- United States

- /

- Aerospace & Defense

- /

- OTCPK:AERG

Discover May 2025's Top Penny Stocks

Reviewed by Simply Wall St

Over the last 7 days, the U.S. market has risen by 1.2%, contributing to a 12% increase over the past year, with earnings anticipated to grow by 14% annually. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever; these stocks can provide a mix of affordability and growth potential when paired with strong financials. Below, we'll explore three penny stocks that stand out for their financial strength and resilience in today's market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.83 | $186.38M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.05 | $174.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (NasdaqGS:PBYI) | $3.38 | $167.28M | ✅ 3 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.31 | $55.16M | ✅ 1 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $98.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.77 | $21.99M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.848 | $6.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.47 | $71.05M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $1.10 | $30.73M | ✅ 3 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.02 | $34.79M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 730 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CollPlant Biotechnologies (NasdaqGM:CLGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CollPlant Biotechnologies Ltd. is a regenerative and aesthetic medicine company specializing in 3D bioprinting of tissues and organs, as well as medical aesthetics, with a market cap of $38.95 million.

Operations: CollPlant Biotechnologies Ltd. has not reported any specific revenue segments.

Market Cap: $38.95M

CollPlant Biotechnologies, with a market cap of US$38.95 million, is navigating its path in the biotech sector with a focus on innovative 3D bioprinting and medical aesthetics. Despite being unprofitable, the company recently reported first-quarter sales of US$2.06 million, showing significant growth from last year’s figures. However, it remains pre-revenue in terms of meaningful income streams and faces challenges such as high volatility and limited cash runway under one year if current cash flow trends persist. The experienced management team and board are crucial assets as CollPlant seeks strategic partnerships to bolster its financial position amidst ongoing industry developments like FDA regulatory changes.

- Take a closer look at CollPlant Biotechnologies' potential here in our financial health report.

- Understand CollPlant Biotechnologies' earnings outlook by examining our growth report.

Erasca (NasdaqGS:ERAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erasca, Inc. is a clinical-stage precision oncology company dedicated to the discovery, development, and commercialization of therapies for RAS/MAPK pathway-driven cancers, with a market cap of $311.62 million.

Operations: Erasca, Inc. currently does not report any revenue segments.

Market Cap: $311.62M

Erasca, Inc., with a market cap of US$311.62 million, is a clinical-stage precision oncology company focused on RAS/MAPK pathway-driven cancers and remains pre-revenue. Despite its unprofitability and high volatility compared to most US stocks, the company has a stable cash runway exceeding two years without debt. Recent FDA clearance for ERAS-0015 and an IND filing for ERAS-4001 highlight potential advancements in their RAS-targeting franchise. The strategic pipeline prioritization may enhance focus on promising therapies like naporafenib in pivotal trials, while the seasoned management team aims to leverage these developments amid ongoing financial challenges.

- Click to explore a detailed breakdown of our findings in Erasca's financial health report.

- Learn about Erasca's future growth trajectory here.

Applied Energetics (OTCPK:AERG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Applied Energetics, Inc. specializes in developing and manufacturing advanced high-performance lasers and optical systems for various sectors including defense and biomedical, with a market cap of $419.35 million.

Operations: No specific revenue segments are reported for Applied Energetics, Inc., which focuses on creating advanced laser and optical technologies for sectors such as defense and biomedical.

Market Cap: $419.35M

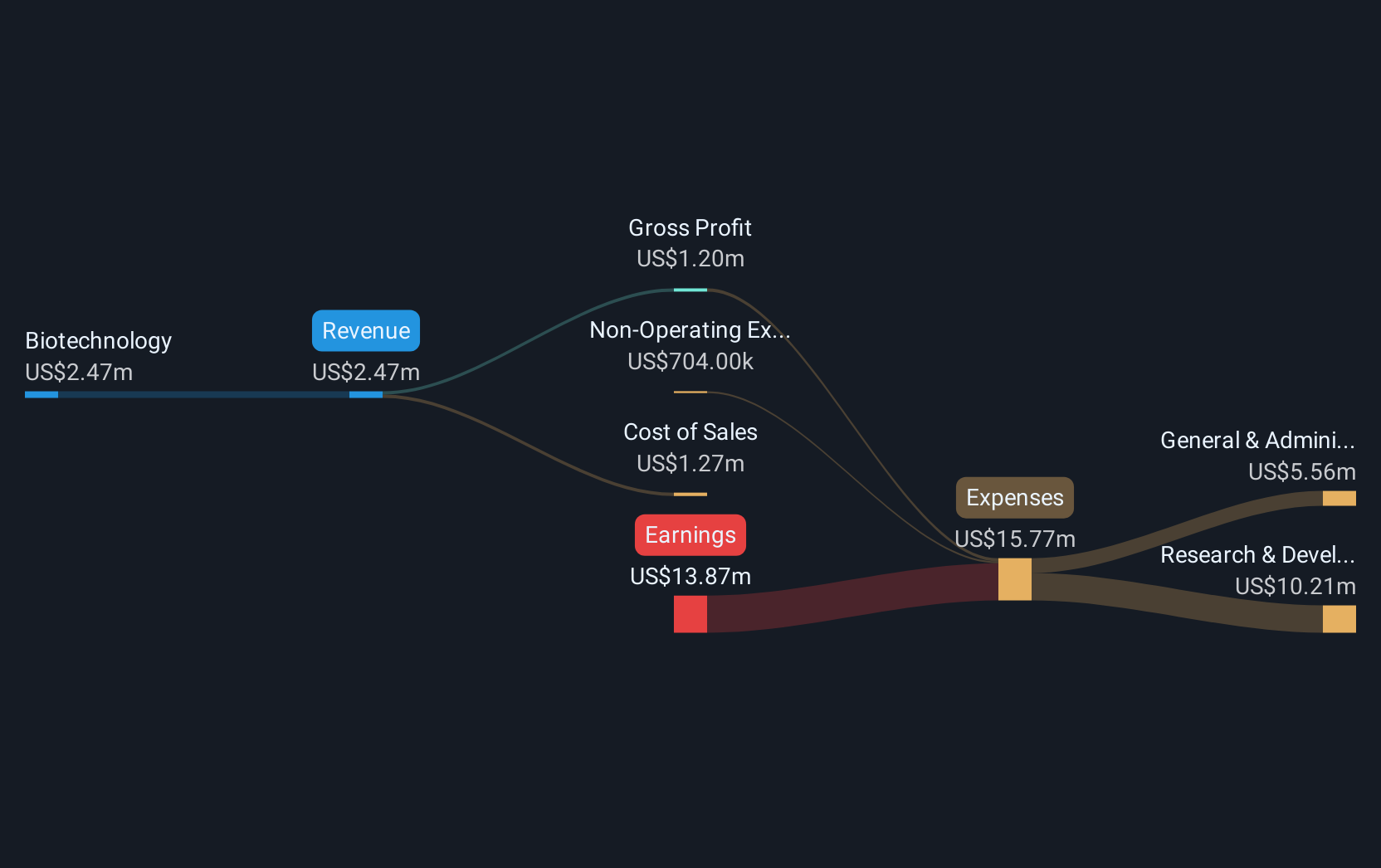

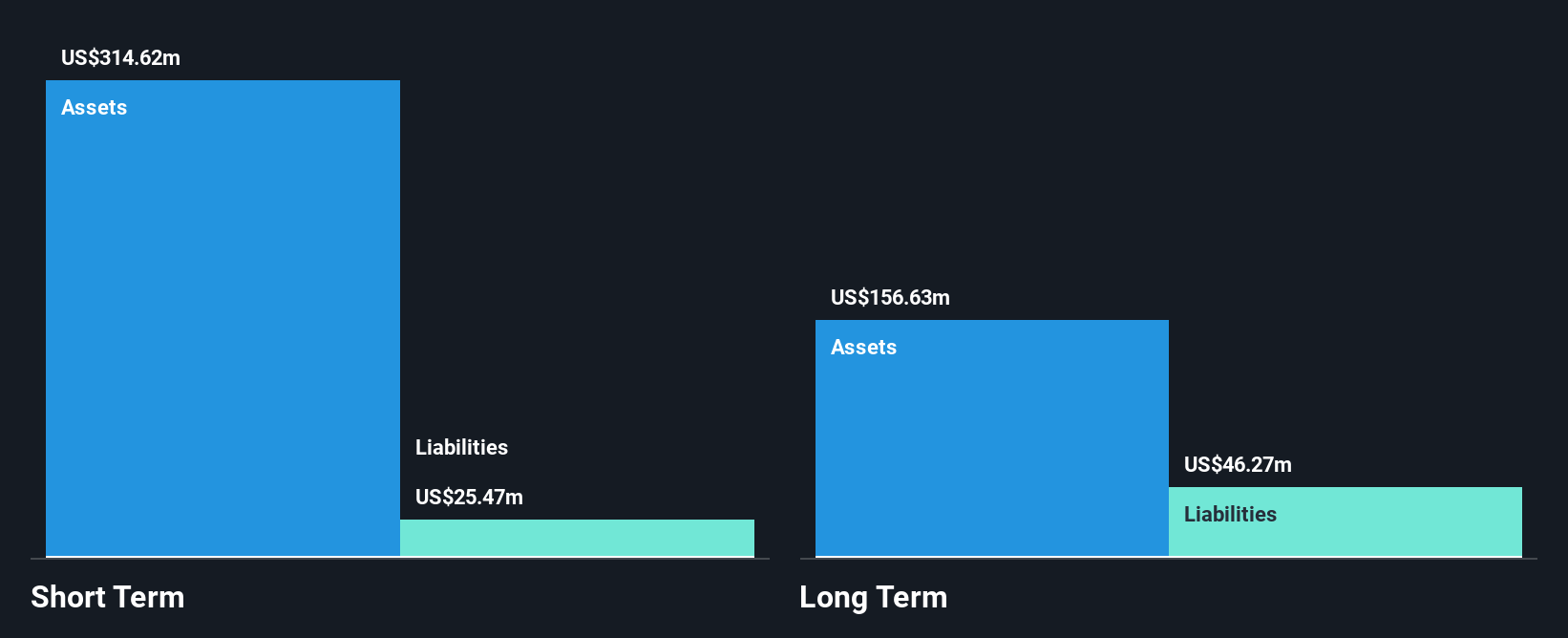

Applied Energetics, Inc., with a market cap of US$419.35 million, operates in the advanced laser and optical systems sector but remains pre-revenue with sales of US$0.21 million in Q1 2025 and a net loss of US$3.11 million. The company is debt-free, though its cash runway is under one year amid growing losses over the past five years. Recent collaboration with Kord Technologies on pulsed laser systems may open new defense opportunities, yet auditors have expressed going concern doubts due to financial instability. Despite high volatility and unprofitability, the experienced board provides some governance stability amidst these challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Applied Energetics.

- Gain insights into Applied Energetics' historical outcomes by reviewing our past performance report.

Key Takeaways

- Access the full spectrum of 730 US Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:AERG

Applied Energetics

Develops, manufactures, and sells advanced high-performance lasers and optical systems, and integrated guided energy systems to defense, national security, industrial, biomedical, and scientific customers worldwide.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives