- United States

- /

- Biotech

- /

- NasdaqCM:ELUT

Elutia Inc.'s (NASDAQ:ELUT) Share Price Is Matching Sentiment Around Its Revenues

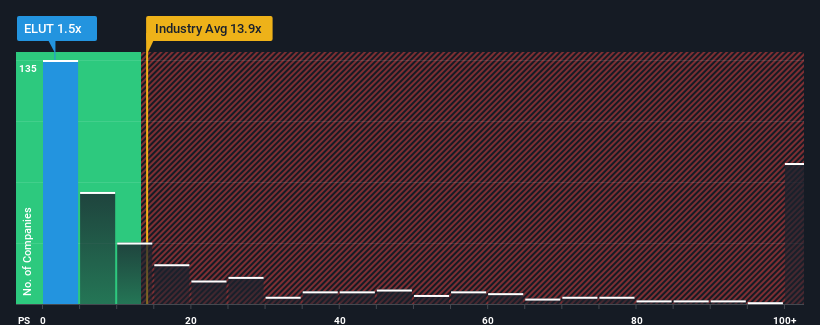

You may think that with a price-to-sales (or "P/S") ratio of 1.5x Elutia Inc. (NASDAQ:ELUT) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in the United States have P/S ratios greater than 13.9x and even P/S above 64x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Elutia

How Elutia Has Been Performing

Elutia certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Elutia.How Is Elutia's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Elutia's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 81% last year. As a result, it also grew revenue by 20% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 1.5% each year over the next three years. With the industry predicted to deliver 262% growth per annum, that's a disappointing outcome.

With this in consideration, we find it intriguing that Elutia's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Elutia's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Elutia's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 5 warning signs for Elutia (1 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Elutia, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Elutia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ELUT

Elutia

A commercial-stage company, develops and commercializes drug-eluting biologics products for neurostimulation and breast reconstruction in the United States.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives