- United States

- /

- Pharma

- /

- NasdaqGM:FULC

Some Confidence Is Lacking In Fulcrum Therapeutics, Inc. (NASDAQ:FULC) As Shares Slide 62%

Fulcrum Therapeutics, Inc. (NASDAQ:FULC) shareholders that were waiting for something to happen have been dealt a blow with a 62% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

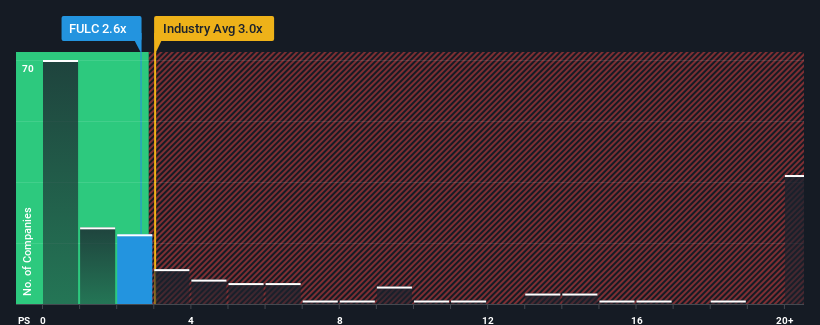

Even after such a large drop in price, there still wouldn't be many who think Fulcrum Therapeutics' price-to-sales (or "P/S") ratio of 2.6x is worth a mention when the median P/S in the United States' Pharmaceuticals industry is similar at about 3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Fulcrum Therapeutics

What Does Fulcrum Therapeutics' P/S Mean For Shareholders?

Fulcrum Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fulcrum Therapeutics.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Fulcrum Therapeutics' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 11% each year during the coming three years according to the nine analysts following the company. Meanwhile, the broader industry is forecast to expand by 17% per year, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Fulcrum Therapeutics' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On Fulcrum Therapeutics' P/S

With its share price dropping off a cliff, the P/S for Fulcrum Therapeutics looks to be in line with the rest of the Pharmaceuticals industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Fulcrum Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Fulcrum Therapeutics (2 are a bit concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FULC

Fulcrum Therapeutics

A clinical-stage biopharmaceutical company, develops small molecules to improve the lives of patients with genetically defined diseases in the areas of high unmet medical need in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives