- United States

- /

- Pharma

- /

- NasdaqGM:EYPT

Subdued Growth No Barrier To EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) With Shares Advancing 41%

Despite an already strong run, EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) shares have been powering on, with a gain of 41% in the last thirty days. This latest share price bounce rounds out a remarkable 525% gain over the last twelve months.

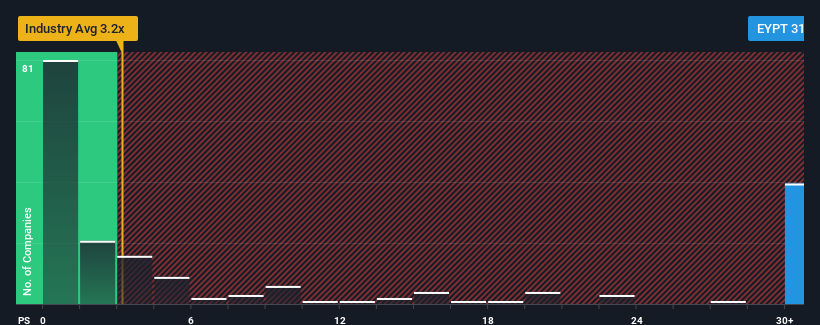

After such a large jump in price, EyePoint Pharmaceuticals may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 31.8x, when you consider almost half of the companies in the Pharmaceuticals industry in the United States have P/S ratios under 3.2x and even P/S lower than 0.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for EyePoint Pharmaceuticals

What Does EyePoint Pharmaceuticals' Recent Performance Look Like?

EyePoint Pharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think EyePoint Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For EyePoint Pharmaceuticals?

EyePoint Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 18% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 3.0% per annum during the coming three years according to the ten analysts following the company. Meanwhile, the broader industry is forecast to expand by 52% each year, which paints a poor picture.

With this in mind, we find it intriguing that EyePoint Pharmaceuticals' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

The strong share price surge has lead to EyePoint Pharmaceuticals' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that EyePoint Pharmaceuticals currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 4 warning signs for EyePoint Pharmaceuticals (1 can't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on EyePoint Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if EyePoint Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EYPT

EyePoint Pharmaceuticals

A clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives