- United States

- /

- Biotech

- /

- NasdaqGS:EDIT

Editas Medicine, Inc. (NASDAQ:EDIT) Looks Inexpensive After Falling 35% But Perhaps Not Attractive Enough

The Editas Medicine, Inc. (NASDAQ:EDIT) share price has softened a substantial 35% over the previous 30 days, handing back much of the gains the stock has made lately. For any long-term shareholders, the last month ends a year to forget by locking in a 83% share price decline.

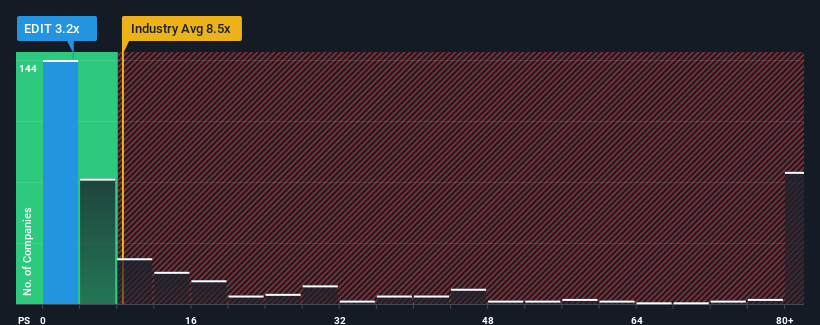

Since its price has dipped substantially, Editas Medicine may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.2x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.5x and even P/S higher than 54x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Editas Medicine

What Does Editas Medicine's P/S Mean For Shareholders?

Editas Medicine could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Editas Medicine.Is There Any Revenue Growth Forecasted For Editas Medicine?

Editas Medicine's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 59%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.7% each year during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 149% each year, which paints a poor picture.

In light of this, it's understandable that Editas Medicine's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Editas Medicine's P/S?

Having almost fallen off a cliff, Editas Medicine's share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Editas Medicine maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You need to take note of risks, for example - Editas Medicine has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Editas Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EDIT

Editas Medicine

A clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives