- United States

- /

- Medical Equipment

- /

- NasdaqCM:KRMD

CuriosityStream And 2 Other Promising Penny Stocks On US Exchange

Reviewed by Simply Wall St

As the S&P 500 inches toward a record high and investors digest a flurry of earnings reports, the spotlight on smaller market players has intensified. Penny stocks, while often considered relics of past market eras, continue to offer intriguing opportunities for those willing to explore beyond the major indices. Typically associated with smaller or newer companies, these stocks can present an appealing mix of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88 | $6.38M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.63M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2798 | $10.12M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $90.69M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.95 | $53.09M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.82 | $45.59M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.415 | $46.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.52 | $26.96M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.882 | $81.84M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CuriosityStream (NasdaqCM:CURI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuriosityStream Inc. operates as a factual content streaming service and media company with a market cap of $156.17 million.

Operations: The company's revenue segment is derived entirely from its factual content streaming service, amounting to $51.78 million.

Market Cap: $156.17M

CuriosityStream, with a market cap of US$156.17 million, has been reducing its losses at an annual rate of 11.6% over the past five years despite being unprofitable. The company maintains a strong financial position with short-term assets of US$39.1 million exceeding both its short-term and long-term liabilities, and it remains debt-free. CuriosityStream's cash runway is sufficient for more than three years if current free cash flow levels are maintained or grow as expected. Recently, the company increased its quarterly dividend by 20%, indicating confidence in its financial stability despite ongoing volatility concerns.

- Unlock comprehensive insights into our analysis of CuriosityStream stock in this financial health report.

- Gain insights into CuriosityStream's future direction by reviewing our growth report.

Equillium (NasdaqCM:EQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Equillium, Inc. is a clinical-stage biotechnology company focused on developing and selling products for severe autoimmune and immuno-inflammatory disorders with unmet medical needs, with a market cap of $25.15 million.

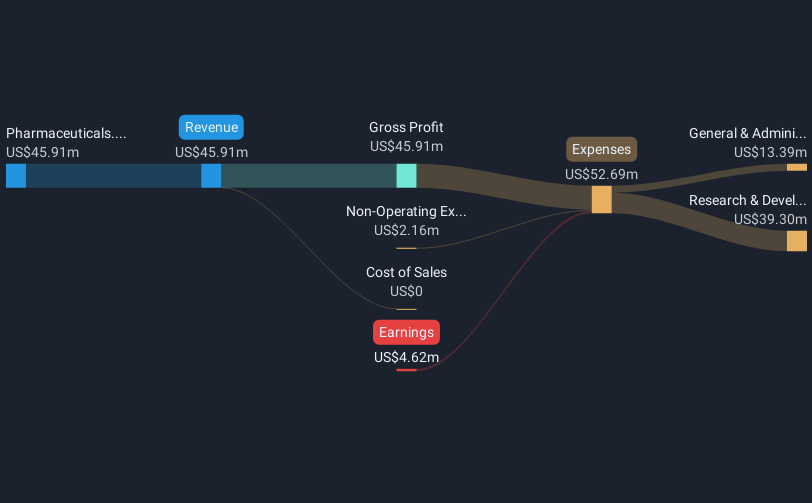

Operations: Equillium's revenue is derived entirely from its Pharmaceuticals segment, totaling $45.91 million.

Market Cap: $25.15M

Equillium, Inc., with a market cap of US$25.15 million, is a clinical-stage biotech firm focusing on severe autoimmune disorders. Despite being unprofitable, it has reduced losses by 9% annually over the past five years and remains debt-free. The company recently reported positive Phase 2 study results for itolizumab in ulcerative colitis treatment, showing promise in clinical remission rates compared to standard treatments. However, Equillium faces challenges with Nasdaq compliance due to its stock trading below US$1.00 per share and may consider actions like a reverse stock split to regain compliance by June 2025.

- Dive into the specifics of Equillium here with our thorough balance sheet health report.

- Examine Equillium's earnings growth report to understand how analysts expect it to perform.

KORU Medical Systems (NasdaqCM:KRMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: KORU Medical Systems, Inc. develops and manufactures medical devices and supplies both in the United States and internationally, with a market cap of $224.60 million.

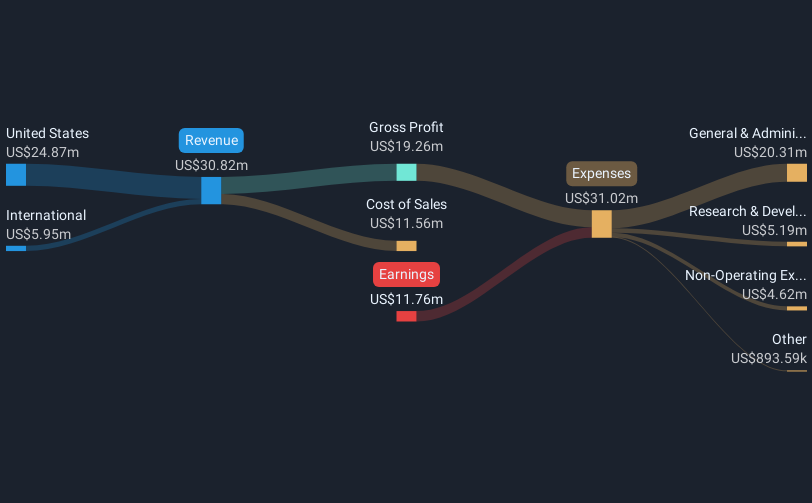

Operations: The company generates revenue of $31.99 million from its Surgical & Medical Equipment segment.

