- United States

- /

- Pharma

- /

- NasdaqGM:ETON

Subdued Growth No Barrier To Eton Pharmaceuticals, Inc. (NASDAQ:ETON) With Shares Advancing 40%

Eton Pharmaceuticals, Inc. (NASDAQ:ETON) shares have had a really impressive month, gaining 40% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 65% in the last year.

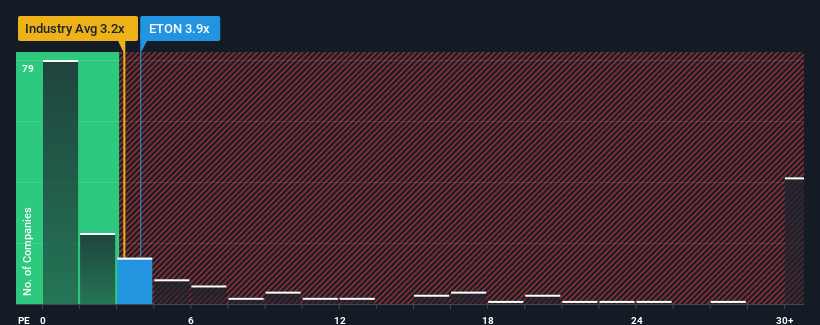

Following the firm bounce in price, Eton Pharmaceuticals may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 3.9x, when you consider almost half of the companies in the Pharmaceuticals industry in the United States have P/S ratios under 3.2x and even P/S lower than 0.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Eton Pharmaceuticals

What Does Eton Pharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Eton Pharmaceuticals has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Eton Pharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Eton Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 74%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 19% over the next year. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Eton Pharmaceuticals' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in Eton Pharmaceuticals' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Eton Pharmaceuticals, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Eton Pharmaceuticals with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Eton Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Eton Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ETON

Eton Pharmaceuticals

A specialty pharmaceutical company, focuses on developing, acquiring, and commercializing pharmaceutical products for rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives