- United States

- /

- Biotech

- /

- NasdaqGM:FHTX

Foghorn Therapeutics Inc.'s (NASDAQ:FHTX) Shares Climb 35% But Its Business Is Yet to Catch Up

The Foghorn Therapeutics Inc. (NASDAQ:FHTX) share price has done very well over the last month, posting an excellent gain of 35%. Notwithstanding the latest gain, the annual share price return of 6.7% isn't as impressive.

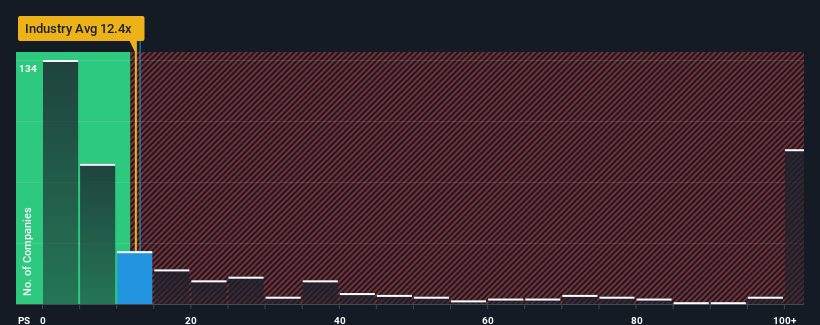

Although its price has surged higher, there still wouldn't be many who think Foghorn Therapeutics' price-to-sales (or "P/S") ratio of 13x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 12.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Foghorn Therapeutics

What Does Foghorn Therapeutics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Foghorn Therapeutics has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Foghorn Therapeutics will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Foghorn Therapeutics?

The only time you'd be comfortable seeing a P/S like Foghorn Therapeutics' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 62% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 16% per year over the next three years. That's shaping up to be materially lower than the 138% per annum growth forecast for the broader industry.

In light of this, it's curious that Foghorn Therapeutics' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Foghorn Therapeutics' P/S Mean For Investors?

Foghorn Therapeutics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Foghorn Therapeutics' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Foghorn Therapeutics (1 is concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FHTX

Foghorn Therapeutics

A clinical-stage biopharmaceutical company, engages in the discovery and development of medicines targeting genetically determined dependencies within the chromatin regulatory system in the United States.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives