- United States

- /

- Biotech

- /

- NasdaqGS:ENTA

Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) Not Doing Enough For Some Investors As Its Shares Slump 27%

Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 66% loss during that time.

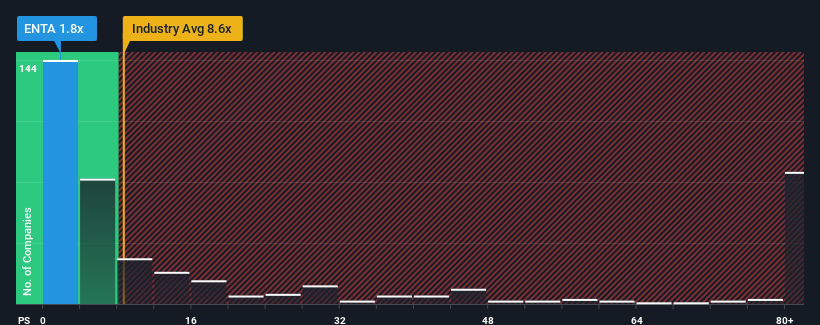

Following the heavy fall in price, Enanta Pharmaceuticals' price-to-sales (or "P/S") ratio of 1.8x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 8.6x and even P/S above 55x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Enanta Pharmaceuticals

What Does Enanta Pharmaceuticals' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Enanta Pharmaceuticals' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Enanta Pharmaceuticals.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Enanta Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 28% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 3.3% each year as estimated by the seven analysts watching the company. With the industry predicted to deliver 149% growth per annum, that's a disappointing outcome.

With this in consideration, we find it intriguing that Enanta Pharmaceuticals' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Enanta Pharmaceuticals' P/S Mean For Investors?

Having almost fallen off a cliff, Enanta Pharmaceuticals' share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Enanta Pharmaceuticals' P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Enanta Pharmaceuticals (1 is concerning!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Enanta Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ENTA

Enanta Pharmaceuticals

A biotechnology company, discovers and develops small molecule drugs for the treatment of viral infections and liver diseases.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives