- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

Revenues Not Telling The Story For Denali Therapeutics Inc. (NASDAQ:DNLI) After Shares Rise 25%

Denali Therapeutics Inc. (NASDAQ:DNLI) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

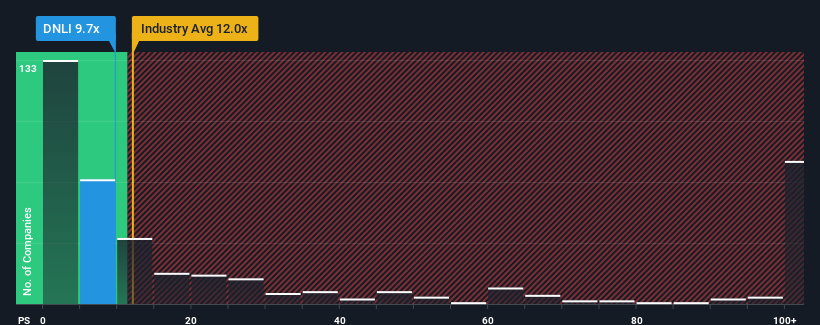

In spite of the firm bounce in price, there still wouldn't be many who think Denali Therapeutics' price-to-sales (or "P/S") ratio of 9.7x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Denali Therapeutics

How Has Denali Therapeutics Performed Recently?

Denali Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Denali Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Denali Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 191% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 13% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 1.8% each year over the next three years. With the industry predicted to deliver 210% growth per annum, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Denali Therapeutics' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

Denali Therapeutics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of Denali Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Having said that, be aware Denali Therapeutics is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, develops a portfolio of product candidates engineered to cross the blood-brain barrier for neurodegenerative diseases and lysosomal storage diseases in the United States.

Flawless balance sheet and fair value.

Market Insights

Community Narratives