Market Cap: $224.6M

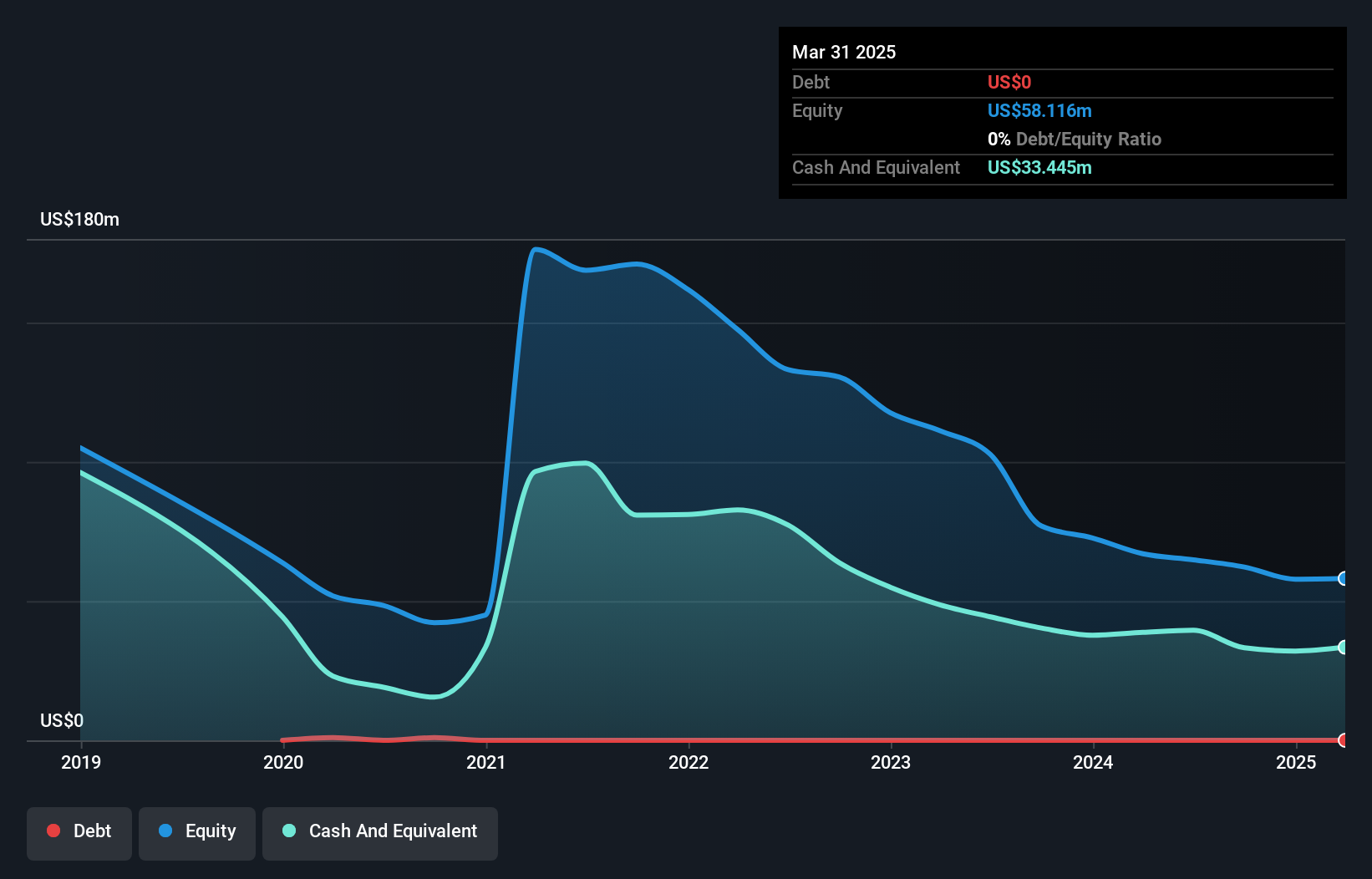

KORU Medical Systems, with a market cap of US$224.60 million, is experiencing revenue growth, expecting full-year 2024 revenues of US$33.7 million, up 18% from the previous year. Despite being unprofitable and having increased losses over the past five years at a rate of 50.6% per year, it maintains strong financial health with short-term assets exceeding liabilities and more cash than total debt. Recent collaboration on a Phase III trial for treating rare renal disorders highlights its strategic partnerships in expanding drug delivery solutions. The management team is experienced with an average tenure of 3.1 years.

- Click to explore a detailed breakdown of our findings in KORU Medical Systems' financial health report.

- Learn about KORU Medical Systems' future growth trajectory here.

Turning Ideas Into Actions

- Investigate our full lineup of 706 US Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KORU Medical Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:KRMD

KORU Medical Systems

Develops and manufactures medical devices and supplies in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives