- United States

- /

- Pharma

- /

- NasdaqGM:ETON

Not Many Are Piling Into Eton Pharmaceuticals, Inc. (NASDAQ:ETON) Stock Yet As It Plummets 26%

Eton Pharmaceuticals, Inc. (NASDAQ:ETON) shares have had a horrible month, losing 26% after a relatively good period beforehand. Indeed, the recent drop has reduced its annual gain to a relatively sedate 8.5% over the last twelve months.

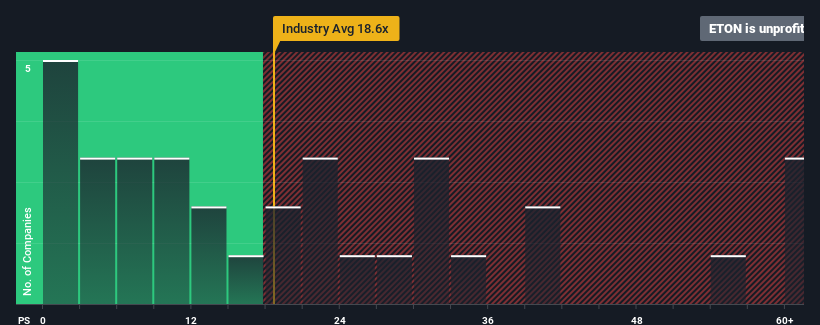

Even after such a large drop in price, Eton Pharmaceuticals may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -11.8x, since almost half of all companies in the United States have P/E ratios greater than 16x and even P/E's higher than 33x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's superior to most other companies of late, Eton Pharmaceuticals has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Eton Pharmaceuticals

Is There Any Growth For Eton Pharmaceuticals?

In order to justify its P/E ratio, Eton Pharmaceuticals would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 48%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 16% during the coming year according to the lone analyst following the company. With the market only predicted to deliver 5.3%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Eton Pharmaceuticals is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Eton Pharmaceuticals' P/E?

Having almost fallen off a cliff, Eton Pharmaceuticals' share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Eton Pharmaceuticals currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Eton Pharmaceuticals that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Eton Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ETON

Eton Pharmaceuticals

A specialty pharmaceutical company, focuses on developing, acquiring, and commercializing pharmaceutical products for rare diseases.

High growth potential with adequate balance sheet.