- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Cytokinetics (CYTK) Is Up 8.7% After Aficamten Surpasses Metoprolol in Key HCM Trial Outcomes Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In November 2025, Cytokinetics announced that new data from the MAPLE-HCM trial showed aficamten provided greater improvements than metoprolol in multiple measures of hypertrophic cardiomyopathy, with higher responder rates and better patient-reported outcomes, presented at two major scientific conferences and published in a leading cardiology journal.

- An important aspect of these results was aficamten's association with significant reductions in cardiac biomarkers and improvements in exercise capacity, suggesting potential for meaningful clinical benefit beyond symptom control.

- Next, we'll assess how these favorable aficamten trial outcomes may reshape Cytokinetics' investment case and address previous regulatory uncertainties.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cytokinetics Investment Narrative Recap

For shareholders in Cytokinetics, the investment thesis centers on aficamten’s potential to become a first-in-class therapy for hypertrophic cardiomyopathy, driving rapid revenue growth upon regulatory approval. The newly published MAPLE-HCM data bolster confidence in aficamten’s clinical profile, but the FDA’s review extension and ongoing REMS negotiations remain the most important short-term catalyst and risk, as further delays could materially affect timelines. The recent clinical news does not fully resolve this risk.

Of all recent announcements, the FDA’s extension of the aficamten review and the requirement for a Risk Evaluation and Mitigation Strategy is most relevant. This regulatory pause now sits squarely between strong new efficacy data and the critical question of whether aficamten reaches the market on its revised schedule, illustrating the delicate balance between clinical and regulatory milestones for the investment case.

Yet for all the progress, investors should not overlook the uncertainties that can still arise from regulatory back-and-forth...

Read the full narrative on Cytokinetics (it's free!)

Cytokinetics' narrative projects $649.5 million in revenue and $90.6 million in earnings by 2028. This requires 96.4% yearly revenue growth and an earnings increase of $696.9 million from current earnings of -$606.3 million.

Uncover how Cytokinetics' forecasts yield a $76.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

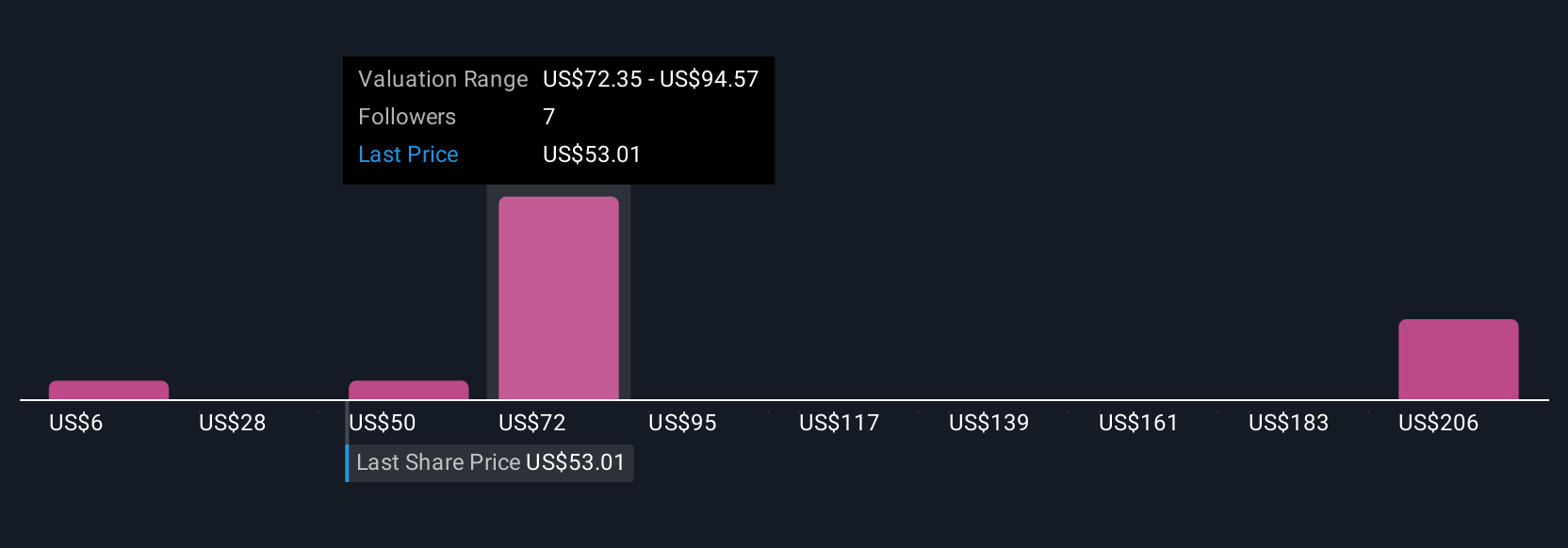

Five fair value estimates from the Simply Wall St Community span from US$2.16 to US$112.91 per share, highlighting sharply divided outlooks. With pivotal FDA decisions still pending, market participants weigh strong trial results against approval timing risks when assessing future performance.

Explore 5 other fair value estimates on Cytokinetics - why the stock might be worth less than half the current price!

Build Your Own Cytokinetics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cytokinetics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Cytokinetics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cytokinetics' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYTK

Cytokinetics

A late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives