- United States

- /

- Life Sciences

- /

- NasdaqGS:FTRE

Benign Growth For Fortrea Holdings Inc. (NASDAQ:FTRE) Underpins Stock's 38% Plummet

To the annoyance of some shareholders, Fortrea Holdings Inc. (NASDAQ:FTRE) shares are down a considerable 38% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

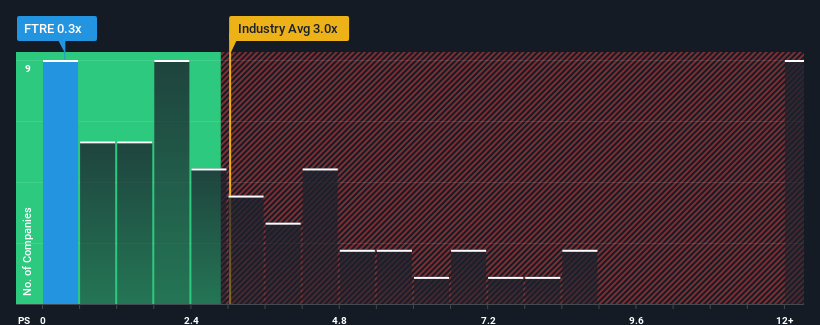

After such a large drop in price, Fortrea Holdings' price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Life Sciences industry in the United States, where around half of the companies have P/S ratios above 2.8x and even P/S above 6x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Fortrea Holdings

What Does Fortrea Holdings' P/S Mean For Shareholders?

Fortrea Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fortrea Holdings.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Fortrea Holdings' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 12% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 4.2% each year over the next three years. With the industry predicted to deliver 6.6% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Fortrea Holdings' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Fortrea Holdings' P/S?

Fortrea Holdings' P/S looks about as weak as its stock price lately. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Fortrea Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Fortrea Holdings with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FTRE

Fortrea Holdings

A contract research organization, provides biopharmaceutical product and medical device development solutions to pharmaceutical, biotechnology, and medical device customers worldwide.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives