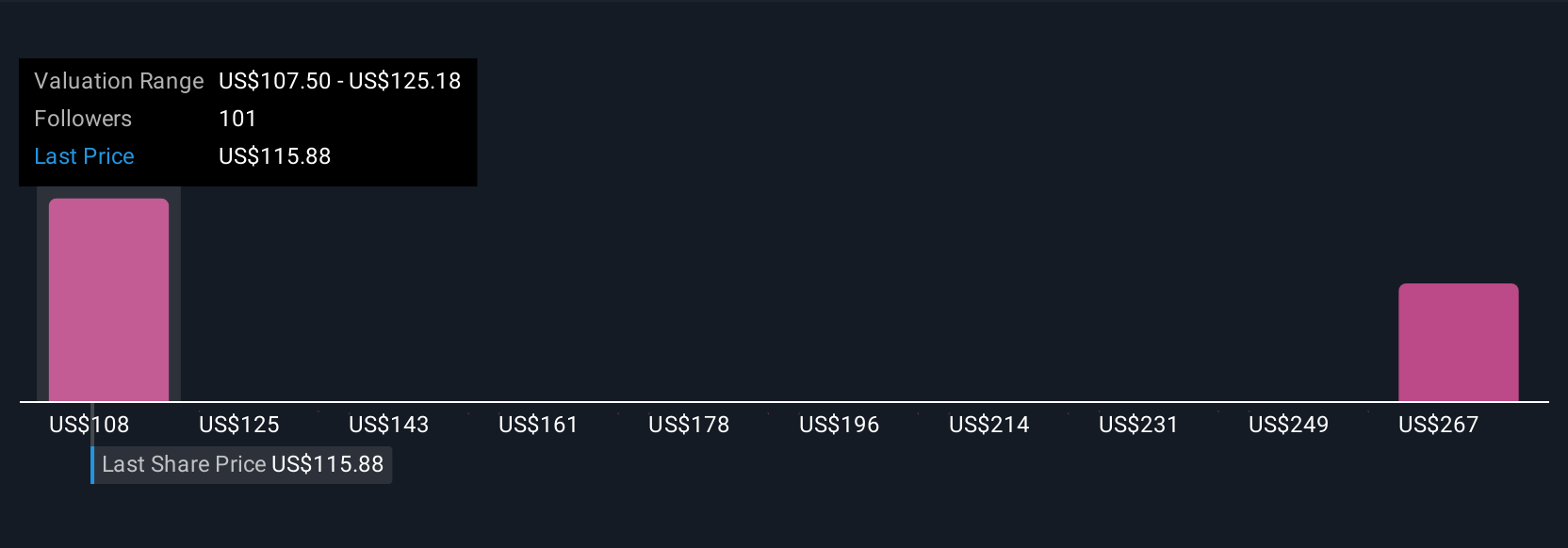

Uncover how Gilead Sciences' forecasts yield a $124.91 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts saw Gilead’s new launches and investment in US$32 billion of innovation driving revenues to US$33.9 billion and earnings to US$10.8 billion by 2028. Those views highlight how investor outlooks may shift if these major partnerships and approvals evolve commercial momentum or competitive pressures in ways not fully factored into earlier forecasts. Be sure to weigh several perspectives to judge if these assumptions fit your expectations.

Explore 9 other fair value estimates on Gilead Sciences - why the stock might be worth over 2x more than the current price!

Build Your Own Gilead Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gilead Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilead Sciences' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives