- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

Is Cancerguard’s Launch With Quest Diagnostics Altering the Investment Case for Exact Sciences (EXAS)?

Reviewed by Simply Wall St

- Earlier this month, Exact Sciences announced the commercial launch of Cancerguard™, a multi-cancer early detection (MCED) blood test now available as a laboratory-developed test in the United States, supported by a broad access partnership with Quest Diagnostics.

- As the first commercially available MCED test to analyze multiple biomarker classes and detect signals from cancers responsible for over 80% of annual U.S. diagnoses, Cancerguard aims to substantially address unmet early screening needs across a wide patient population.

- We'll explore how the introduction of Cancerguard, with Quest Diagnostics collaboration, could shift Exact Sciences' outlook in multi-cancer detection.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Exact Sciences Investment Narrative Recap

To be a shareholder in Exact Sciences, you need to believe that broad adoption of blood-based early cancer detection, now spearheaded by Cancerguard, can meaningfully expand the company’s revenue base beyond Cologuard, while eventually leading to sustained profitability. The Cancerguard launch is an exciting milestone that amplifies Exact’s ambition in multi-cancer testing, but near-term commercial uptake and payer acceptance remain pivotal catalysts and risks, early market access via Quest Diagnostics does not yet resolve reimbursement or clinical uptake uncertainties.

Of Exact’s recent announcements, the expanded partnership with Humana for Cologuard Plus stands out as most relevant in the context of cancer screening access, since it shows the company’s ability to drive payer adoption and influence screening guideline inclusion, factors critical to the success of Cancerguard as well. Both initiatives aim to solidify Exact’s position in increasingly competitive and regulated diagnostic markets, but their ultimate impact will depend on payer support, physician trust, and the trajectory of clinical guidelines.

However, investors should be aware that even with strong test sensitivity and strategic partnerships, payer coverage and reimbursement policy for new blood-based cancer screens like Cancerguard ...

Read the full narrative on Exact Sciences (it's free!)

Exact Sciences' narrative projects $4.1 billion revenue and $277.2 million earnings by 2028. This requires 11.6% annual revenue growth and an earnings increase of $1.277 billion from current earnings of -$1.0 billion.

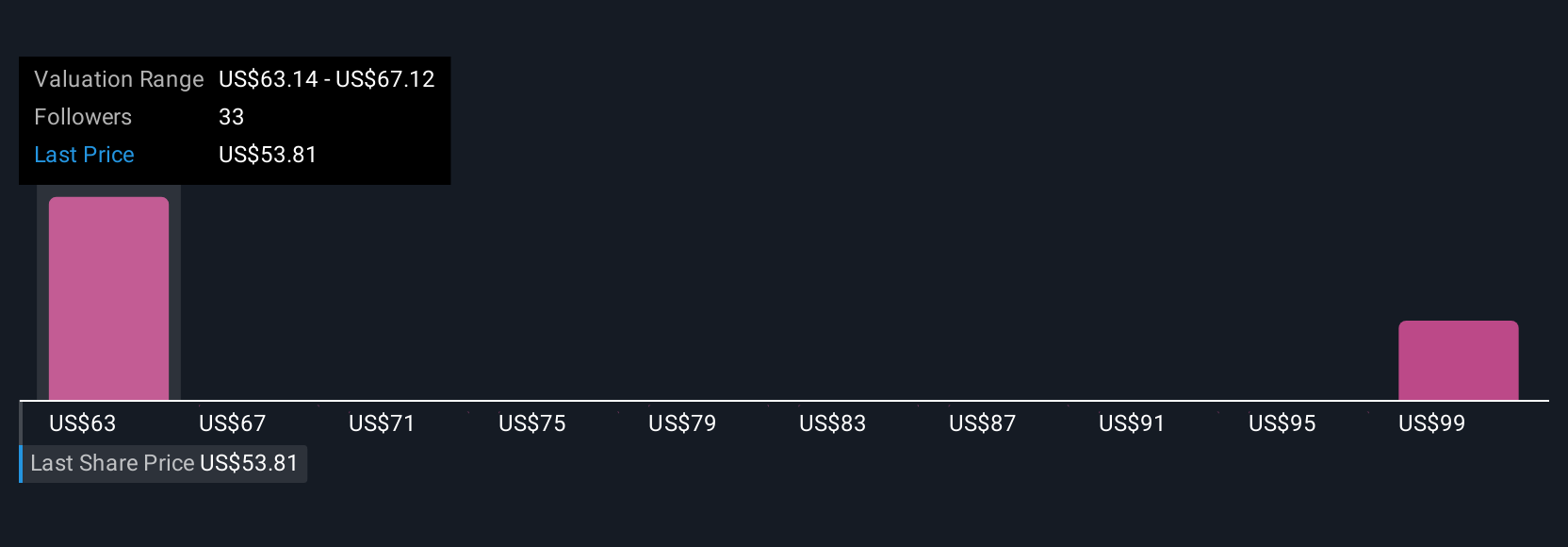

Uncover how Exact Sciences' forecasts yield a $64.01 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community estimated exact fair value between US$64.01 and US$102.65. While projections are optimistic on future screening volume, actual payer adoption could set the pace for any revenue growth, inviting you to explore how your views align with this spectrum.

Explore 6 other fair value estimates on Exact Sciences - why the stock might be worth as much as 93% more than the current price!

Build Your Own Exact Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exact Sciences research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Exact Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exact Sciences' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives