- United States

- /

- Biotech

- /

- NasdaqGS:GBT

Shareholders May Not Be So Generous With Global Blood Therapeutics, Inc.'s (NASDAQ:GBT) CEO Compensation And Here's Why

Under the guidance of CEO Ted Love, Global Blood Therapeutics, Inc. (NASDAQ:GBT) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 17 June 2021. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Global Blood Therapeutics

How Does Total Compensation For Ted Love Compare With Other Companies In The Industry?

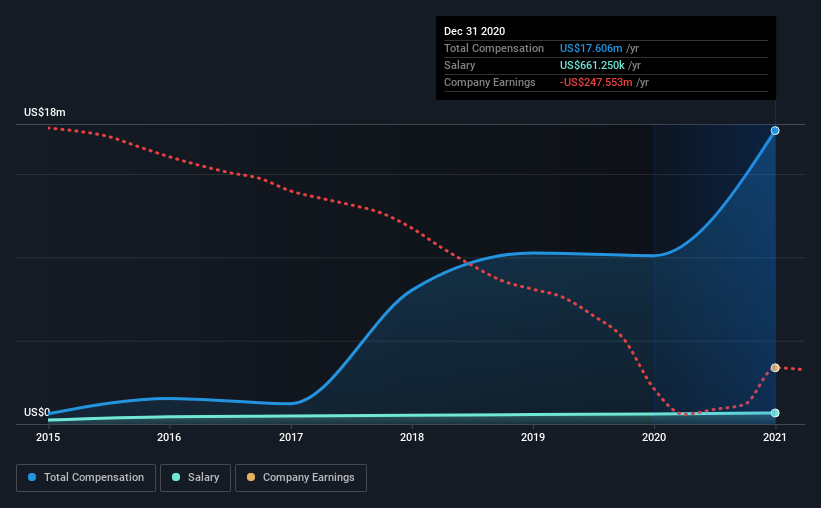

Our data indicates that Global Blood Therapeutics, Inc. has a market capitalization of US$2.5b, and total annual CEO compensation was reported as US$18m for the year to December 2020. We note that's an increase of 74% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$661k.

In comparison with other companies in the industry with market capitalizations ranging from US$2.0b to US$6.4b, the reported median CEO total compensation was US$6.8m. This suggests that Ted Love is paid more than the median for the industry. Furthermore, Ted Love directly owns US$44m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$661k | US$597k | 4% |

| Other | US$17m | US$9.5m | 96% |

| Total Compensation | US$18m | US$10m | 100% |

Speaking on an industry level, nearly 20% of total compensation represents salary, while the remainder of 80% is other remuneration. Interestingly, the company has chosen to go down an unconventional route in that it pays a smaller salary to Ted Love as compared to non-salary compensation over the one-year period examined. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Global Blood Therapeutics, Inc.'s Growth

Global Blood Therapeutics, Inc. has reduced its earnings per share by 13% a year over the last three years. In the last year, its revenue is up 817%.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Global Blood Therapeutics, Inc. Been A Good Investment?

Global Blood Therapeutics, Inc. has not done too badly by shareholders, with a total return of 1.5%, over three years. It would be nice to see that metric improve in the future. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Global Blood Therapeutics primarily uses non-salary benefits to reward its CEO. Some shareholders will be pleased by the relatively good results, however, the results could still be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Global Blood Therapeutics that you should be aware of before investing.

Switching gears from Global Blood Therapeutics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Global Blood Therapeutics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:GBT

Global Blood Therapeutics

Global Blood Therapeutics, Inc., a biopharmaceutical company, engages in the discovery, development, and delivery of treatments for underserved patient communities with sickle cell disease (SCD).

High growth potential and good value.

Market Insights

Community Narratives