- United States

- /

- Pharma

- /

- NasdaqGM:EYPT

Optimistic Investors Push EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) Shares Up 194% But Growth Is Lacking

EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) shareholders would be excited to see that the share price has had a great month, posting a 194% gain and recovering from prior weakness. This latest share price bounce rounds out a remarkable 725% gain over the last twelve months.

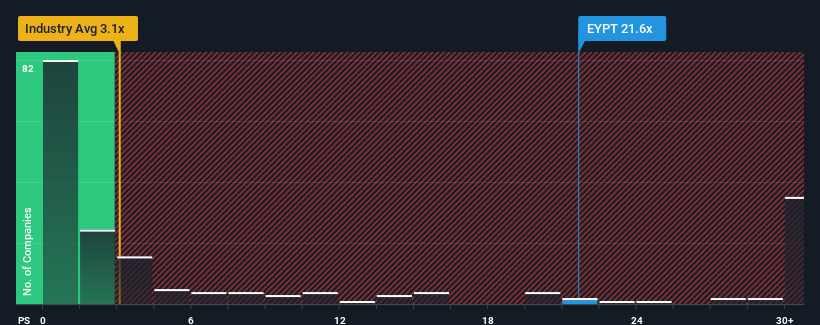

Following the firm bounce in price, EyePoint Pharmaceuticals may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 21.6x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios under 3.1x and even P/S lower than 0.7x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for EyePoint Pharmaceuticals

How EyePoint Pharmaceuticals Has Been Performing

With revenue growth that's inferior to most other companies of late, EyePoint Pharmaceuticals has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on EyePoint Pharmaceuticals will help you uncover what's on the horizon.How Is EyePoint Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, EyePoint Pharmaceuticals would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 18% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to slump, contracting by 2.6% each year during the coming three years according to the nine analysts following the company. That's not great when the rest of the industry is expected to grow by 53% each year.

With this information, we find it concerning that EyePoint Pharmaceuticals is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

EyePoint Pharmaceuticals' P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of EyePoint Pharmaceuticals' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for EyePoint Pharmaceuticals (1 is concerning!) that you need to be mindful of.

If you're unsure about the strength of EyePoint Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if EyePoint Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EYPT

EyePoint Pharmaceuticals

A clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives